Aura vs. Experian: Which One Wins? (2024 Update)

After over 700 hours of testing Aura vs. Experian, there’s no doubt – Aura is the better identity protection service.

Aura found almost twice as many unique dark web alerts (15, to be exact – Experian only found 8).

Aura also offers up to $5 million in identity theft insurance. That’s 5x more than Experian.

You can rest easy with Aura, knowing their 24/7 customer service team is always available to help. Experian’s customer service is good, but they have limited hours.

If all that wasn’t enough, Aura safeguards your family’s privacy with lots of security extras, including parental controls, a VPN, and antivirus software

With our discount code, you can lock in OFF Aura for life, making it the best value, too.

- You want accurate and comprehensive dark web monitoring. Aura offers better identity monitoring than any other service.

- You want to protect your family with up to $5 million in identity theft insurance.

- You want easy access to 24/7 customer service. Contacting Aura’s customer service team is a breeze.

- You want digital security features that safeguard your privacy, including antivirus software, a VPN, parental controls, and safe gaming.

- You want the best value available. Our discount code ensures you pay less for Aura than most other services, even though it comes with more security and features.

- 60-Day Money Back Guarantee

- You need a free credit monitoring tool.

- You’re not worried about full digital security.

- You’re okay with an inbox full of marketing emails.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Aura vs. Experian Review At A Glance

Aura Overview

Aura is a comprehensive digital security tool that goes above and beyond standard identity protection.

It excels at monitoring your personal information and credit score while providing security tools like a VPN, antivirus software, automatic data broker removal services, a password manager, and more. Aura even includes parental controls and safe gaming tools with its family plan bundles.

When I tested Aura, I expected at least a few of these extras to fall short. When a company tries to include too much, it produces a mediocre result most of the time. With Aura, that wasn’t the case.

Aura has made a habit of acquiring excellent start-ups, like Circle Parental Controls and Kidas Safe Gaming. So, rather than crafting everything from scratch, Aura adds features to its all-in-one digital security solution that industry experts build. The result is an incredible product that continues to improve.

Pros

Cons

Experian Overview

In case you’re unfamiliar, Experian is one of the major three credit bureaus, and Experian is its solution to identity protection. Given its foundations, it’s no surprise that Experian provides many credit monitoring tools, but it struggles to stand out in any other area.

There are almost no security extras included in Experian plans, and during testing, we found it wasn’t very effective at uncovering dark web threats. Ultimately, we concluded that paying for an Experian plan wasn’t worth the price.

However, Experian IdentityWorks does have a free credit monitoring tool that might be worth signing up for. There are cons to doing so (namely, many spam emails), but if free is all that’s in your budget, Experian is better than nothing.

Pros

Cons

Aura vs. Experian: In-Depth Feature Comparison

Comparing Aura and Experian feature by feature feels like comparing a yacht to a raft, but we’ll do our best.

For each section, we’ve listed which service wins right up top. Then, we explain the differences in detail.

Editor’s Ranking Table

Monitoring and Alerts: Aura

Let’s start with the core of any identity protection service – its ability to monitor your personal information and alert you to threats.

With their top-level plans and benefits, Aura and Experian provide the following monitoring and alert services:

- Dark web monitoring

- Three-bureau credit monitoring

- SSN monitoring

- Change of address alerts

- Court record alerts

- Sex offender registry monitoring

- Non-credit loan alerts

- Financial account monitoring

Experian also includes social media account monitoring. At first, that seems like a huge plus for Experian, especially given the prevalence of social media these days. Look a little closer, though, and you’ll find that Aura offers full online account monitoring (which includes social media and all your other online accounts).

Aura also includes identity verification, home, and auto title monitoring, which Experian excludes.

Right away, it’s clear that Aura is the more comprehensive service, but comprehensiveness isn’t everything. Let’s look at the accuracy of each service is by comparing their dark web capabilities.

Dark Web

Aura found 15 dark web alerts for my personal information. That’s as accurate as any other service I’ve tested and far more accurate than most.

Experian only found one unique dark web alert, which shows it’s not very good at monitoring the dark web.

Sadly, that’s a common story with identity protection services. Most services I test don’t come close to touching Aura when it comes to dark web monitoring or monitoring in general.

That’s too bad because the dark web is where your information is bought and sold. If you know what’s out there (and we all have something out there), you can take basic steps to protect yourself. If you don’t know what’s available to identity thieves, you’re just waiting for a full-blown theft event, which is much harder to deal with.

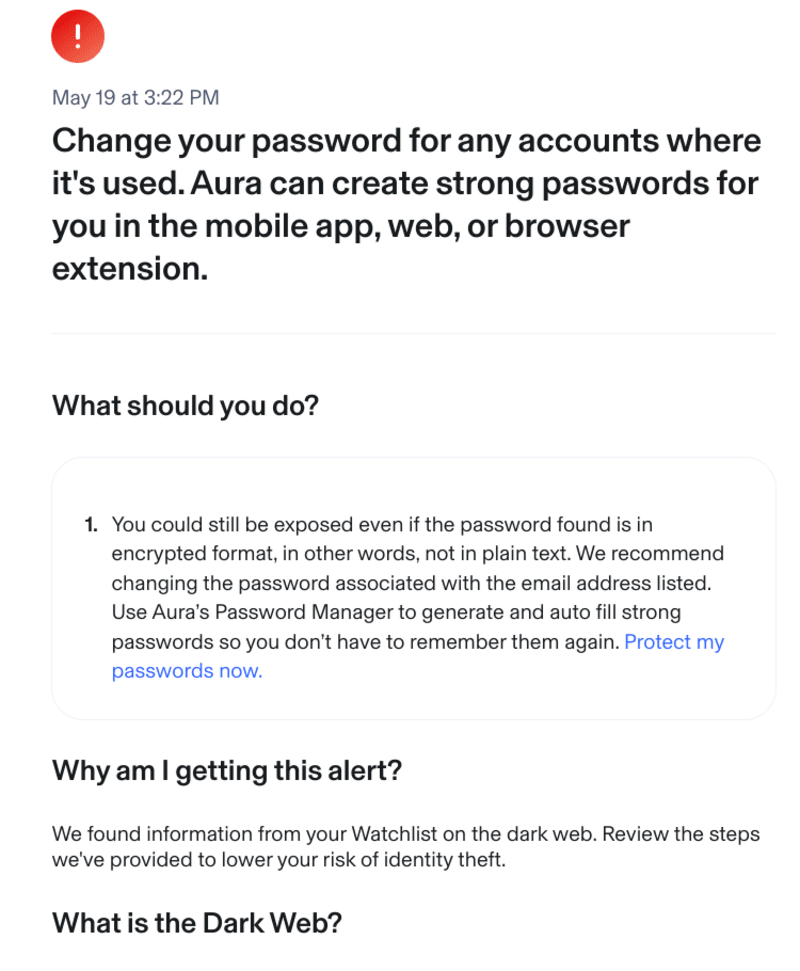

Alert Speed and Actionability

For alerts to be effective, they need to be quick and actionable. If there’s a data breach, your identity protection service should alert you long before you get a formal letter from the company.

The way they alert you should also include all the information you need to act, such as the date of the breach, what was exposed, and basic steps you can take to protect yourself.

Aura’s alerts come in quickly, and they make it easy to take proactive steps. Just look at how nicely they lay out what you should do in this alert:

Experian on the other hand, took over a month to find a single unique dark web threat. By that point, the alert is nearly worthless. Your information has almost certainly been bought, sold, and exposed to countless criminals.

Credit and Financial Monitoring

Experian certainly offers a lot when it comes to credit monitoring, which makes sense. Yet, if you have a family to protect, Aura still comes out ahead in this category.

Here’s why.

Both services offer three-bureau credit monitoring when you opt for their top plans. Both also offer in-portal Experian credit locks and credit score tracking.

Experian offers quarterly three-bureau reports, while Aura only offers annual reports, which makes Experian look better initially. Dig a little deeper, though, and you’ll find Aura includes child three-bureau credit freezes with their family plans.

Freezing your child’s credit until they turn 18 (or close, if they’re applying for higher education) is one of the best ways to protect them from identity thieves, and Aura makes that an easy process. Experian doesn’t.

Public Records Monitoring

Aura is also ahead of Experian when it comes to monitoring public records. With Aura, you get home and auto title monitoring alongside more standard services like court and criminal record monitoring.

Home and auto title monitoring might seem like a niche service, but if you own your home or car, it is something you should seek out. No one wants to lose one of their biggest assets to a title fraud criminal.

Threat Resolution Services: Aura

|  | |

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

Even the best monitoring, which Aura clearly provides, can’t keep you safe from all identity threats. That’s why top-notch threat resolution services must be part of your identity protection plan.

Here, there’s no doubt Aura comes out ahead of Experian IdentityWorks. There are a couple of reasons for this:

- Aura provides 24/7/365 U.S.-based customer service and threat resolution. I’ve called their team several times at all hours of the day and hit them with rapid-fire questions and dispute just to see if they can keep up. They’ve never let me down.

Experian, on the other hand, means calling Experian. Experian deals with a lot of phone traffic as one of the major credit bureaus. That means you must navigate a complicated phone tree before speaking with a live human being. They also have limited customer service hours (Monday-Saturday, 7 a.m. – 8 p.m.).

In testing, I called on a Friday morning, and it took me nearly ten minutes to reach a real person. They were knowledgeable and friendly, but getting to them was frustrating.

- Aura’s team has a lot of experience. Aura boasts seven years of average threat resolution experience across its customer service team. On the other hand, Experian simply puts reps through a ten-week training.

Lost Wallet Protection

Experian and Aura offer lost wallet protection, and these services are essentially equal here. They’ll help you cancel and replace your bank and ID cards, or what they call “your wallet’s contents.”

Some services go above and beyond in this area. Identity Guard, for example, will wire you emergency funds from one of your connected accounts. Still, I can’t complain about Aura or Experian regarding lost-wallet services.

Theft Insurance – Aura

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

Aura’s theft insurance ranks amongst the best available. It’s way ahead of what you get with Experian.

While both services boast a $1 million identity theft insurance policy, Aura’s increases with every adult you add to the plan. Aura allows you to add up to five adults to a family plan, giving you up to $5 million in coverage.

Experian offers $1 million in theft insurance regardless of the number of people on your plan.

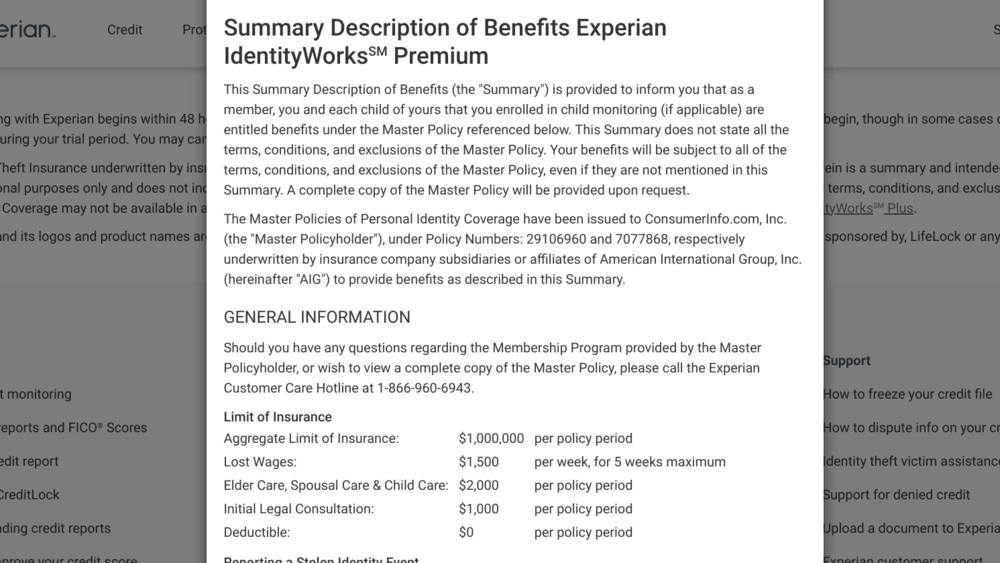

As far as the policies themselves, Aura and Experian offer similar limits.

Take a look – here’s Experian’s insurance breakdown:

And here’s Aura’s:

- Lost wages: $2,000 per week for a maximum of five weeks

- Travel expenses: $1,000 per policy period

- Eldercare, spousal care, and child care: $2,000 per policy period

- Certified public accountant costs: $1,000 per policy period

The only real difference is the amount you can collect for lost wages. Aura offers a little more.

Additional Security Services – Aura

|  | |

Additional Services |

|

|

Aura’s biggest selling point is that it’s an all-in-one digital security service. With an Aura plan, you get full identity protection alongside a massive list of security services, including:

- Antivirus software

- VPN

- Safe browser

- Password manager

- Secure online storage vault

- Spam call and junk mail removal

- AI call protection (family plan bundle)

- Safe gaming and parental controls (family plan bundle)

Experian doesn’t offer nearly as much, even when you opt for a premium plan. They’ll “help remove your information from people finding sites,” and that’s it.

If you opt for an Experian plan, you’ll need to invest in other services like a VPN and antivirus software to protect yourself and your family online.

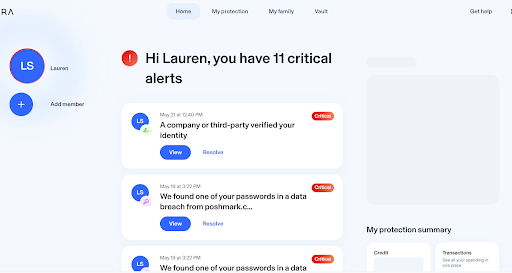

Ease of Use – Aura

If a service isn’t streamlined and easy to use, you won’t use it.

If you’ve read some of Home Security Heroes’ earlier reviews, you’ll know that this was our biggest issue with Aura. Its interface was on the clunky side.

In recent months, that’s changed. Aura’s current interface makes its services very easy to use. When you log in, you’ll find that Aura is ready to integrate with your entire system. You don’t have to think about using it; it just starts working.

When you go to log in to a site or create a new account, your password manager automatically pops up. When you have a new alert, you get a friendly notification through the app. And if you need to add more information, like a bank account or new ID, Aura makes it an intuitive process.

In comparison, Experian could be a lot better. It’s not that the interface is bad or that the service is tricky to navigate, it just leaves something to be desired.

Yes, they put a premium on their credit management services, putting those tools ahead of their identity protection services, but that’s to be expected with an Experian product. You can still see everything you need to with relative ease. The real issue with using Experian comes down to one thing:

Communication.

Experian will email you if there’s an alert on your information, but when you sign up for Experian’s services, you’ll find you get a lot of emails from them.

During the month of testing Experian vs Aura, we received over 39 emails from them, none of which were for alerts. The vast majority were advertisements for credit cards and personal loans.

In the same time frame, Aura sent six, four of which were legitimate alerts (the other two were to confirm our subscription renewal and introduce us to their email alias tool).

When a service sends a barrage of marketing emails, real alerts are likely to get lost. Our email program even started filtering Experian emails as junk because of their frequency. So, it’s not that Experian is hard to use as much as that it renders itself ineffective.

Family Plans – Aura

While Experian offers a family plan, it’s nothing to write home about. It allows you to add one additional adult and up to ten children to their monitoring services. It has no additional features and no additional insurance coverage. It doesn’t even provide the child credit tools you might expect it to.

Aura provides all of those things.

Aura’s family plan bundles make it easier to protect your loved ones, regardless of their age. Family plans with Aura allow for up to five adults, allowing you to cover your parents, your college-aged kids, and your spouse. And, as mentioned, Aura’s insurance coverage increases with each adult you add.

They also come with several tools that parents of toddlers, kids, and teens will appreciate, including:

These additional services aren’t poor-quality add-ons, either. Aura’s safe gaming comes from Kidas and is very highly rated. It alerts parents to signs of cyberbullying and predatory behavior, which are too prevalent in multiplayer games.

Another well-respected company, Circle, provides Aura’s parental controls. These controls include screen time management tools, content filtering, and the ability to pause the internet. Even better, they integrate seamlessly with both Android and iOS.

Aura vs. Experian Compared: Which is Better?

Pricing Comparison

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

| 1 Adult and Up to 10 Children

2 Adult and Up to 10 Children

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Aura’s includes many services, so it wouldn’t be that surprising if they charged significantly more in fees than Experian – but they don’t!

That’s the most shocking thing when comparing these two services. Experian’s paid plans cost more than Aura, even though they offer far less.

The only exception to this is with Aura’s family protection bundle – it’s a few dollars more per month than Experian IdentityWork’s family plan, given what Aura’s family plan includes, though (parental controls, safe gaming, and so on), Aura remains the better deal.

Aura’s plan for individuals and families pricing looks even better when you consider our discount code. With that in place, you can lock in an exceptionally low rate for Aura’s services. It’s also compatible with Aura’s 14-day free trial and 60-day money-back guarantee.

It is true that Experian offers a free plan, while Aura does not. However, Experian’s free option doesn’t provide true identity protection. It’s more of a credit monitoring tool.

With the free plan, you get a one-time dark web surveillance report and a one-time “personal privacy scan.” In testing, neither of these worked. They failed to uncover a single threat. Plus, they’re a one-time thing, which can’t rival the continuous monitoring of a real identity protection service.

The free credit tools that Experian provides are effective, but they’re just that – credit tools. And as with Experian’s paid plans, if you sign up for this service, expect a battery of marketing emails to follow.

If you can’t afford to pay a fee for a service like Aura right now, signing up for Experian’s frees credit tools is better than having no protection. Still, you’ll want to opt for a more comprehensive service, like Aura, as soon as possible.

Final Ratings – Aura Wins!

If you want peace of mind while your family is online, you want Aura. It’s superior versus Experian in every way.

With Aura, you get accurate and comprehensive monitoring, expert threat resolution, insurance coverage that increases with each adult on your plan, and a full arsenal of security tools.

Experian somehow charges more for their paid plans and offers less.

That makes the choice between these two services obvious. Aura is the better pick.

Use our discount code to snag the best rate on Aura’s plans and enjoy all the peace of mind that comes with them.

Other Comparison Articles: