ProtectMyID Review – AAA Identity Theft – Is it Any Good?

We spent over two weeks testing for this ProtectMyID review and ultimately found its services were mediocre.

If you want the best identity protection, get Aura instead.

Aura protects you with more comprehensive monitoring, including things like home title and investment account monitoring – ProtectMyID doesn’t include either.

Aura also offers peace of mind with more theft insurance and digital security features like a VPN and antivirus software. ProtectMyID doesn’t include any valuable extras, and its insurance is limited.

Using our discount code, you can lock in off for life, making Aura a better value than ProtectMyID too.

- You want award-winning identity theft monitoring and alerts. Aura monitors everything of value to you, from your credit score to your home and auto title.

- You want the highest theft insurance coverage – up to $5 million with a family plan.

- You want an all-in-one digital security solution. Aura includes a VPN, antivirus software, parental controls, safe gaming, a password manager, and more.

- 24/7 customer service matters to you. Reach a team of experts whenever you need them.

- You want the best value. Aura includes more than ProtectMyID and you don’t need to pay for a AAA membership.

- You’re a AAA member already, and you’re okay with a mediocre service as long as it comes from AAA.

- $1 million in theft insurance coverage is fine by you, even though you could have more with another service – like Aura.

- You don’t mind limited customer service hours. In the event of an identity theft event, you have no problem waiting until the office opens to get help.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

I gave ProtectMyID a thorough inspection, testing every bell and whistle it claimed to have. And, I have to say, the results weren’t bad.

If I’m going to trust a service to protect my credit score, my retirement account, and my kid’s Social Security numbers, though, I don’t want “not bad” – I want the best available, AND I don’t want to overpay for it.

That’s why I think Aura is the better choice for most people.

Aura offers more comprehensive coverage, 24/7/365 customer service, and industry-leading theft insurance policies. Plus, they let you cover up to five adults on one plan, so you can include your college-aged kids, your in-laws, or your parents. And, they increase the insurance for each adult you add, up to $5 million in coverage.

If you’re thinking Aura must be pricey to include all of that, I understand where you’re coming from, but you’re wrong.

Aura offers the best value in the industry, and with our discount code, you can get it for even less.

If you’re an AAA member and you still want to hear about ProtectMyID, read on. I’ll give you all the dirty details about this service. And, in the end, my guess is you’ll agree – for the vast majority of people, Aura beats ProtectMyID.

Is ProtectMyID Worth Getting?

ProtectMyID might be worth getting, though I think Aura is better for most.

ProtectMyID is a product of a partnership between Experian and AAA. It allows AAA members to get Experian’s identity protection services at a very low rate. Similar to Complete ID, another Experian-based identity theft protection service that is available only to Costco Members.

While Experian excels at credit monitoring, I think its identity monitoring is lacking. They’re not great at finding threats. Other identity protection services, like Aura, are much better at scanning the dark web and offer a wider monitoring breadth.

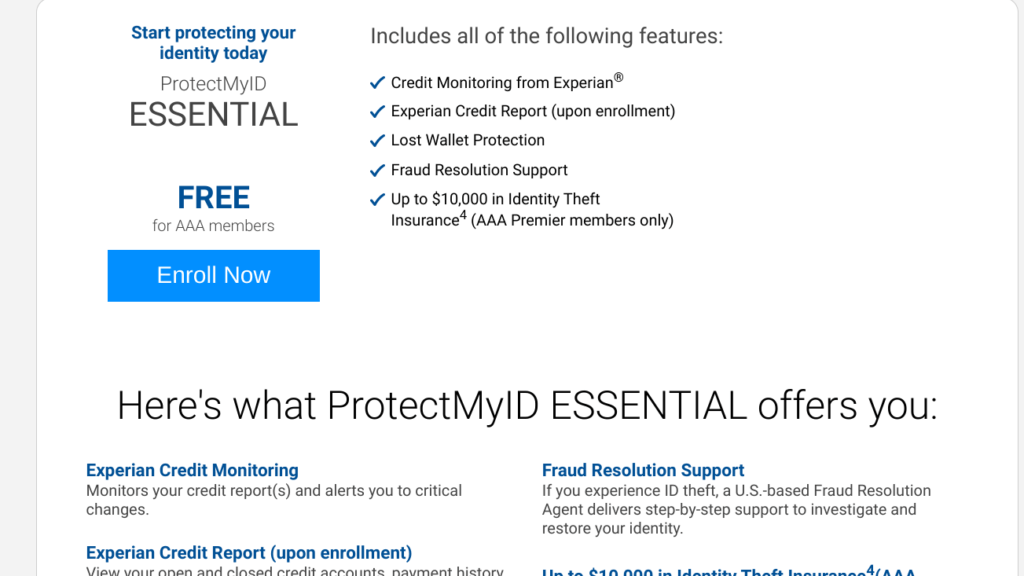

However, ProtectMyID offers a free Essential plan that might work if you’re single, very budget-conscious, and don’t have anything extra to spend on identity protection.

Of course, you get what you pay for, and the free plan is missing lots of protection services you’ll ultimately want to have.

As I’m about to meticulously explain, even the Platinum plan is missing key pieces. So, while ProtectMyID seems like a great idea, if you really want protection for yourself and perhaps your family, you want something like Aura instead.

Editor’s Ranking

|  | |

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

|

Customer Support |

|

Operation Hours: MON-FRI: 7AM-7PM |

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Monitoring & Alerts: 6/10

AAA ProtectMyID is run by Experian. So, it’s no surprise that its monitoring and alert capabilities are in line with other Experian products like CreditWorks and IdentityWorks.

The protection they offer with their Platinum plan is fairly comprehensive. There are two other plan offerings from ProtectMyID – an Essentials plan, which is free, and a Deluxe plan, which is available at a lower price, but offers fewer services.

I chose to review their Platinum plan so I could delve into all the extras. That said, I’ll do my best to point out where the other plan options sit compared to the Platinum plan’s offerings when relevant.

With the Platinum plan, you get:

The only missing services are home and auto title monitoring and investment account monitoring – all of which are good to have. However, many identity protection companies skip over them, so I can’t judge ProtectMyID too harshly for not including them.

What I can judge them harshly for is their subpar threat detection.

Unfortunately, none of the Experian products are stellar at finding your compromised information – at least, not the way Aura is.

Dark Web Alerts

ProtectMyID found the same handful of alerts that other Experian products found on me. Sadly, that handful is far less than what Aura found.

That tells me that ProtectMyID isn’t catching everything on the dark web. And I rank dark web monitoring as one of the most important parts of an identity protection tool.

With accurate dark web monitoring, you can prevent extensive identity damage. If your personal information is found there early on, changing your passwords or locking your credit might be enough to stop a cybercriminal.

When dark web monitoring isn’t thorough, you might not catch a criminal until after the damage is done. It might take a fraudulent account opening in your name or suspicious activity on your credit report for you to realize you’ve become an identity theft victim.

Since ProtectMyID missed several dark web alerts that Aura found, I have to give it a low score in monitoring and alerts – which isn’t good. You want a service that catches small threats before they become all-out identity theft, if possible. And that service isn’t ProtectMyID.

Alerts Dashboard

ProtectMyID’s alerts dashboard is easy to use and provides plenty of information.

Unlike some of Experian’s other products, it gives detailed steps about what to do if your information is compromised (rather than simply saying you should freeze your credit).

As an example, when ProtectMyID finds a compromised email, it recommends changing your password for any site that uses that email and password combination. It also gives a brief explanation of how to create strong passwords within the alert.

I like this setup because it doesn’t require me to dig for more details. I don’t have to look up articles or click on multiple links to understand the alert. Instead, I know exactly how to proceed within minutes of clicking the notification.

Financial and Credit Monitoring

You would think that ProtectMyID would excel in this area, given that the service is powered by one of the major three credit bureaus – but that’s not quite the case.

While ProtectMyID offers standard financial monitoring, it misses deeper-level investment account monitoring.

Investment account monitoring is crucial if you’re saving for retirement. It watches for signs of criminals messing with your 401(k) or other investment-type accounts. Many services fail to offer investment account monitoring, but if you want it (trust me, you do), Aura includes it with their plans.

In terms of credit monitoring, their Platinum plan is a little misleading.

Here’s what I mean:

When you sign up for the Platinum plan, it says you’ll get 3-bureau credit monitoring. I take that to mean you’ll have access to scores and reports from all three credit bureaus. But when I got inside ProtectMyID’s credit monitoring module, I discovered that wasn’t the case.

ProtectMyID may monitor your credit score from the big three bureaus, meaning you’ll get an alert if there’s suspicious activity. However, if you want to see your score or view your credit report from anyone other than Experian, you’ll have to pay for it.

ProtectMyID charges $31.99 for a one-time, 3-bureau credit report, even with their Platinum plan.

Of course, the information on your Experian score is detailed. ProtectMyID goes deep, offering your score, a list of credit inquiries, creditor contact information, your open accounts, revolving credit accounts, and more.

You don’t need this much information from all three credit bureaus, but I’d expect at least the score from each one if the service is claiming 3-bureau credit monitoring.

Public Records Monitoring

AAA ProtectMyID offers decent public records monitoring services.

They monitor court records to ensure crimes aren’t committed in your name. They also provide a sex offender monitoring service that informs you if a registered sex offender moves into your area. It also lets you know if someone registered as a sex offender with your information.

However, they don’t provide home or auto title monitoring. If you own a home or car, this is a service you want. Aura is one of the few identity protection services to offer it with all of their plans.

Threat Resolution: 9/10

|  | |

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

ProtectMyID is through Experian, and unfortunately, Experian’s customer service isn’t the best.

Luckily, ProtectMyID has a separate customer service line for AAA members. That makes ProtectMyID’s threat resolution capabilities much better than any of the other Experian offerings.

Customer Support

I was worried when I called ProtectMyID’s customer service line on a Wednesday afternoon, but I shouldn’t have been.

As it turned out, I reached a representative in under a minute, and she was incredibly helpful. She answered all my questions and made sure I didn’t need any additional information.

As far as hours go, their customer service team is available from 7 a.m. to 7 p.m., Monday through Friday. That’s not ideal. Data breaches can occur at any time, after all, and its stress builds if you have to wait to talk to someone.

Still, overall ProtectMyID’s customer support gets high marks from me. Reaching a friendly human being was remarkably easy.

Concierge Service

ProtectMyID’s threat resolution service is also through Experian, but as with their customer support, there’s a separate line to call.

This means their concierge service is excellent. When you call, you reach a U.S.-based resolution specialist who’s received at least ten weeks of training.

This isn’t quite as impressive as Aura’s seven years of average industry experience, but it’s pretty good.

Lost Wallet Protection

ProtectMyID comes with lost wallet protection, meaning you can call and cancel your bank cards and medical cards in one go.

Some services go above and beyond with this feature by offering to help you replace your passport and even your driver’s license when possible. ProtectMyID doesn’t go that far, but they meets industry standards.

Theft Insurance: 7/10

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

AAA ProtectMyID is unique in that its Essentials (free) plan comes with identity theft insurance. It only provides $10,000 in coverage, which isn’t very much, but that a free plan includes insurance at all is awesome.

Their Deluxe and Platinum plans come with the industry standard $1 million in identity theft insurance. $1 million is great, but it’s nothing compared to Aura’s $1 million per adult (up to $5 million for family coverage).

If you’re looking for plenty of theft insurance, Aura leads the industry. I highly recommend them if you have a family you want to protect, which leads me to my next point…

Family Plans: 6/10

Aura offers the best family identity theft coverage without question. ProtectMyID, and every other service I’ve tested, fails to come close.

With Aura, you can cover your spouse (a Couples plan) or up to five adults and unlimited children on a Family plan. The latter means you can include your spouse, adult children, in-laws, and grandparents without purchasing extra protection. And each adult gets $1 million in identity insurance coverage.

All of that said, AAA ProtectMyID isn’t terrible for families with children, but it’s not great.

They don’t offer true family plans. Instead, you can add up to ten children under 18 onto the Deluxe plan for $3.95 per month. With their Platinum plan, you can include up to 10 kids at no cost. However, you can’t cover adult children, and there’s no option to cover your spouse.

Ease of Use: 9/10

AAA ProtectMyID has a functional interface. It’s not going to win any awards for design, but it works, and it’s easy enough to figure out.

Signing up takes just a few minutes, after which you’re given a lengthy list of information to input. After you dig up your passport, enter all your medical IDs, and provide your bank account information, ProtectMyID can start to do its job.

Once you get to the dashboard, there’s no orientation, but you also don’t really need one. Most of the features are self-explanatory.

Dark web notifications are prominently featured alongside a toggle switch that can lock your credit and all of the promised credit score modules, including a VantageScore tracker.

Notifications, including identity alerts, appear across the top of the main screen, making them easy to address.

All in all, I don’t have any complaints here. Everything loads with ease, and you can quickly navigate to anything you need to.

Additional Services: 5/10

|  | |

Additional Services |

|

|

In terms of additional services, ProtectMyID doesn’t offer very many. In some respects, it is an additional service to your AAA membership. So you don’t get a VPN, antivirus software, or parental controls included with ProtectMyID.

You do get a VantageScore tracker, though.

Most consumers are more familiar with FICO credit scores. VantageScore is similar. It was created by the big three credit bureaus as an alternative tool for lenders to determine creditworthiness.

It uses predictive models that allow it to include more consumers than the original FICO score (including those with limited credit history). That means it’s growing in popularity amongst lenders, and you should probably know what yours is if you plan to finance anything in the future.

Still, for ProtectMyID to excel in this category, it would need to include more.

My top pick for identity protection, Aura, offers a VPN, antivirus software, a password manager, and parental controls. It even offers safe gaming, which allows parents to keep track of their children’s online gameplay – going as far as to send alerts when it detects cyberbullying or grooming.

A VantageScore tracker is nice, but I’d rather have all the features Aura includes instead.

ProtectMyID Cost: 9/10

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

Covers 2 Adults |

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Assuming you’re already a AAA member, the cost of ProtectMyID is very reasonable.

Their free Essential plan is nothing to scoff at. Though it doesn’t include many of the monitoring services, it comes with some theft identity insurance, and fraud resolution.

The Deluxe and Platinum plans are also available at a reasonable rate. Given that you can include up to ten children on the Platinum plan, $15.95 per month isn’t bad.

Of course, if you factor in the cost of your AAA membership (an average of about $12 per month), the monthly price goes up. And, you’re still not getting all the services the best identity protection plan can offer – like a VPN, antivirus software, and parental controls.

So, if you’re looking at value rather than pure cost, I think there’s better out there.

Aura, for example, offers more services, more accurate monitoring, more insurance coverage, and family plans for up to five adults. It’s a much better value than ProtectMyID overall.

FAQs

Final Verdict: 7/10

Overall, I like AAA ProtectMyID.

It offers a broad range of monitoring services (though they’re not nearly as accurate as I’d like) and a fantastic customer service team. It also meets my ease of use requirements and offers the industry standard in theft insurance. Plus, it’s relatively low cost if you’re already paying for a AAA membership.

That said, their customer service team isn’t 24/7, the family plans are lacking, and there aren’t many additional features.

So, while AAA ProtectMyID is good – Aura is better.

Aura offers exceptional monitoring tools, including home title and investment monitoring. They also have a first-rate customer service team ready to help 24/7/365.

And Aura features super flexible family plans that allow you to include up to five adults – with $1 million in insurance coverage for each one (that’s $5 million total)! Aura also comes with a full suite of additional features, including a VPN, antivirus software, and parental controls.

So, even though ProtectMyID might look like a decent service at a great price – if you’re serious about protecting yourself and your family, Aura is the better choice.

Related Articles:

Citations:

1. https://department.va.gov/privacy/identity-theft/

2. https://www.ftc.gov/legal-library/browse/rules/safeguards-rule