Aura vs Allstate (InfoArmor): Can One Of These Be This Bad?

We tested Aura vs. InfoArmor (aka Allstate Identity Protection) for twelve weeks. The results made it clear – Aura is the absolute winner.

Aura offers the best identity protection available. It found 15 unique dark web alerts – Allstate found zero!

Aura also comes with up to $5 million in identity theft insurance, providing total peace of mind. Allstate maxes out at $2 million in identity theft insurance coverage.

Plus, Aura includes a full suite of digital security extras. You can keep your identity private and your family safe with a VPN, password manager, email alias tool, parental controls, and more.

Using our discount code, you can lock in OFF Aura for life, making Aura a better value than InfoArmor, too.

- You want the best value in the industry.

- You want accurate threat detection that protects you, your assets, and your family.

- You want comprehensive coverage that includes home and auto title monitoring, criminal record monitoring, and more.

- You want to include up to five adults and unlimited children with up to $5 million in theft insurance coverage.

- 60-Day Money Back Guarantee

- You trust the Allstate name. Allstate is a big name in the insurance world, though its identity protection tools are lacking.

- You want to include up to ten family members. Allstate allows you to include more adults on one plan, but the insurance is still capped at $2 million.

- You don’t want extra security features. Allstate includes a few, but its missing key privacy tools like a VPN.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Aura vs AllState (InfoArmor) – Head to Head Comparison

In the Aura vs. Allstate battle, Aura is the clear winner.

As you’re about to see, Aura pulls ahead in every category. But that doesn’t mean Allstate is that bad.

It fails to accurately detect threats, which is a huge negative. But Allstate Identity Protection (formerly InfoArmor) does offer several decent features. Its 24/7 customer service team and flexible family plans are certainly above industry standards.

But here’s the thing…

Aura is the best identity protection service I’ve ever experienced. Allstate (and every other service I’ve tested) simply can’t compare.

Nonetheless, I put these two services head-to-head by category below, so you can see what I mean when I say Aura is the better option.

Editor’s Ranking Table

Monitoring and Alerts: Winner – Aura

I’ll jump straight to the point here.

Allstate Identity Protection fails to detect threats.

It also doesn’t provide the breadth of coverage that you need to protect your assets and identity.

Aura, however, offers a huge amount of coverage, and all of its tools are effective.

Let’s dig a little deeper.

Both Allstate and Aura offer all of the following:

That list might make it seem like Allstate covers everything you need. But before you jump to that conclusion, take a look at some of the additional coverage Aura offers that Allstate doesn’t:

Those are major areas for Allstate to miss. And, as I’ll explain in detail below, Allstate’s coverage, even where it offers it, is ineffective.

Aura’s coverage, however, goes deep. With its service, you’re much more likely to catch identity thieves. So, if you’re trying to protect yourself and your family, there’s no question that Aura is the better choice. If you need further evidence of that, read on.

Dark Web Monitoring

When I sign up for an identity protection service, I expect it to find a certain number of threats, usually between 10 and 15. Remember, I test these services for a living, so I have a good idea of what information surrounding my identity is available on the dark web.

Aura found all 15 threats. It took over a half hour to scan, which isn’t very fast, but the accuracy is impressive.

Allstate Identity Protection found zero.

When it said its dark web scan was complete, my jaw literally dropped. I’ve never had a service come up with nothing. I’m not sure how Allstate Identity Protection justifies charging what it does when it can’t catch dark web threats. I suppose if you want to pretend you’re protected, it’s a great service to have.

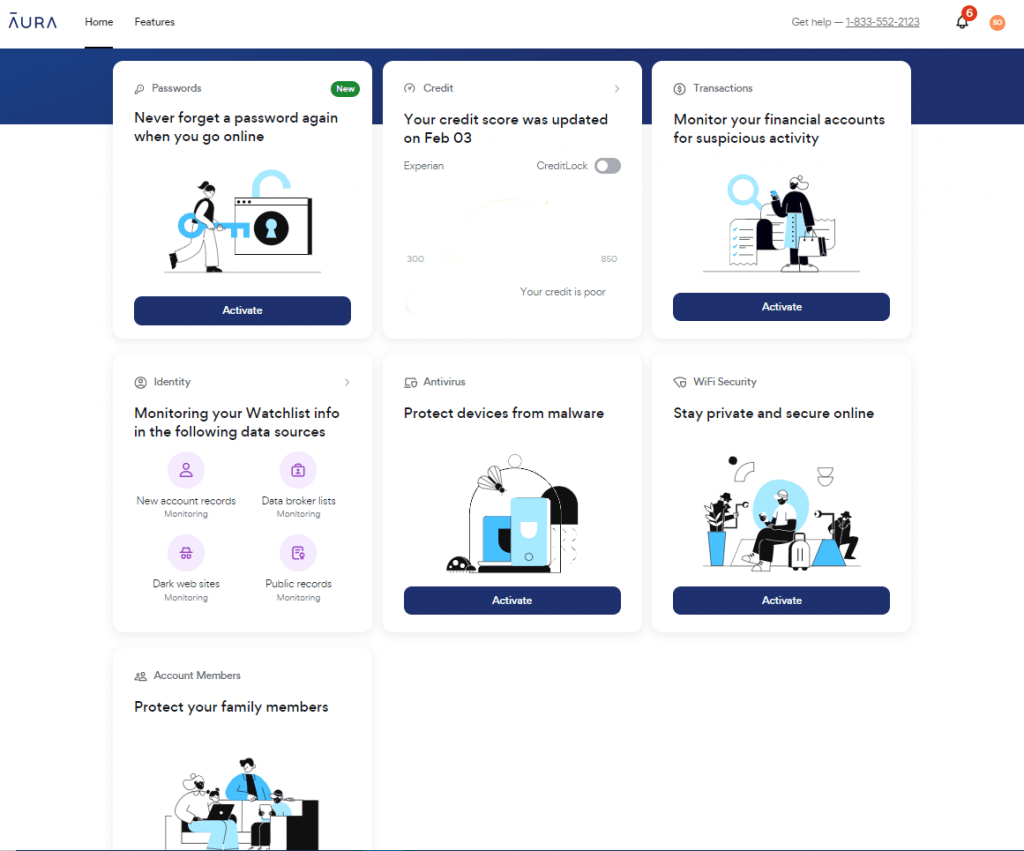

Alerts Dashboard

The alerts dashboard for any identity protection service should:

Aura does all of this.

From Aura’s main dashboard, you can click the alerts icon on the top right-hand corner of the screen. That takes you to the alerts dashboard, which lists each alert by type. Using the drop-down function at the side of each alert, you can glean more information, including next steps to help you to avert the threat.

Allstate Identity Protection does everything as well.

They list alerts on the main page by category. Using the drop-down function, you can review more information about the alert, including information on how to resolve it.

Unfortunately, Allstate doesn’t do a very good job of identifying threats. So, even though their alert dashboard is functional, it’s essentially useless.

Credit and Financial Monitoring

Here, Aura and Allstate are almost neck and neck, but Aura comes out ahead.

Both services offer robust credit and financial monitoring. They allow you to lock your credit, set transaction alerts on financial accounts, and monitor investment accounts like your 401(k).

The only difference is this:

Aura offers 3-bureau credit monitoring, while Allstate only offers single-bureau credit monitoring. Single bureau monitoring will likely catch an identity thief, but it won’t help you catch reporting errors that only show up on one report. So, Aura wins this category by a hair.

Public Records Monitoring

If you want a service that includes comprehensive public records monitoring, you want Aura.

Public records monitoring with Aura includes criminal record and home and auto title monitoring. Both of these are crucial for thorough identity protection.

Here’s why:

Identity thieves that have all of your information can use your name when committing crimes. If you’re not watching court and criminal records, convictions and police records can show up in your name even though you didn’t commit the crime.

Thieves can also target your home title. With basic information, like your name and Social Security number, criminals can transfer your home title, effectively stealing one of your largest assets!

With Aura, if a thief attempts either of those schemes, you’ll know about it right away. And, Aura will take steps to help you remedy the issue (more on that below).

With Allstate, you’re vulnerable. If a criminal goes after your home title or uses your name to commit other crimes, you probably won’t know about it until major damage is done. So, this is another area where Allstate falls short.

Threat Resolution Services: Winner – Aura

Both Aura and Allstate tout high-end threat resolution services, and while Allstate isn’t bad in this area, Aura is better overall.

I’ll go into specifics below, but know that if you want the best customer service, white glove identity restoration, and top-notch wallet protection, you want Aura.

Customer Support

Both Aura and Allstate offer 24/7, U.S.-based customer service.

And when I tested their teams, both made it easy to connect to a live human being. I called them one after the other one Monday morning and reached a representative within one minute both times.

However, Aura’s representative was more experienced and better able to answer my questions. This makes sense, given that Aura’s team has an average of 7-year industry experience.

Concierge Service

With Aura, you receive white glove identity restoration services.

This means that should you end up the victim of identity theft, Aura’s restoration team will walk you through the process of restoring your identity. They’ll file paperwork on your behalf, take 3-way calls with your bank, and keep an eye out for any signs of credit fraud.

Allstate also offers full-service threat resolution. They provide you with a case manager who will help you through the process. The case manager does much of what Aura’s restoration team will do, including filing paperwork on your behalf and watching for signs of credit fraud.

Allstate even boasts a customer satisfaction score of 99 percent when it comes to identity remediation services.

However…

Because Allstate’s service seems to have difficulty finding threats, I have to wonder how much damage has to occur before you can use their resolution team. So, even though Allstate’s good at restoring your identity, Aura still wins.

With Aura, you’ll catch more threats, negating potential damage before things escalate.

Wallet Protection

Aura and Allstate offer the same in terms of wallet protection.

Both services offer to help you replace your bank and identification cards should you lose your wallet.

Theft Insurance: Winner – Aura

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

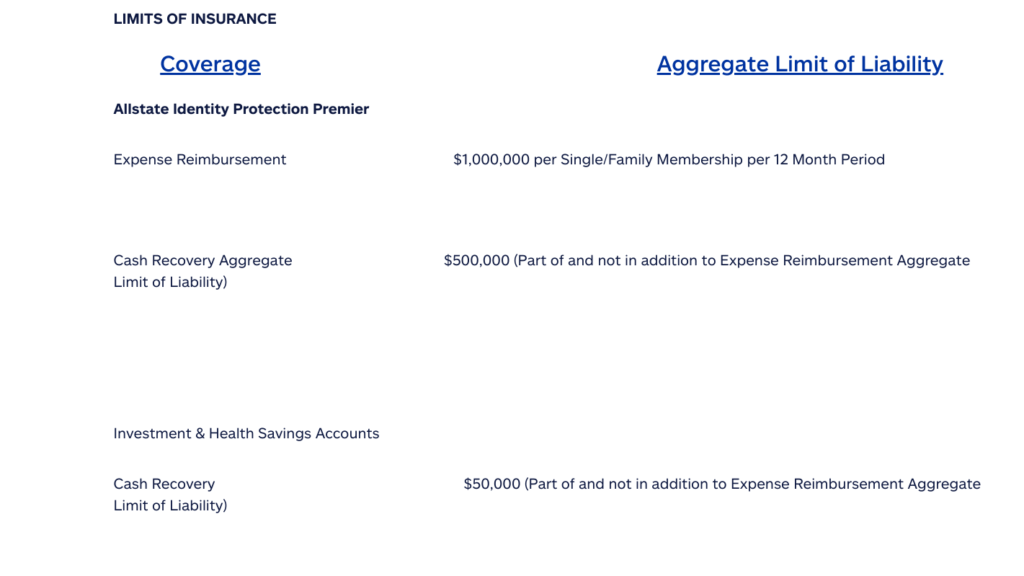

It’s pretty hard to beat Aura when it comes to theft insurance coverage. They offer the best coverage in the industry. I will say, though, Allstate’s insurance coverage isn’t bad.

Allstate offers the industry standard $1 million in theft insurance coverage. With a family plan, that increases to $2 million in total coverage.

Allstate also includes some nice features with its coverage, like stolen fund reimbursement. They’ll even reimburse stolen tax refunds with some plans.

However, Aura’s insurance is far better.

With an Aura family plan, you get $1 million in coverage per adult – That means $2 million for couples and up to $5 million for families!

You won’t find that sort of coverage anywhere else in the industry, and it’s a huge plus for families trying to cover more than two adults. If you have adult children, in-laws, or grandparents that you want to cover with your plan, Aura is the best option.

Family Plans: Winner—Aura

Again, Aura comes out on top here.

Allstate’s family plans are much better than most of the industry, I’ll give them that. They allow for up to ten members on any plan, including college-age kids and seniors. So, like Aura, you can cover your in-laws, adult kids, or grandparents.

However, Aura still beats Allstate here because they offer more insurance coverage.

Two million dollars in coverage with Allstate won’t go very far if more than one family member is an identity theft victim within the same year. With Aura, you get up to $5 million in coverage for your family, allowing you to rest easy.

Ease of Use: Winner – Aura

To be honest, I’m not a huge fan of Aura’s interface. However, it beats Allstate without question.

Here’s what I mean:

Aura’s interface is functional, and it’s easy enough to use. However, several of the options on the front page are things you’ll activate, then never need to touch again. Aura could have filled the home screen with more relevant tools.

Allstate’s main user interface is worse. It shows your credit score and a vague accounting of current alerts (if it manages to find any). Then, it gives you an identity health score that’s supposed to summarize “how you’re doing” in terms of managing your identity.

I’m not sure how they calculate this score, and given the inability of the tool to find threats, I’m pretty sure the score’s not accurate. So, if anything, it’s just making you feel good.

Plus, Allstate’s site takes a long time to load. This makes it frustrating to use. Sometimes a few of its key widgets refuse to load at all, rendering the tools ineffective.

Additional Services: Winner – Aura

|  | |

Additional Services |

|

|

Aura offers more than identity protection. It also provides a full fleet of identity health services, including:

Allstate provides a VPN and password manager with their top-tier plan but no antivirus software. So, Aura wins.

Cost: Winner – Aura

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Compared to some other identity protection services, Allstate’s prices aren’t bad.

But Aura’s are better (especially when you use our promo code).

Aura also offers a better price structure, allowing for couples, individuals, and families. With Allstate, it’s individuals or families only.

Given that Aura provides better threat monitoring, more insurance coverage, and more additional features, Aura is the clear winner here. If you want the best value in identity protection, Aura is the best option.

Final Verdict – Aura Wins

Though Allstate has certainly improved its service offerings (the original InfoArmor service was terrible), it can’t compare to Aura in key areas.

Allstate fails to find threats, doesn’t offer comprehensive monitoring, and has no added features.

Meanwhile, Aura is the best in the industry. It doesn’t just meet industry standards; it sets new ones with incredibly accurate threat detection, fully comprehensive monitoring, and amazing family plans that offer unheard-of theft insurance coverage.

So, if you’re trying to protect the things you value most, you want Aura.

Related Articles: