LifeLock Alternatives and Competitors – SAVE 68% On This One

If you’re looking for LifeLock alternatives, you’ve come to the right place. After over six months of testing, we recommend Aura over any other identity protection service, including LifeLock.

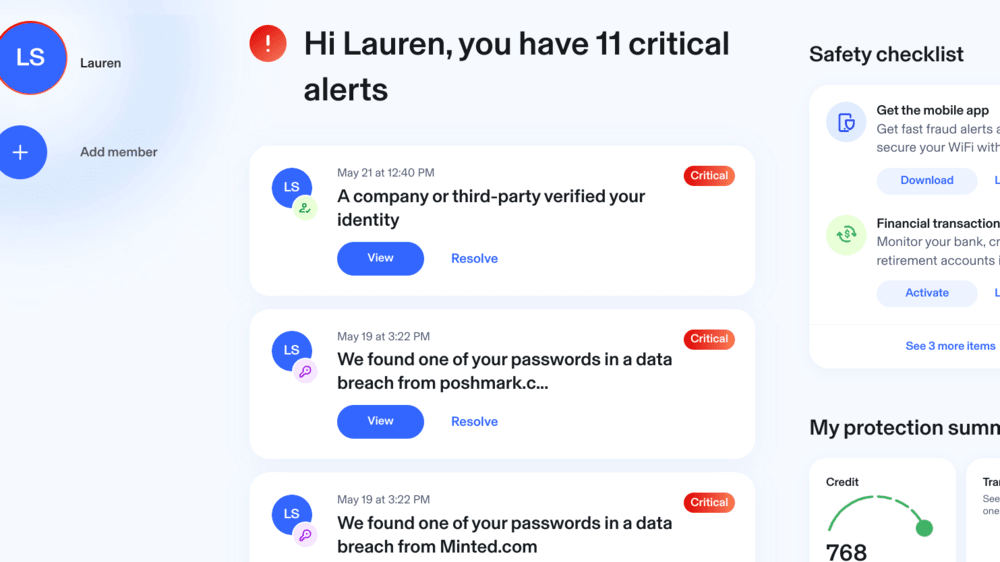

Aura protects your identity with more accurate alerts – it found 15 during testing. LifeLock only found one.

Aura also offers more comprehensive protection than LifeLock’s top-tier plan, including features like automatic data broker removal services.

And it gets better. With our discount code, you can lock in our OFF Aura for life and avoid LifeLock’s subscription renewal price hikes.

Why You Should Get Aura:

- Aura offers more accurate and comprehensive monitoring to keep your identity safe.

- $5 million in identity theft insurance is included with Aura family plans. You can rest easy knowing your family is protected.

- Aura offers 24/7/365 customer service. They’re easy to reach and ready to help.

- Aura is the best value in identity protection, charging less than LifeLock yet offering more.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

You Should Get…

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

So if you’re like me and found LifeLock to be less than it claims, this article is for you. And, if you’re one of the lucky few who didn’t sign up for LifeLock because you knew there was better out there, this is still an excellent article to reference.

By the time you’re done reading it, you’ll know which identity protection service is best suited to your needs. My guess is it will be Aura, but I’ll let you decide.

Top 10 Best LifeLock Competitors and Alternatives in 2024

- Aura

- Identity Guard

- IdentityForce

- IDShield

- ID Watchdog

- Allstate Identity Protection

- IDX

- IdentityWorks

- PrivacyGuard

- Costco Complete ID

Below, I’ll briefly summarize each service, including its top features and who it’s best suited for. Then, I’ll explain how LifeLock competitors compared during testing. Finally, I’ll summarize each service’s pricing and plans so you know what to expect if you switch.

Ready? Let’s do this!

1. Aura

Pros

- More accurate and effective monitoring

- Better customer service and threat resolution

- More flexible family plans

- More affordable

Cons

- Less theft insurance coverage compared to LifeLock’s top-tier plan

Aura is my top pick for identity protection, the best LifeLock alternative for several reasons.

It offers comprehensive and award-winning identity theft and credit monitoring, full-service identity restoration, 24/7 customer service, and flexible family plans that allow you to include up to five adults.

Add in their suite of parental control tools and online privacy features, and you’ve already surpassed LifeLock by a mile.

And, when you use our discount code, you slash Aura’s already low price, locking you in at an even lower rate for life – something LifeLock fails to do (they up their price upon renewal).

That means I recommend Aura to most people.

If you want to protect your credit, financial assets, and identity, Aura is the best pick. It’s also ideal for parents with children of any age. And it’s fantastic for seniors who need niche monitoring for assets like their home and car titles – and need it on a budget.

| ||

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

How It Compares To LifeLock

When I tested Aura, it found two dark web alerts and ten compromised passwords in a matter of minutes. LifeLock found one dark web alert and no compromised passwords, so I know it’s not finding what it should.

Aura’s customer service team was also quick to answer and extremely helpful. I’ve called them at the most inhospitable times (midnight, four am, etc.), and each time I’ve reached a representative in under two minutes. I can’t say the same for LifeLock.

Though LifeLock offers 24/7 customer service and a live chat line, I’ve found that neither is very effective. In either case, it takes a long time to reach a real person, and in my experience, said person tends to be less than knowledgeable about their product.

LifeLock’s family plans are also rigid, only allowing two adults and up to five children. If you’re trying to protect college-aged kids or aging parents, LifeLock doesn’t work.

LifeLock’s “Norton Family” protection suite seems appealing at first glance, but Aura’s parental controls and Internet security have more features, including the ability to “pause the internet” from any device.

Aura also comes with safe gaming controls for computer security. These monitor over 200 popular online games for signs of cyberbullying, harassment, racism, and grooming so parents can step in when needed.

While LifeLock’s insurance coverage looks more appealing up front (they offer up to $3 million per adult and $1,050,000 per child on the top-tier family plan), only the top tier comes with that much coverage. Lower tiers are significantly reduced, with the “Select” plan only offering $25,000 in stolen funds and expense reimbursement.

And, at LifeLock’s top tier, it’s very expensive. As you’ll see with Aura’s plans and pricing below, Aura is much more affordable.

Pricing and Plans

| |

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

Aura keeps its plans and pricing simple. They avoid tiered pricing structures and offer one flat rate that includes everything. I like this much better than LifeLock’s tiered pricing structure.

- $12 per month annually ($15 monthly) for individuals

- $24 per month annually ($30 monthly) for families, including up to five adults and unlimited children

These rates are already affordable, and unlike LifeLock, they don’t rise after the first year. But you can do better by using our Home Security Heroes discount, giving you a phenomenally low rate for LIFE.

2. Identity Guard

Pros

- More accurate monitoring

- Better customer service

- A more flexible family plan

- No frills, “Value” plan available for a very low rate

Cons

- Minimal online privacy and security features

- Only includes identity restoration services with its top-tier plan

Identity Guard is Aura’s predecessor, offering many of the same advantages as Aura.

Its monitoring is accurate, its customer service team is top-notch, and though it doesn’t have all the bells and whistles that Aura and LifeLock’s ID theft protection provide, it does have one incredible benefit.

You can get Identity Guard’s most basic protection at a very low price. So, if you’re looking for basic monitoring and insurance coverage only (no identity restoration services, advanced monitoring, or credit tools), then Identity Guard might be a good option.

| ||

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Related: Identity Guard vs LifeLock: Head to head comparison.

How It Compares To LifeLock

Identity Guard has the same monitoring capabilities as Aura. So, it found the same two dark web alerts and the same ten password alerts on me during testing. This is much better than LifeLock’s one dark web alert.

Their customer service team is also the same as Aura’s, so again, they were much easier to get a hold of and far more knowledgeable than LifeLock’s team.

Just like Aura, Identity Guard also comes with a very flexible family plan, allowing you to include up to five adults and unlimited children. So, you can protect your parents, in-laws, or adult children. With LifeLock, you’re limited to just two adults and five kids.

That said, LifeLock does offer increasing insurance coverage for each plan member, including children. This insurance coverage starts small, though, with the lowest plan only offering $25,000 each in stolen fund reimbursement and expense coverage.

Identity Guard’s insurance is $1 million per adult, even with its lowest plan, which is more affordable than LifeLock’s base-level offerings (especially when considering LifeLock’s increased pricing upon renewal).

Unfortunately, Identity Guard doesn’t come with much in the way of extras. There are no parental controls, no VPN, and no antivirus software. It does have a password manager and a safe browser built-in, but that’s it. So, LifeLock definitely comes out ahead if you’re looking for additional features.

But if you want a no-frills product that’s accurate and relatively inexpensive, Identity Guard is a good pick.

Pricing and Plans

| |

Promo Code | |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

Promo Code |

Identity Guard offers three pricing tiers:

- Value ($7.50 per month annually for individuals, $12.50 for families)

- Total ($16.67 per month annually for individuals, $25 for families)

- Ultra ($25 per month annually for individuals, $33.33 for families)

The Value plan includes very basic monitoring (dark web, data breach, and high-risk transactions only) with a $1 million identity theft insurance policy.

The Total plan adds on bank account monitoring and basic three-bureau credit monitoring.

The Ultra plan is most comparable to LifeLock because it includes comprehensive monitoring (including home title monitoring and investment account monitoring) and white glove identity restoration services, alongside thorough credit monitoring.

3. IdentityForce

Pros

- More accurate monitoring

- Better customer service

- No cost increase for renewal

Cons

- Parental control features aren’t as thorough as LifeLock’s

- Insurance does not increase with added plan members

- Pricey

IdentityForce is a good choice for alternatives to LifeLock if you’re switching from LifeLock because it offers more accurate monitoring, a unique suite of credit tools, and online security features.

IdentityForce also offers good customer service and white glove identity restoration with all of its plans. Plus, they provide nice online privacy extras for adults and kids.

So, IdentityForce is great for parents, especially those with kids who are active on social media. It’s also good for people who are trying to improve their credit scores.

| ||

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Related: Identity Force vs LifeLock: Head to head comparison.

How It Compares To LifeLock

When I tested IdentityForce, I walked away impressed. Its monitoring capabilities were

just as accurate as Aura’s (it found the same alerts, just as fast).

And its monitoring services are very comprehensive. Like LifeLock and Aura, it includes investment account monitoring (though it misses home and auto title monitoring, which Aura provides).

Their customer service team is also responsive. Unlike LifeLock, getting a hold of a customer service rep with IdentityForce is easy. When I called, I reached a rep in under two minutes, and they had no problem answering my questions.

IdentityForce’s identity restoration services are also uniquely extensive. They go as far as to offer identity restoration for immediate family members, even if you don’t have a family plan.

Speaking of which, I used to take issue with IdentityForce for not publishing their family plan rates. Up until very recently, you had to call in to get rates and inclusions, but as of this writing, IdentityForce has begun publishing their family plan rates online, which is ideal.

Like LifeLock, their family plan structure is rather rigid- allowing only two adults. Unlike LifeLock, though, IdentityForce allows for unlimited children rather than its competition limiting it to five kids under eighteen.

Each family plan comes with IdentityForce’s ChildWatch service, which isn’t quite as comprehensive as Norton’s Family suite. It doesn’t include true parental control features. However, it does scan social media for signs of racism, bullying, or harassment, which is helpful to parents.

IdentityForce offers $1 million in identity theft insurance regardless of whether you sign up for a family plan or as an individual. So, LifeLock has IdentityForce beat there.

And unfortunately, IdentityForce is a bit pricey. But, the price doesn’t increase upon renewal as LifeLock’s does.

Pricing and Plans

Promo Code | |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

Promo Code |

IdentityForce comes with two plan types: UltraSecure and UltraSecure + Credit.

The latter includes a number of credit monitoring tools, including a credit simulator tool that lets you predict your future credit score given certain events. UltraSecure is straight identity monitoring with no credit monitoring functions.

Pricing looks like this:

- UltraSecure: $19.95 per month for individuals or $189.95 per year

- UltraSecure + Credit: $34.99 per month or $329.95 per year

- Family Plan (includes everything in UltraSecure + Credit and Childwatch) – $35.99 per month or $359.95 per year)

4. IDShield

Pros

- Licensed private investigator-led restoration team

- Easy to reach customer service

Cons

- Not very accurate monitoring

- Giltchy tools

- Customer service has limited hours

IDShield makes the list of LifeLock competitors because of its identity restoration services. Unlike other options, IDShield goes above and beyond by using licensed private investigators to help victims of identity theft.

Based on our IDShield identity protection reviews, IDShield also offers a good customer service team and fairly comprehensive monitoring (though it’s missing a few key features like investment account monitoring and home title monitoring).

Unfortunately, IDShield isn’t the most accurate service I’ve tested, and some of its tools are a little glitchy. But for those who want to ensure they have restoration help from uniquely qualified individuals, IDShield might be worth looking into.

| ||

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Related: IDShield vs LifeLock: Head to head comparison.

How It Compares To LifeLock

LifeLock isn’t a very accurate tool, but, unfortunately, neither is IDShield. When I tested its services, it failed to find a single threat.

IDShield makes up for this with stellar customer service and a great restoration guarantee. They promise to return your identity to pre-theft status or your money. And after speaking with IDShield’s customer service team, I believe they could.

When I called, they answered in under one minute and were very knowledgeable. Sadly, their regular customer service hours are limited, but there is a 24-hour emergency hotline for members.

LifeLock offers restoration services, but given my experience with their customer service reps, I hope I never have to use them!

IDShield’s monitoring isn’t quite as comprehensive as LifeLock, though. As mentioned, they don’t monitor your home title or investment accounts. They also don’t have as many credit monitoring tools or online privacy features.

While LifeLock has handy services like an in-portal Transunion credit lock, IDShield only offers freeze assistance, which isn’t nearly as convenient.

IDShield offers a VPN and anti-phishing software, but it can’t compare to Norton’s antivirus software, nor does IDShield include any sort of parental controls. It does offer reputation management, though, which is unique.

Its reputation management tool is supposed to connect to your social media accounts, scan for anything that’s possibly offensive, and allow you to remove it from the internet. It also provides guides for creating a more attractive LinkedIn profile, which may make it a good choice if you’re seeking a job.

Their reputation management tool doesn’t work very well. It had a hard time linking to my accounts – it took me three tries. And, once it linked, it didn’t flag anything for review. So, either my social media is squeaky clean or it doesn’t work very well (I’m guessing it’s the latter).

Their insurance coverage is also a standard $1 million in expense and fund reimbursement, which pales next to LifeLock’s top-tier offerings.

However, IDShield is cheaper than LifeLock’s Advantage or UltimatePlus plans, making it a decent replacement overall.

Pricing and Plans

| |

Promo Code | |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

Promo Code |

IDShield offers two pricing tiers – one with one-bureau credit monitoring through Equifax and the other with three-bureau monitoring. They also offer family plans within both tiers. The pricing looks like this:

- One Bureau: $14.99 per month for individuals/ $29.95 per month for families

- Three Bureau: $19.99 per month for individuals/ $34.95 per month for families

5. ID Watchdog

Pros

- Customizable alerts

- 24/7/365 customer service

- $2 million in stolen funds and insurance coverage

Cons

- Poor monitoring capabilities

ID Watchdog is Equifax’s identity protection service. They offer excellent, 24/7 customer service and, as you might expect, a full suite of credit monitoring tools.

Unfortunately, ID Watchdog isn’t a very accurate monitoring service. It’s less accurate than LifeLock, in my experience. So, if you opt for this alternative, you’re choosing it mainly for its credit monitoring capabilities.

How It Compares To LifeLock

As I mentioned, ID Watchdog isn’t very accurate when it comes to monitoring. It didn’t find a single dark web alert on me, which was disappointing because it stands a step above LifeLock in other areas.

Its customizable alerts are nice, especially for families. It allows you to automatically share alerts with other adult family members, which is something I’ve only ever seen from Aura.

I also like ID Watchdog’s customer service team much more than LifeLock’s. They’re available 24/7/365, and when I called, I reached a representative in less than one minute.

As expected, ID Watchdog’s credit monitoring tools are also top-notch. These tools include the ability to lock your child’s credit using an in-portal switch. It also comes with a credit score tracker so you can keep close tabs on your current score.

ID Watchdog’s subprime loan block is essentially the same as LifeLock’s payday loan block switch. When toggled on, you’ll receive an alert if someone tries to take out a short-term loan in your name.

Additionally, ID Watchdog offers $2 million in coverage – $1 million as a standard identity theft insurance policy and an additional $1 million for stolen fund reimbursement. It’s not quite LifeLock’s $3 million policy per adult, but ID Watchdog’s pricing is also better – especially since it doesn’t increase after the first year.

Pricing and Plans

| |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

ID Watchdog comes in two forms. The Select plan only covers credit monitoring but includes identity theft insurance. The Premium plan includes identity monitoring as well.

Pricing is as follows:

- Select: $14.95 per month for individuals/ $23.95 per month for families

- Premium: $21.95 per month for individuals/ $34.95 per month for families

6. Allstate Identity Protection

Pros

- Incredible reimbursement policy

- In-portal credit lock feature

- A good suite of online privacy features

Cons

- Monitoring isn’t accurate

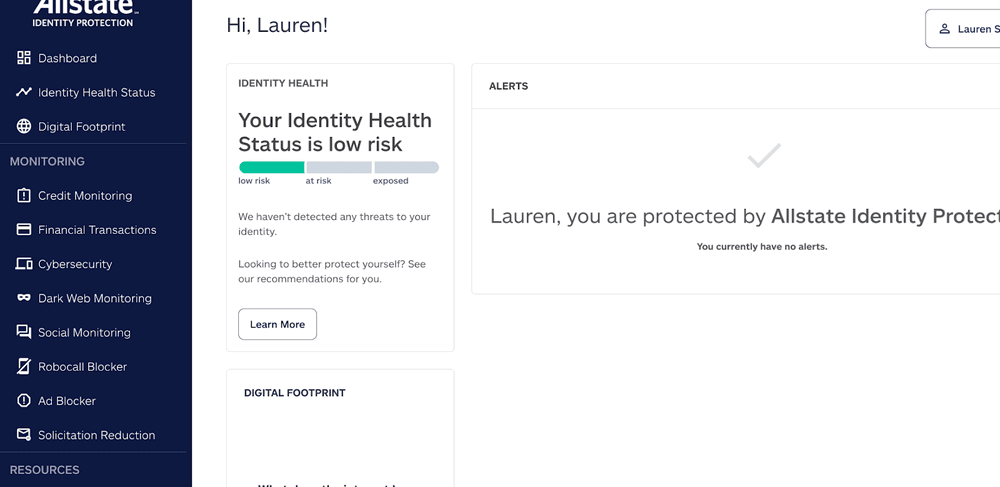

At its top level, Allstate Identity Protection appears impressive. It offers thorough monitoring coverage, fantastic fund reimbursement policies, and a suite of online safety and privacy tools that rival LifeLock’s.

Their lesser plans aren’t as comprehensive and probably aren’t worth considering if you’re switching from LifeLock. But with its “Cyber Blue” plan, Allstate might be worth looking into, especially if fund reimbursement is a top priority for you.

How It Compares To LifeLock

Sadly, Allstate Identity Protection isn’t as accurate as LifeLock when it comes to monitoring. Even after a full week of testing, it failed to find a single threat.

Outside of its inaccuracies, though, Allstate is a solid rival to LifeLock in many ways and is even a step ahead in some areas.

Their customer service team is excellent, answering in under a minute when I called and providing expert answers. This is obviously an area where they come out ahead of LifeLock.

Right in line with LifeLock, Allstate provides a full suite of credit monitoring services, including the ability to lock your Transunion credit with a single click.

As far as a family-friendly product goes, Allstate comes out ahead of LifeLock. That’s because they define a family plan as you plus ten members. Those members can be adults or children, which allows for a lot of flexibility.

And Allstate offers a full range of parental controls, including location alerts and screen time management – very similar to the Norton Family suite.

Allstate’s Cyber Blue plan also includes a full range of online privacy features, including antivirus software, solicitation reduction, and a robocall blocker. Here, again, Allstate is a step ahead of LifeLock. Even though Norton antivirus software is some of the best available, LifeLock doesn’t include a robocall blocker as Allstate does.

Allstate also offers better fund reimbursement. LifeLock offers a generous $1 million in expense coverage and $1 million for fund reimbursement per adult with its top plan. But that’s nothing compared to Allstate.

Allstate’s Cyber Blue plan comes with $2 million in family plan expense coverage and $1 million in fund reimbursement. Plus, Allstate includes an additional $1 million in 401(k) reimbursement and up to $500 in emergency funds if you lose your wallet.

Finally, Allstate’s prices rival LifeLock with all plans, and they don’t increase after the first year. So, if you’re thinking of switching, it’s not a bad option.

Pricing and Plans

| |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

Allstate offers three plans similar to LifeLock – Essentials, Premier, and Cyber Blue.

The Essentials plan offers one-bureau credit monitoring, basic identity monitoring and identity restoration, and a $1 million identity theft insurance policy.

The Premier plan includes everything in the Essentials plan plus more in-depth financial monitoring, including high-risk transaction and investment account monitoring. It also offers more stolen funds reimbursement ($500,000 rather than $50,000 with the Essentials plan).

Finally, the Cyber Blue plan comes with everything in the Essentials and Premier plans but also adds a full suite of online privacy and digital safety features, like parental controls and antivirus software.

It also offers $1 million in stolen fund reimbursement, $1 million in investment account reimbursement, and up to $2 million in home title fraud reimbursement, alongside $1 million in identity theft insurance.

Pricing for these plans is as follows:

- Essentials: $9.99 individual, $18.99 family

- Premier: $17.99 individual, $34.99 family

- Cyber Blue: $19.00 individual, $36.00 family

7. IDX

Pros

- Incredible reimbursement policy

- In-portal credit lock feature

- A good suite of online privacy features

Cons

- Monitoring isn’t accurate

One of the things I like about LifeLock is its interface. If you’re like me and highly value usability, consider looking at IDX instead.

Like Lifelock, IDX has a smooth interface that’s very easy to use. It also offers very actionable alerts (while LifeLock’s alerts are anything but).

So, though IDX has some significant flaws, which I’ll cover below, it’s certainly no worse than LifeLock overall.

How It Compares To LifeLock

IDX has a lot going for it when you put it next to LifeLock.

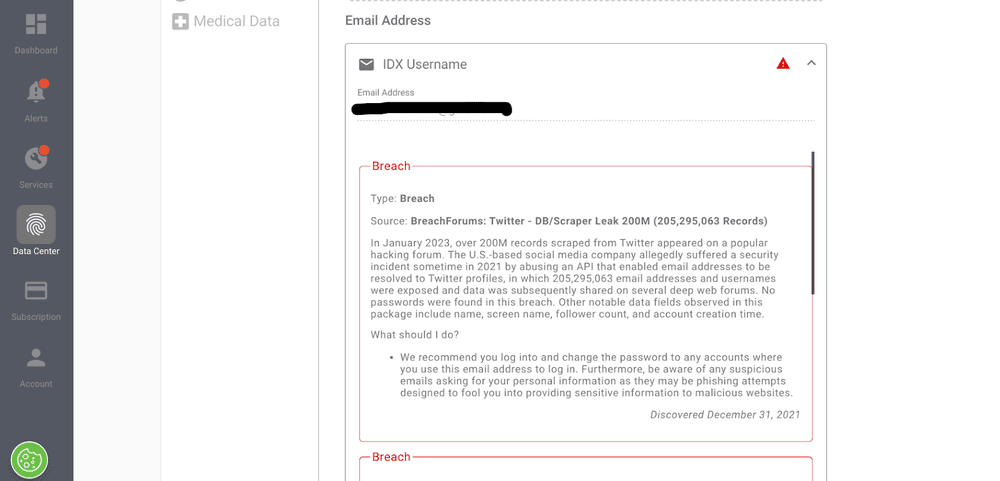

Though it’s not as accurate as some other services, like Aura or Identity Guard, IDX is better at catching threats than LifeLock. When I put it to the test, it found three total threats, which is better than LifeLock’s one.

I also like the way IDX presents its alerts. They’re very detailed. In the case of a data breach, it says when it occurred, who was responsible, how it happened, and what the breach contained. No other service I’ve tested provides quite that level of information.

LifeLock’s alerts, in comparison, are pretty vague and borderline annoying. At one point, they sent me an alert that shouldn’t have been an alert – it was letting me know they were now monitoring my home title. But it showed up in big, bold, and rather scary red letters as “Home Title Alert.”

Letting me know you’ve begun monitoring my information should be a notification – it’s not something I need to take action on. IDX doesn’t mix up those two communication types.

IDX also includes a unique feature that LifeLock doesn’t – comprehensive social media monitoring. Its “Social Sentry” is supposed to flag everything from hate speech and cyberbullying to DM scams. Unfortunately, it’s a little too thorough.

When I tested it, it flagged a “killer recipe” as violent and a post about “Dick’s Drive-In Burgers” as sexually explicit.

Nevertheless, it might be a valuable tool if you’re trying to make social media safer for your children or other vulnerable family members.

As I mentioned, I like IDX’s interface overall. I found it very intuitive to use. But it’s not a low-priced tool. While IDX does include more affordable plan options, they’re missing integral features – like insurance coverage. So, you’ll want to purchase the top-tier plan.

And that’s pricey – pricier even than LifeLock, given that it only includes $1 million in insurance coverage and fewer online privacy features. There are no parental controls, for example.

Still, IDX could be worth a second look if it’s in your budget. It’s not my favorite service, but it’s better than LifeLock.

Pricing and Plans

| |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

|

Renewal Price Increased After 1st Year? |

|

IDX offers three plans, only one of which is comprehensive.

The Identity plan includes all identity monitoring but none of the online privacy features. The Privacy plan does the opposite. Finally, IDX Complete includes full identity and credit monitoring plus all of the online privacy features.

Pricing is as follows:

- Privacy: $11.66 per month billed annually for individuals / $23.36 for families

- Identity: $8.96 per month billed annually for individuals / $17.96 for families

- Complete $29.61 per month billed annually for individuals / $58.49 for families

8. IdentityWorks by Experian

Pros

- Offers a free credit monitoring-only plan

- Good credit tools with all plans

- As accurate as LifeLock (but slower)

Cons

- Not many online privacy tools

- Poor customer service

If you require thorough credit monitoring and repair tools, Experian’s IdentityWorks might be a good alternative to LifeLock.

Though this service has difficulty standing up to top-notch identity monitoring services (like Aura or Identity Force), it offers great credit services. If you need to fix your credit score, are about to make a big purchase, or want to look into a very basic but free service, IdentityWorks might be worth your time.

How It Compares To LifeLock

In testing, IdentityWorks didn’t do so well. It found one dark web threat on me, but it took several days to do so.

It also needs to have fully comprehensive monitoring services available. Unlike LifeLock, IdentityWorks doesn’t include monitoring for financial transactions, investment accounts, or your home title.

However, it does have a pretty awesome suite of credit tools. Like LifeLock, IdentityWorks includes an in-portal credit lock (there’s is with Experian, of course).

But, it then goes above and beyond by offering a FICO score tracker so that you can keep a real-time eye on your credit score.

You’ll also have access to Experian’s Credit Boost, which allows you to count regular bills towards your credit score, including monthly utilities and subscriptions, like Netflix.

However, you don’t need to pay for IdentityWorks to get Experian’s Credit Boost – it’s free.

In fact, Experian offers an entirely free IdentityWorks plan that includes all of its credit monitoring tools. So, if that’s all you’re worried about, it might be an excellent service to sign up for.

Unfortunately, IdentityWorks doesn’t offer the online privacy tools that LifeLock does. There’s no VPN or antivirus software, though it does assist with data broker removal.

And I haven’t had the best experience with IdentityWorks’ customer service team. Like LifeLock, they’re a bit tricky to get a hold of. It took me almost five minutes to get through the machine prompts the last time I called.

Pricing and Plans

| |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost | 1 Adult and Up to 10 Children

2 Adult and Up to 10 Children

|

Renewal Price Increased After 1st Year? |

|

IdentityWorks is available in three tiers. The lowest basic plan only offers credit monitoring tools. The Premium plan is for individuals and offers all features. Then, they offer a Family plan with all features for children and one adult.

Pricing looks like this:

- Basic: Free

- Premium: $24.99 per month

- Family: $34.99 per month

9. PrivacyGuard

Pros

- Great mobile app

- Less expensive than LifeLock

Cons

- Sketchy account security

- Limited customer service hours

When you’re looking for an alternative, PrivacyGuard is bound to make the list. This might be a good option if you want to manage your identity protection service from your phone.

This service flaunts an excellent app and fairly comprehensive monitoring at a price that’s far better than LifeLock’s.

Unfortunately, there are some red flags when it comes to using PrivacyGuard. So, though it might be better than LifeLock, it’s not what I’d recommend for identity protection.

How It Compares To LifeLock

When I tested PrivacyGuard, it came up with zero dark web alerts – which is never a good sign.

I also didn’t feel good about using it.

Most identity protection services have thorough security members with strict password requirements and multi-factor identification built-in.

This is important when you think about all the sensitive information you’re going to give to monitor. Your Social Security number, address, birthdate, phone number, and maybe even your children’s Social Security numbers are all going to be there.

Unfortunately, PrivacyGuard only requires a six-character password and offers no other cybersecurity features, which made me nervous.

If you can get beyond that, though, PrivacyGuard has an app that works exceptionally well. I’d say it’s their main selling point over LifeLock. LifeLock’s app isn’t bad by any means, but PrivacyGuard’s is more streamlined and intuitive to use.

They also have good customer service, though their service team has very limited hours (9 a.m. – 6 p.m. EST, Monday- Friday). When I called, they picked up the phone in less than a minute and answered my questions well.

With PrivacyGuard, there’s no option to set up a family plan. However, the top-tier option includes monitoring your children’s Social Security number. This isn’t as thorough as LifeLock’s family plan offerings, but it is less expensive.

PrivacyGuard also doesn’t have the added features that LifeLock includes, though it does have a few unique offerings – namely, a credit simulator tool and emergency travel funds.

However the insurance policy with PrivacyGuard is a standard $1 million in coverage, and their identity restoration services seem a little lackluster. You get a dedicated restoration expert, but they don’t promise to do paperwork or make phone calls on your behalf – instead, they simply help you formulate a plan.

Pricing and Plans

Privacy Guard features three tiers that are oddly priced.

At the top level, you get credit and identity monitoring. Lower levels include just credit or just identity coverage.

Strangely, credit tools are significantly more expensive than identity coverage. There are several free credit monitoring services available, so this doesn’t make a ton of sense.

However, all plans are relatively affordable, and they don’t increase upon renewal.

Pricing looks like:

- Identity: $9.99 per month

- Credit: $19.99 per month

- Total: $24.99 per month

10. Costco Complete ID

Pros

- Accurate monitoring

- Good online privacy suite

- Good customer service

Cons

- Poor user interface

- Annoying and slow alerts

If you’re a Costco Executive member, Costco Complete ID might be a good alternative to LifeLock. Its monitoring is accurate, its customer service is good, and it includes several online privacy features that rival LifeLock.

However, if you’re only a Costco regular member or don’t have a Costco membership at all, Complete ID’s price points aren’t worth their services.

How It Compares To LifeLock

I was impressed by how accurate Costco Complete ID was during testing. It found every alert that Aura did.

Unfortunately, like LifeLock, its alerts are annoying. It alerted me to every “alias” associated with my Social Security number – which meant it alerted me to my own name over five times, and then to my maiden name twice. My Social Security number should be associated with those, and it seems like something Costco Complete ID could filter out.

Complete ID was also slow with alerts compared to LifeLock. It took two full days for it to finish scanning.

And I don’t love Complete ID’s user interface. It has a lot of white space, which means a lot of scrolling to get to the things you need. LifeLock’s interface is far more user-friendly.

Still, Complete ID offers comprehensive monitoring, a decent online privacy suite, and an in-portal Experian credit lock. And, its customer service is surprisingly good for being an Experian product. I reached a representative in under one minute, and she was very knowledgeable.

Best of all, Complete ID is far less expensive than LifeLock if you’re a Costco Executive member – and the price doesn’t increase upon renewal.

Pricing and Plans

| |

Individual Plan Cost |

|

Couple Plan Cost |

|

Family Plan Cost |

---

|

Renewal Price Increased After 1st Year? |

|

Costco CompleteID is only available to Costco members. To join Costco costs $60 per year for a regular membership or $120 per year for an executive membership.

Executive members and regular members pay different rates for Costco CompleteID. Pricing is as follows:

- Individual: $8.99 per month (Executive) or $13.99 per month (regular)

- One adult and up to five children: $11.98 per month (Executive) or $17.98 per month (regular)

- Two adults: $15.99 per month (Executive) or $25.99 per month (regular)

- Two adults and up to five children: $18.99 per month (Executive) or $29.99 per month (regular)

Why Consider Alternatives to LifeLock?

LifeLock may have the most brand recognition, but there are several reasons why you should consider a substitute and different identity protection services. Here are five:

1. LifeLock isn’t accurate.

LifeLock’s monitoring is subpar at best compared to other services I’ve tested, like Aura. LifeLock caught half the threats Aura did during testing.

2. LifeLock is expensive.

Their pricing looks good initially, but you must read the fine print. They’re one of the only services to increase their prices at renewal! And the increase is substantial at over 15%.

3. LifeLock has a sketchy history.

LifeLock recently settled an FTC lawsuit for not protecting their customer’s data and using deceptive advertising practices.

4. LifeLock’s customer service could be better.

I’ve called three times now for various reasons, and I’ve yet to have a good experience. More so, their 24-hour chat could be better. They can only answer basic questions.

5. LifeLock’s family plans are rigid.

If you’re a single parent, want to protect adult children, or need to cover aging parents and in-laws, LifeLock’s plans won’t accommodate your needs compared to other alternatives.

How To Cancel Your LifeLock Subscription

At this point, you’re probably ready to cancel your LifeLock subscription – I know I would be.

Luckily, LifeLock doesn’t make cancellation too tricky.

Here’s what you do:

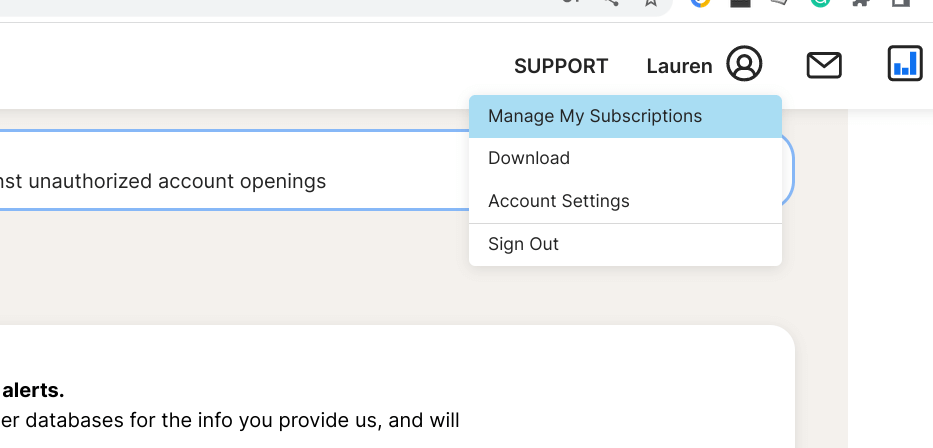

- Log in to your LifeLock account.

- Run your cursor over your account name and click Manage My Subscriptions.

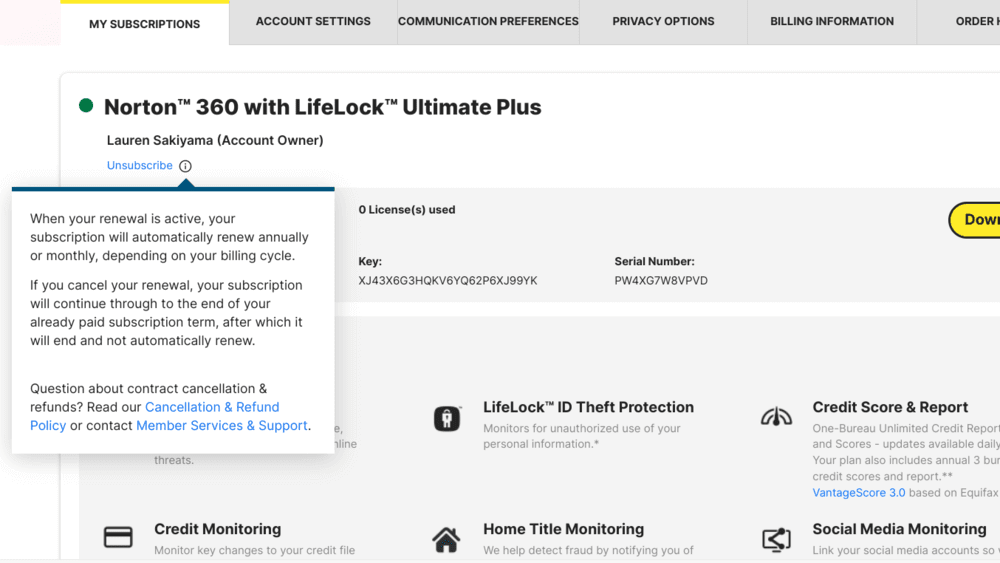

3. Choose Unsubscribe.

- If your account still auto-renews next month, you’ll have to contact LifeLock support (you have my full sympathies).

- Note that if you’re canceling within 60 days of signing up for an annual subscription, you’re entitled to a full refund per LifeLock’s refund policy. The same goes for monthly subscriptions canceled within the first two weeks.

You’ll need to contact customer service and request a refund. Or, you can request a refund in LifeLock’s live chat feature.

LifeLock Alternatives Final Thoughts

LifeLock spends a lot of marketing dollars to make you think it’s the only identity protection service worth considering, but that’s far from true. There are many, better protection services available.

So what makes Aura a top alternative?

Based on my testing, Aura is the best service for most. Its monitoring is incredibly accurate, its customer service team is amazing, and its family plans allow for plenty of flexibility – allowing you to protect up to five adults and unlimited children.

Aura also has a full suite of online privacy tools, including parental controls and safe gaming features that monitor popular games for signs of harassment, grooming, and cyberbullying.

If all of that wasn’t enough, Aura comes at a lower price than LifeLock – and once you sign up, the price doesn’t change! With our discount code, you can slash the rate even lower for life.

LifeLock may be the most recognized brand, but it’s not the best. So pick a different service from this list – you’re sure to be better protected.

Related Article: Full LifeLock reviews.