LifeLock vs. Allstate Identity Theft Protection (Formerly InfoArmor)

In the LifeLock vs. Allstate (formerly InfoArmor) battle, the winner is clear – LifeLock comes out on top.

After four weeks of testing, LifeLock found one unique dark web alert, while Allstate found zero, proving LifeLock is the more accurate monitoring service.

LifeLock also offers more theft insurance coverage with its top-tier plan (up to $3 million), so you don’t have to worry about identity theft expenses.

On top of that, you can include device protection from Norton with your LifeLock plan, giving you comprehensive digital security.

LifeLock is available at a more affordable rate than Allstate, too, when you use our discount code, which locks in OFF.

- You want monitoring tools that are comprehensive and accurate. LifeLock found more dark web alerts than Allstate.

- You want plenty of identity theft insurance coverage. LifeLock’s top-tier plan includes up to $3 million per adult.

- You want exemplary device security tools, including Norton antivirus software.

- You don’t mind a service that isn’t very accurate. During testing, Allstate found zero alerts.

- You don’t mind a $2 million theft insurance cap. Even with up to ten adults on your plan, Allstate insurance maxes out at $2 million.

- You don’t need antivirus software. Allstate includes a few device security features, but antivirus software isn’t one of them.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

LifeLock vs. Allstate Identity Theft Protection: Head-to-Head Comparison

For this comparison, let’s start with one of the most important aspects of any identity protection service – its ability to monitor your personal information.

| ||

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

Only Ultimate Plus offers $1M coverage |

|

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Monitoring & Alerts

Picking a winner for this category was challenging. I had to give it to LifeLock, but only through gritted teeth.

You’ll see what I mean if you keep reading, but for those who just like to skim, here’s the main reason for my decision:

LifeLock wasn’t great at monitoring my personal information, but it performed better than Allstate Identity Protection overall.

You wouldn’t know that if you didn’t test both services. On paper, LifeLock and Allstate both offer comprehensive monitoring with their top-tier plans, including:

- Dark web monitoring

- Credit monitoring

- Address change alerts

- Student loan monitoring

- Sex offender monitoring

- 401(k) and investment account monitoring

- Bank account transaction monitoring

- High-risk transaction monitoring

Allstate also includes social media monitoring, which LifeLock doesn’t. Yet otherwise, they’re the same, and they both look exceptionally thorough. Things don’t start to break down until you put them to the test.

Dark Web Monitoring

I’ve tested many identity protection services, which means I generally know how much of my information is on the dark web.

LifeLock and Allstate both severely underperform in this area. LifeLock only found one dark web alert, and Allstate found none.

Both services missed several significant data breaches that exposed passwords to several of my accounts. That’s a really bad sign.

Dark web monitoring is a crucial piece of any identity protection service, and when it works, it can be extremely helpful. It allows you to protect your identity proactively. A simple password change could keep a thief out of your accounts. If a service fails to inform you that your information is exposed, you’re left waiting for more significant issues to arise.

So, while LifeLock comes out ahead here, I’m hesitant to recommend it. There are far more accurate options that are just as comprehensive (if not more so).

Alerts Dashboard

They may need to improve at finding dark web threats, but LifeLock and Allstate both offer fantastic alert dashboards.

You might not think how a service presents alerts matters, but trust me when I say it does. I’ve tested several services that populate alerts in a convoluted and confusing way. When that happens, you’re less likely to pay attention to them, which makes them essentially worthless.

Allstate and LifeLock both give alerts that are clear and concise.

I’m partial to Allstate’s alert dashboard because it walks you through each alert with a beginner-friendly interface. When you click on an alert, it initiates a series of pop-ups that give you the appropriate next steps.

For example, if you have an alert for recent activity on your credit report, a pop-up will ask if you recently allowed a company to run your credit. If you click yes, the alert disappears. If you click no, you’ll get a series of prompts telling you how to protect yourself.

LifeLock’s alert dashboard could be more beginner-friendly but is still among the best.

Alerts are detailed without being overwhelming, giving you a brief synopsis that includes the date of exposure and related accounts. They then provide a bullet-pointed list of appropriate next steps.

Financial and Credit Monitoring

When you opt for a top-tier plan, both Allstate and LifeLock include thorough credit and financial monitoring, including:

- Three-bureau credit monitoring

- Investment account (401(k) monitoring)

- In-portal credit lock (for TransUnion)

- Credit freeze assistance

- High-risk transaction monitoring

- Bank account/ financial transaction monitoring

Overall, this is a pretty impressive list. Including things like an in-portal credit, lock makes keeping your credit score safe much easier. Very few services cover things like investment account monitoring, so that’s a huge win.

However, neither of these services has the full range of credit tracking tools that some identity protection companies offer.

With Aura, for example, you get everything that Allstate and LifeLock include alongside an in-depth credit tracking tool that provides insights on your credit score – making it that much easier to improve it.

Public Records Monitoring

LifeLock offers comprehensive public records monitoring, including:

- Home title monitoring

- Criminal records monitoring

- Sex offender registry monitoring

Including home title monitoring makes LifeLock one of the top identity protection services. Aura is the only company I know to take things a step further by offering home and auto title monitoring, but most companies don’t make any mention of home title protection. See how Aura wins against LifeLock.

So, it’s not that surprising that Allstate misses home title monitoring. What is surprising is that Allstate does reimburse for home title fraud expenses – up to $2 million! That’s an extremely generous policy.

Sadly, Allstate doesn’t do criminal or court record monitoring, though. LifeLock still comes out ahead here.

Threat Resolution

No service can completely protect you from identity theft, which means top-notch threat resolution services have to be included.

In this area, Allstate formerly InfoArmor vs LifeLock , there’s no question – Allstate wins.

Ask anyone who’s had to call LifeLock’s customer service team, and you’ll understand why. LifeLock is notoriously terrible when it comes to white-glove services and any reviewer who says differently is probably on LifeLock’s marketing team.

Don’t believe me? Keep reading.

Customer Service

I called both Allstate and LifeLock to quiz their customer service team. When I do this, I’m looking for a few things

I called Allstate on a Thursday at 12 p.m. (PST). I was connected to their automated system, but it only took me a minute to navigate. After less than two minutes on the phone total, I was talking to a customer service rep. He was friendly, helpful, and obviously knew the product well.

Calling LifeLock was a very different story.

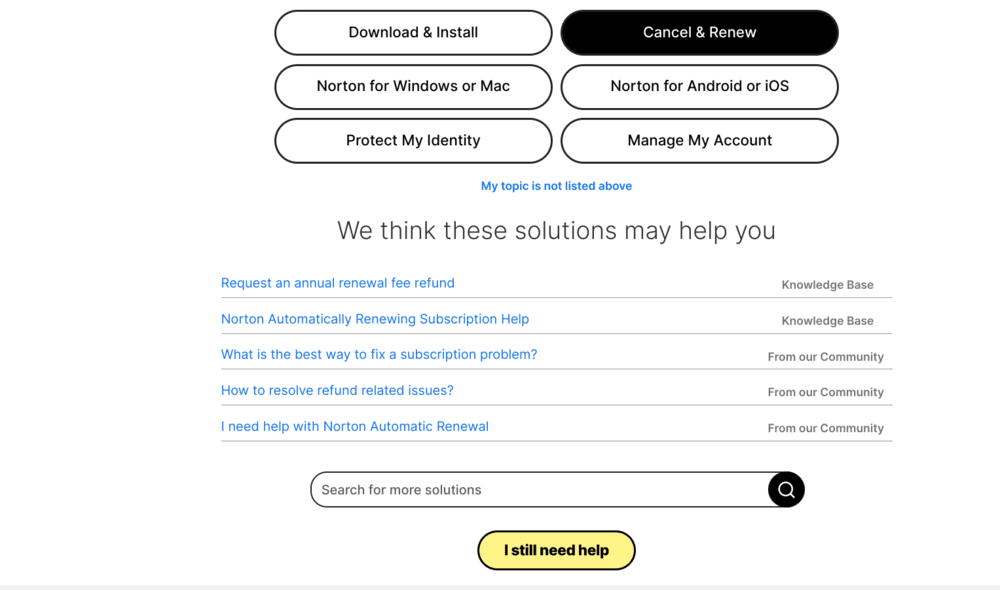

Just getting to LifeLock’s customer service number takes perseverance and fortitude. They don’t post it for anyone to find. You have to go through a series of “Support” pages that look something like this:

If you keep clicking, “I still need help,” you eventually get to a form you’ll have to fill out. Once you submit that, they’ll give you a phone number to call.

I called at 2:00 p.m. (PST) on a Thursday and reached their overseas customer representative in less than five minutes on hold.

You read that correctly.

LifeLock’s customer service is overseas.

Don’t get confused, I know their service page says they provide U.S.-based threat resolution. But that’s not who you’re calling.

The threat resolution team for LifeLock is completely separate, and you can’t reach them until an overseas customer service rep either connects you or provides you with the appropriate phone number.

I wouldn’t mind that LifeLock uses a third-party company to handle customer service, except that the representative I spoke with wasn’t very knowledgeable about LifeLock’s products. If was calling with a real problem, I would have been frustrated.

Related Article: Best Alternatives to LifeLock

Concierge Restoration

I wish I could say that LifeLock redeems itself with an excellent concierge resolution team, but I can’t. When you read the fine print in their service agreement, you learn that LifeLock’s threat resolution representatives are company employees and U.S.-based, but they don’t actually handle the concierge services.

If you’re an identity theft victim, you’ll give all your relevant information to a LifeLock threat resolution team member, who then turns it over to an undisclosed third party. The third party is the one doing the “heavy lifting” – filing paperwork, making appropriate phone calls, and so forth.

I don’t love that system, and I imagine there’s a reason LifeLock buries the policy in its fine print.

Allstate, on the other hand, has a 99 percent satisfaction rate for its threat resolution services. Their team is entirely U.S.-based and clearly knowledgeable.

Allstate also offers an unbelievable reimbursement policy, which I’ll cover in detail when we compare insurance coverage. Just know that what they say seems true – with Allstate, you’re in good hands.

Wallet Protection

Offering lost wallet protection is standard amongst identity protection services. Typically, it includes help canceling and replacing things like your bank card, social security card, and insurance cards.

LifeLock goes a step further by also covering your wallet (or purse). In other words, if your wallet or purse is considered valuable, their insurance policy entitles you to reimbursement for it. For those who carry designer bags, this might come in handy.

I like Allstate’s policy better, though. They’re one of the few companies to offer cash reimbursement if your wallet is stolen or lost – up to $500.

Theft Insurance

Allstate comes out ahead when looking at theft insurance policies, too.

With Allstate’s top-tier plan, you get:

- $1 million in expense coverage ($2 million for family plans)

- $1 million in stolen fund reimbursement

- $1 million in 401(k) reimbursement

- $2 million in home title fraud reimbursement

- $1 million in professional fraud expense reimbursement

- $2 million in ransomware reimbursement

Plus, they cover deceased family members. So, if a thief steals the identity of a deceased family member, Allstate will reimburse you for expenses related to the fraud.

Altogether, this is an amazing insurance policy!

I have to hand it to Allstate, though their family plans only include up to $2 million in expense coverage, the rest of their reimbursement policy puts them a mile ahead of the pack.

At first glance, LifeLock’s plans look great. Their top-tier plan includes:

- $ 1 million in expense reimbursement

- $1 million in legal fee coverage

- $1 million in stolen fund reimbursement

Three million in total coverage is really good. And LifeLock’s coverage increases with each adult and child you add to the plan. But there’s a catch…

LifeLock’s lower-tier plans offer coverage below the industry standard of $1 million. The lowest option drops to $25,000 in stolen funds and expense reimbursement.

What’s annoying is that LifeLock still advertises their lowest tier plan as “$1 million protection.” That’s technically true, but the $1 million is only for legal fees.

Are you beginning to spot a trend with LifeLock? Their advertising is consistently borderline deceptive, which doesn’t exactly spark trust in their services.

Family Plans

Allstate wins again here by offering family plans that include up to ten members, regardless of age. That’s exciting because most services only allow for two adults plus kids.

Unfortunately, when you dig a little deeper, you find that Allstate’s family plans have a couple of issues:

- The expense insurance coverage only goes up to $2 million. That’s not a lot if you’re covering ten people.

- Privacy monitoring tools max out at five emails. So, only some included tools are set up to cover the full family.

LifeLock’s family plans are much more traditional, allowing for two adults and up to five kids. Notably, LifeLock offers increasing insurance coverage for each child on the plan. I don’t know of any other service that includes that, and if your child has assets in their name, it’s a huge plus.

Parental Controls and Safe Gaming

Both LifeLock and Allstate include parental control features as well. These features help you monitor screen time, block content, and set location alerts.

If parental controls are important to you, though, I wouldn’t rely on either of these services.

LifeLock’s parental controls are especially frustrating to use. They only monitor web content when your child is using Norton’s in-app browser.

Allstate’s parental controls come from Bark, which is a well-known app. It monitors effectively, but some parents don’t like its approach. Bark is about retaining the child’s privacy, which works great with teens but might not be appropriate for younger kids. And it gives more power to its algorithm rather than the parent.

I’ve tested Bark and Norton Family on my child alongside Circle, another leading brand, and I found Circle to be the best overall. It seamlessly integrated with my child’s devices, made monitoring, filtering, and blocking sites easy, and gave me detailed internet usage reports.

Ease of Use

Allstate and LifeLock both have incredible user interfaces. I have no complaints here for either service. Look at their main dashboards – you’ll see what I mean.

This is LifeLock’s:

It’s clean, easy to navigate, and gives me the important stuff right away. Alerts, credit scores, and transaction monitoring are all above the fold, as an editor might say.

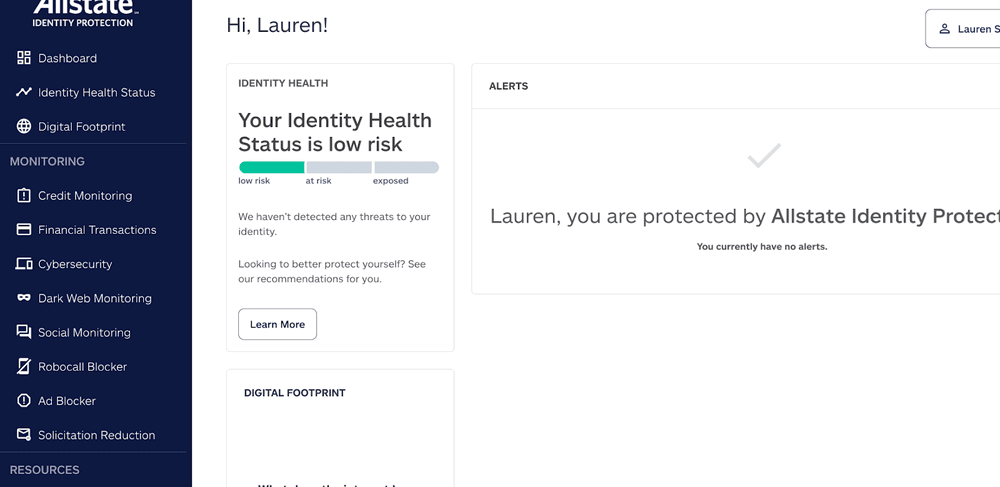

And here is Allstate’s:

It’s also sleek and simple, with alerts up front and a straightforward navigational menu on the side.

Additional Services

Here, both services are neck and neck again.

With Allstate and LifeLock’s top-tier plans, you get:

- A VPN

- Antivirus software

- Parental controls

- WebCam protection

- Safe browser

- Anti ad-tracker

Allstate also includes a password manager and tools to help you find missing devices. Yet LifeLock’s antivirus software is tough to beat. It’s what Norton specializes in and it offers better protection than Allstate’s included software.

Clearly, both of these services are trying to offer full digital security, not just identity protection.

Pricing & Cost

| ||

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

When it comes to comparing prices, Allstate wins, hands down.

Allstate’s top-tier “Blue Cyber Plan” is available for under $20 per month for individuals and under $40 for families. That’s impressive!

Meanwhile, LifeLock’s prices start out high and get higher. For LifeLock’s top-tier plan, you’re looking at just under $25 per month for the first year. Upon renewal, that price increases significantly.

Like so many other aspects of LifeLock’s service, the price increase upon renewal is listed in teeny-tiny print next to the more attractive intro price. Once again, LifeLock’s marketing materials feel a little deceptive that’s why some people are looking for its alternatives.

Final Verdict

LifeLock offers better identity theft protection than Allstate.

Its monitoring is more accurate, allowing you to identify and fix dark web threats before they balloon into bigger problems.

LifeLock also offers more insurance coverage with its top-level plan. Though some of the lower-tier options include less insurance than we’d like to see, LifeLock’s top-tier plan is hard to beat.

LifeLock also comes with superb device security features, including Norton antivirus, allowing you to fortify all your devices from digital threats.

Plus, our discount code gets you, OFF LifeLockmaking it more affordable than Allstate.

So, when it comes to protecting what matters most, you should opt for LifeLock over Allstate.

Read More Comparison: