Identity Guard vs IDShield 2024 – Here’s Which One We Chose

Two months of testing Identity Guard vs. IDShield revealed that Identity Guard is the better identity protection service.

Identity Guard includes better monitoring and alerts – it found 15 dark web alerts during testing, IDShield only found eight.

Identity Guard also lets you protect your entire family with plans that include up to five adults and $1 million in identity theft insurance. IDShield maxes out at two adults on a plan.

While Identity Guard has limited customer service hours, its customer service team is excellent. They’re knowledgeable, easy to reach, and were able to answer all of our questions.

To top it off, Identity Guard offers incredible value. With our discount code, you can lock in off Identity Guard, making it far more affordable than IDShield.

- You want accurate and comprehensive monitoring, ensuring your identity is protected from data breaches and other criminal activity.

- You want to protect your entire family, including college-aged children (up to five adults and unlimited children).

- You value customer service and want access to Identity Guard’s expert team.

- You want affordable identity protection. Identity Guard offers high-quality protection without a high-end price tag.

- You’re okay with less accurate monitoring. IDShield missed several key identity alerts that Identity Guard found.

- You’re worried more about reputation management and device security than identity protection. IDShield offers extra features but struggles with effective identity protection.

- You don’t mind paying a higher price. Even though its services aren’t as protective, IDShield costs more than Identity Guard.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Identity Guard vs IDShield: Head to Head Comparison

In the Identity Guard vs. IDShield competition, the winner isn’t so clear. At first, it seems like these two services offer the same things. Only after a thorough test drive do their differences stand out.

Here’s where they really differ…

Value.

Identity Guard offers a much better value than IDShield, given the price.

Given IDShield’s plan costs, I would expect it to catch all the threats Identity Guard does (spoiler: it doesn’t).

I’d also expect it to offer full coverage, including home title and 401(k) monitoring. And, I’d expect IDShield to have true, 24/7 customer service, not Monday-Friday office phone hours.

Aura, which is IdentityGuard’s successor, offers better value than either IDShield or Identity Guard (especially if you use our promo code). It offers the widest breadth of monitoring services, all of the extras, and 24/7/365 U.S.-based support.

If you’re set on choosing between Identity Guard and IDShield (or are just insatiably curious about identity protection services), keep reading. I’m going to dig into every nook and cranny of these two services. Just know that Aura beats them both.

Editor’s Ranking Table

|  |  | |

Overall Score | |||

Monitoring & Alerts |

|

|

|

Threat Resolution |

|

|

|

Theft Insurance Per Adult |

|

|

|

Customer Support |

|

|

|

Additional Services |

|

|

|

Cost |

|

|

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

Monitoring and Alerts: Winner – Identity Guard

As Aura’s predecessor, I knew Identity Guard was likely to win this category. It uses the same engine that it does to monitor the web for identity threats. And after years of searching, I’ve yet to find another engine that’s as thorough or as accurate.

But, to be fair, assuming you opt for their top-tier plan, both Identity Guard and IDShield offer fairly comprehensive monitoring, including:

IDShield also offers medical record monitoring. And Identity Guard also offers home title and 401(k) monitoring. Again, this is only with their top-tier plan, but that’s the one I’d recommend for most people anyways.

If you’re looking to save money with a lower-tier plan, Identity Guard offers a “Value” option. It’s incredibly low-priced but only offers a few key services. For comparison purposes, it’s best to look at Identity Guard’s top tier vs. IDShield’s individual plan.

From that perspective, where these two services really differ is in their accuracy and speed—more on that below.

Dark Web Monitoring

After signing up for Identity Guard, their monitoring system swiftly informed me of 35 threats (15 of which were unique). It took two minutes, to be exact.

Things worked a bit differently with IDShield.

IDShield’s sign-up process is a little less streamlined. It takes 24 hours to verify and run your payment information.

So, after signing up, you have to wait 24 hours to use the service. I can’t say how long its dark web scan actually took because I couldn’t see it. All I can say is that it was complete by the time I logged back on—somewhere around 26 hours after signing up.

IDShield didn’t do poorly, but it only found 24 threats (8 of which were unique). That’s not as good as Identity Guard’s 15, but it’s not as bad as some other services I’ve tested.

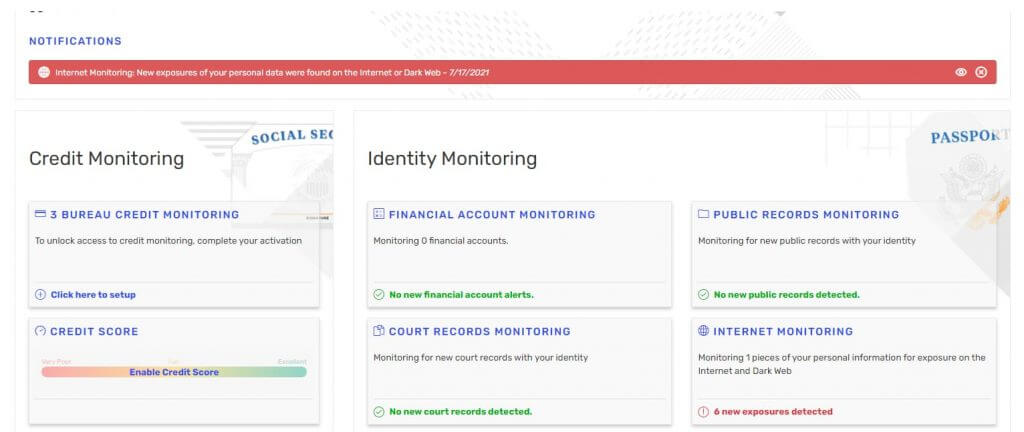

Alerts Dashboard

I’m partial to Identity Guard’s alert dashboard, but IDShield’s isn’t bad.

With Identity Guard, you get detailed alerts with helpful explanations of the threat. Alongside the explanation is advice on how to protect yourself going forward. And once you’ve looked over the alert, you can archive it. This stops it from appearing on your dashboard and keeps everything sleek and clean.

IDShield provides alerts divided by type, which is helpful. So, the dashboard lists the category in bold letters, then lists a brief description below. It might say “Social Media Alert” then “credit card number” below. That would mean your credit card number may have been compromised on a social media account.

My only issue with IDShield’s alert system was in getting to the correct alert dashboard.

I’ll talk more about that in the ease-of-use section, but suffice it to say finding the alert dashboard for IDShield wasn’t as streamlined as it could be.

Credit and Financial Monitoring

Both Identity Guard and IDShield will help you monitor your credit for signs of fraudulent activity but at different levels.

Here’s what I mean:

IDShield offers two plans, one with 3-bureau credit monitoring and one less expensive option with 1-Bureau credit monitoring.

1-bureau credit monitoring is probably efficient for alerting you to an identity thief, but it may miss errors on your credit report which are also crucial to catch. Credit reporting errors, even if only on one report, could block you from financing important purchases.

Identity Guard offers 3-bureau credit monitoring with its two upper-tier plans and no credit monitoring with its basic option.

So, two different levels of credit monitoring, and neither of them is ideal.

As far as financial monitoring goes…

I’ve already pointed out that Identity Guard will help you protect your investment accounts (and, therefore, your retirement) with 401(k) monitoring. On their top-tier, Ultra plan IdentityGuard also offers credit locks and credit freezes. So you can ensure your credit score and retirement funds are safe. .

IDShield will assist with credit freezes, and that’s about it.

Public Records Monitoring

Here, Identity Guard and IDShield are pretty even. Both will monitor public records, including criminal records, so no one uses your name to commit a crime.

However, don’t forget Identity Guard’s Ultra plan also offers home title monitoring while IDShield does not. Home title monitoring is crucial if you own a home. But, of course, if you rent,it probably doesn’t matter much.

What does matter to everyone is broker removal services.

Internet data brokers collect your personal information and sell it to everyone, from marketing companies to insurance companies. If that feels like a violation of privacy…

It is.

IDShield advertises its team of licensed private investigators as data broker removal pros. Meanwhile, Identity Guard doesn’t offer data broker removal services at all.

But, once again, Aura comes out on top. It uses automated data broker removal to scan and remove your name from data brokerage lists. Automation is faster and arguably more thorough than any private investigator can be, so if this is something that matters to you, it is the best option.

And it offers home title monitoring, too, alongside monitoring all other important public records for your name.

Threat Resolution Services: Tie

|  |  | |

Expertise |

|

|

|

US Based Support? |

|

|

|

Customer Hours |

|

|

|

Concierge Resolution |

|

|

|

Lost Wallet Protection |

|

|

|

Both Identity Guard’s Ultra Plan and IDShield offer exceptional threat resolution.

Here’s how:

There are some distinct differences, though, which I’ll discuss below.

Customer Support

Identity Guard and IDShield offer US-based support teams that are speedy and helpful.

When I called to ask a few basic questions about services, I was talking to a human within 1 minute at both companies. And that was on a Friday afternoon!

The difference is in their availability.

Identity Guard’s team is available Monday through Saturday until 11 pm. It’s not quite 24/7 coverage, but it’s close.

They also promise email responses within 48 hours. I tested this with an email on a Thursday afternoon. I didn’t hear back until Tuesday. So, not quite 48 hours, but the response was detailed.

IDShield has fewer phone hours but better availability overall. They offer phone support Monday through Friday from 8-6 pm. They also promise a 24-hour e-mail response, and when I tested them, they met their goal. I emailed on Tuesday at 9 am and had a response that night.

IDShield also offers live chat for members, which is handy for solving small issues.

Concierge Services

Identity Guard and IDShield both have some of the best concierge services in the industry.

Both provide a team of knowledgeable professionals to help you restore your identity. This team will file paperwork for you, make phone calls with you, and essentially hold your hand through what can be a cumbersome process.

Here’s where they differ:

Identity Guard only offers white glove restoration service with their top-tier plan, which is a little frustrating.

IDShield offers restoration with all plan levels, but it’s not quite the same.

They rely on licensed private investigators to handle the restoration rather than restoration specialists.

Whether a licensed PI is any better at helping restore identities than someone who’s worked in the industry for decades is unclear.

Wallet Protection

Wallet protection is fairly standard amongst identity protection services, but it can include very different things—as is the case with Identity Guard’s and IDShield’s versions.

Identity Guard has some of the best wallet protection services I’ve ever come across. Here’s what they include:

- Cancellation of credit and debit cards

- Review of your credit report for signs of fraud

- $2,000 of emergency cash from one of your accounts

If you lose your wallet while traveling, for example, a service that can send you $2,000 from an account you otherwise cannot access is a big deal!

IDShield will help you cancel your credit and debit cards but doesn’t offer the extras Identity Guard does.

Theft Insurance: Winner – Identity Guard

|  |  | |

Theft Insurance Score | |||

Theft Insurance |

|

|

|

Identity Guard and IDShield both offer a $1 million theft insurance policy to help cover expenses should a thief steal your identity.

So, at first glance, this category should be a tie.

However, while Identity Guard offers a detailed, easy-to-review breakdown of what’s covered, IDShield does not.

I scoured IDShield’s website and dashboard for information on their insurance policy. None exists.

Could I call their team and ask?

Sure. But with an insurance policy, it’s nice to have documentation at your fingertips. You’re not going to memorize what’s included (at least, I’m not), but if something happens, you’ll want to review your coverage right away.

Identity Guard’s policy breakdown is easy to find and looks like this:

- $1 million aggregate insurance coverage. This covers everything from long-distance phone calls to hiring a personal investigator to help fix the damage done to your identity.

- $2,000 per week in lost wages for up to 5 weeks.

- $1,000 per policy period for travel expenses.

- $2,000 per policy period for child, elder, or spousal care.

It’s a pretty standard policy. But on transparency alone Identity Guard wins this category.

Family Plans: Winner—Identity Guard

Identity Guard wins this category for two reasons:

- Identity Guard family plans cover up to 5 adults and unlimited kids. IDShield only covers two adults and unlimited kids.

- Identity Guard family plans cost less.

Put those together, and you realize Identity Guard charges less to cover more people. Whether you want to include your in-laws, adult children, or parents with Identity Guard, you can.

With IDShield, you’ll spend more for less coverage.

Side note, Aura will cover up to five adults and provide $1M each in theft insurance coverage. That’s $5 million total! And their family plan is still cheaper than IDShield. So, who’s the real winner here?

Ease of Use: Winner – Identity Guard

Let me start by saying neither service has a bad interface. Both are functional and straightforward.

However, Identity Guard offers a sleeker, more intuitive dashboard.

Its large symbols allow you to navigate quickly. And you can get to most of the information you need in just a click or two.

IDShield’s website is easy to navigate for most things, but there are some caveats.

For example, when I first signed up for IDShield, I received an email link that seemed like it took me to their alert dashboard. As it turned out, that initial dashboard was the LegalShield dashboard (IDShield’s parent company).

The LegalShield interface then asked for a customer number (hidden in the original email). Once I located and inputted said number, I finally gained access to the IDShield alert dashboard.

So, not exactly a streamlined initial process.

IDShield also makes it difficult, if not impossible, to locate some important, albeit less used, things. Their insurance coverage statement comes to mind.

And they don’t make use of clear symbols the way Identity Guard does. I don’t mind reading, but big graphic representations allow users to move through a site more quickly than small font headings do.

Thus, Identity Guard is slightly easier to use.

Additional Services: Winner – IDShield

Here’s where IDShield jumps ahead and perhaps justifies its higher price point.

IDShield offers:

- VPN

- Antivirus software (through Trend Micro)

- Password manager

Identity Guard offers a password manager but no VPN or antivirus software. Neither offers a parental controls suite to help protect kids online.

I have to say, though, if this is how IDShield justifies its high price, it’s a mistake.

Aura offers a VPN, antivirus software, a password manager, and a parental controls suite at a much more affordable rate. So, if you’re after all the added extras, go with it instead.

Costs: Winner – Identity Guard

|  |  | |

Promo Code | |||

Individual Plan Cost |

|

|

|

Couple Plan Cost |

Covers 2 Adults |

|

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

Covers 5 adults & unlimited kids |

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

When you look at their pricing side-by-side, this is an easy one…

Identity Guard offers competitive services for a lower price.

At the top level, both Identity Guard and IDShield offer everything you’d want in an identity protection service—3-bureau credit monitoring, top-notch threat detection, and high-end restoration services.

However, Identity Guard charges $17.99 per month for individuals and $23.99 for families.

IDShield charges $19.95 for individuals and $34.95 for families with only two adults!

I think the winner is clear.

Final Verdict: Identity Guard

Start searching for the best identity protection services, and you’ll find lots of talk surrounding Identity Guard and IDShield.

As I’ve shown, Identity Guard is the better choice if you’re choosing between IDShield and Identity Guard.

If you’re looking for the best way to protect yourself and your family from identity thieves, though, Aura is what you need.

It offers the best value overall. Its prices are lower than IDShield’s and Identity Guard’s (especially when you use our promo code). It offers the best monitoring and accurate threat detection and comes with a team of restoration specialists. Plus, the insurance coverage goes way above the industry standard, at $1M per adult (up to $5M total).

That makes Aura the best choice overall. It beats Identity Guard and IDShield by a long shot.

Other Comparison Articles:

Citations:

1. https://www.usa.gov/identity-theft

2. https://www.natca.org/benefits/home-auto/identityguard/

3. https://bjs.ojp.gov/library/publications/report-indicators-school-crime-and-safety-2020

4. https://home.sophos.com/en-us/security-news/2019/dark-web