Aura Identity Theft Protection Reviews (Family Plans) 2024

Aura’s identity theft protection service ranked #1 in our tests, when it came to providing the most thorough dark web monitoring, 24/7 expert customer service and highest theft insurance coverage.

If you are a parent or have assets worth protecting, Aura is the service that will give you peace of mind.

You can, lock in OFF discount on Aura for life, today!

- You are looking for the best online security and identity theft package for your family.

- You want peace of mind, knowing Aura is keeping an eye out for you with stellar insurance and white glove customer service if your identity gets compromised.

- You have assets worth protecting, whether that’s your net worth, your family, or your online reputation. It took you years to get here, and you don’t want someone to steal it.

- You want the best there is. Period.

Call 1-877-878-4474

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Aura Review: Is It Worth Getting?

In a word: Yes.

The best identity protection service will excel in three areas:

- Monitoring and alerts

- Threat resolution (including insurance)

- Cost

Aura shines in all three and then some.

Aura is the new identity theft protection service from Identity Guard.

Identity Guard is a big name in the identity protection industry, so seeing them launch a new ID theft protection service is inherently exciting.

Still, it begs the question: how good is it really?

Can Aura stand on its own, or is it just relying on a big name?

In this review, I’ll explain why Aura is unique to Identity Guard, where it offers more security features and services, and why it’s the best identity protection you can get.

Editor’s Ranking

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

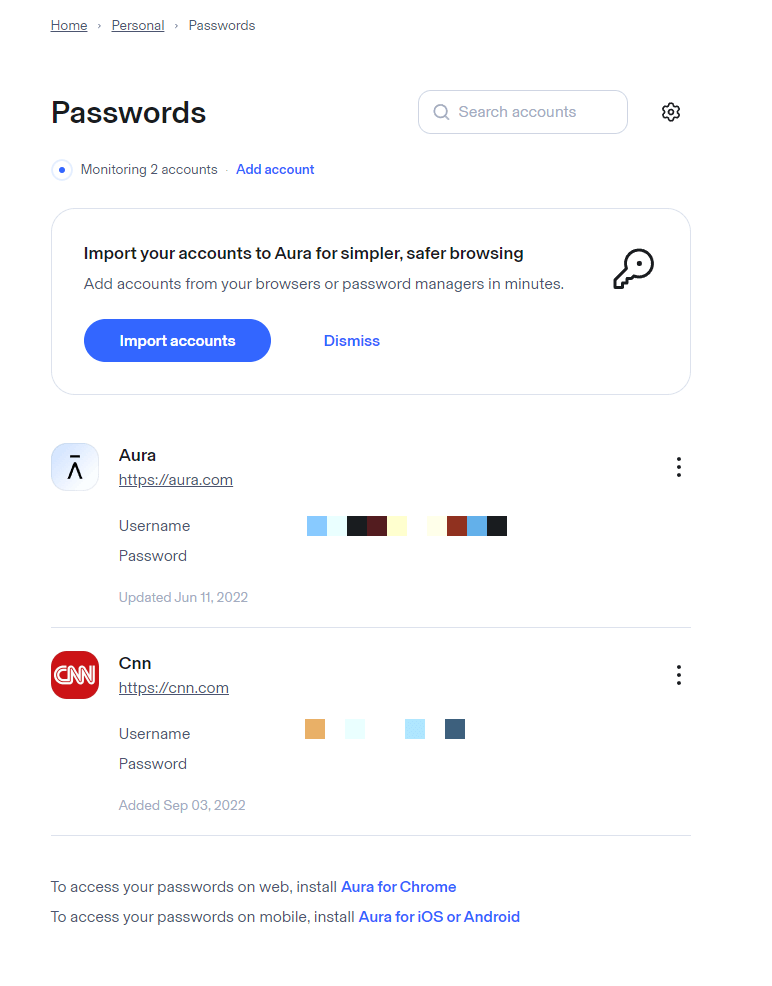

Ease of Use

Let’s get the (minor) negatives out of the way first.

I don’t like Aura’s website and dashboard design. It’s a little too form-over-function. Rather, than displaying the most useful features, Aura prominently places its additional features first.

Here’s what I mean:

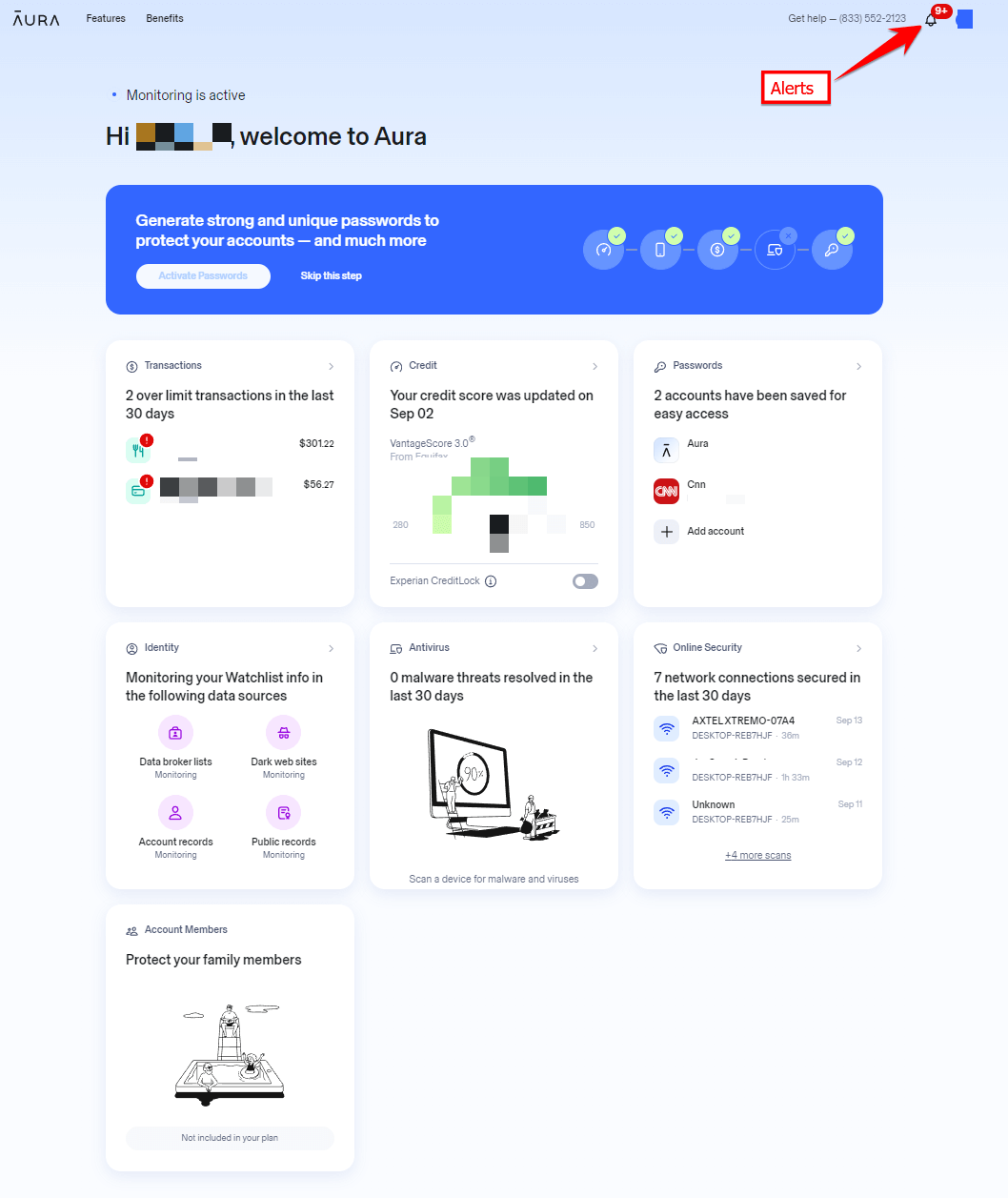

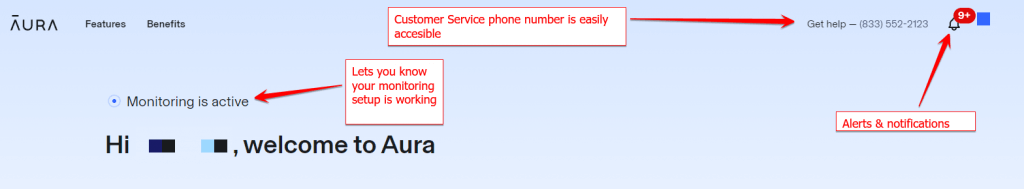

This is the main Aura dashboard you see every time you log in. There’s a lot going on here, and while it’s visually pleasing, the most useful feature–Alerts & Identity Monitoring, isn’t very prominent.

You don’t need access to your VPN, antivirus, and password manager up front. These are things you’ll activate once, then never need to touch again. Transaction alerts and your credit score are more useful but do not form the entirety of a good identity protection service.

Aura’s identity monitoring alerts, including notifications about potentially compromised MFA devices and suspicious company activity, are tucked into the right-hand corner notification bell.

Though this is standard practice for a lot of services when it comes to first-time alerts, there should be a better way. I want to see my alerts listed directly after signing in.

Am I being a little picky?

Perhaps. There are no major technical issues with Aura’s dashboard. It loads quickly and has smooth enough navigation.

Still, if there’s one place Aura could improve, this is it.

Now, let’s discuss the (many) positives, , including identity theft insurance offerings.

Monitoring and Alerts

Monitoring Score | Aura makes excellent monitoring standard on all plans |

Dark Web & Data Breach Monitoring |

|

Data Broker Removal Request |

|

Credit Monitoring | Available on ALL plans

|

Financial Monitoring | Available on ALL plans

|

Public Records Monitoring | Available on ALL plans

|

Reputation Monitoring |

|

Aura has an insanely good monitoring system.

It’s not the fastest (it took between 30 and 60 minutes to populate a list of alerts). But it’s extremely accurate. And the sheer breadth of monitoring is nearly unmatched.

We’re looking at:

Credit Monitoring

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

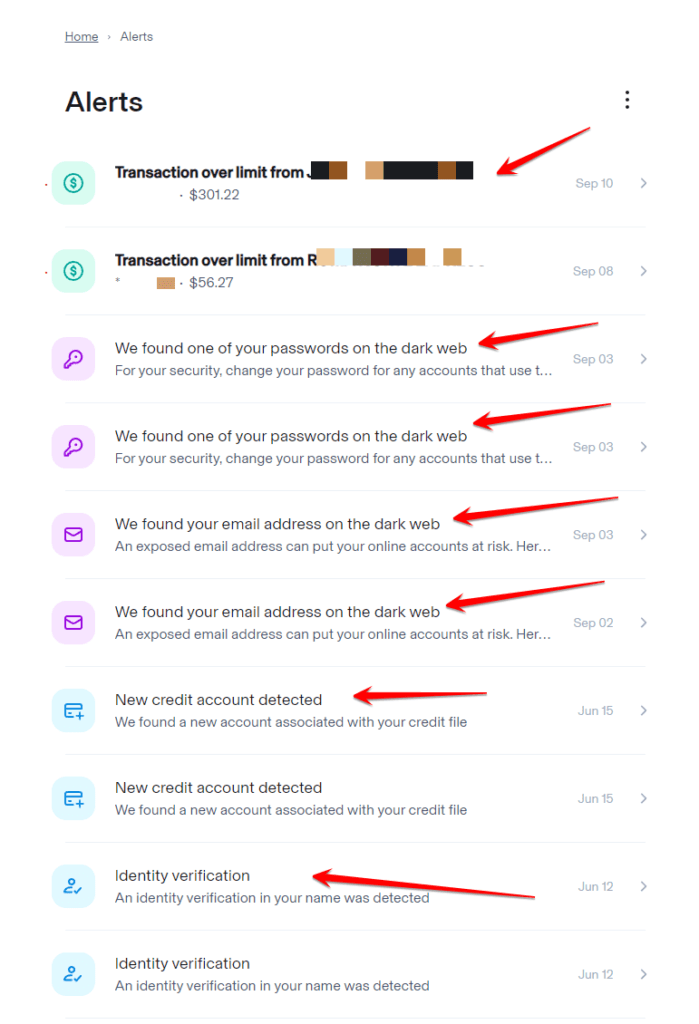

Alerts & Notifications

The page is laid out nicely. Drop-down boxes give a good bit of detail on the type of breach and what account it’s associated with.

Weirdly, if it’s an email breach, it shows the site that was breached in the overview. But it keeps details for other account types hidden beneath the dropdown. This isn’t bad, per se, but it is a little bizarre.

Still, there’s absolutely nothing of substance for me to complain about here. The service is fast, accurate, and thorough. Compared to other protection companies I’ve reviewed (including Identity Guard), Aura is the gold standard for identity theft monitoring and offers valuable identity theft insurance.

Aura Automatically Sends Opt-Out & Removal Requests to Data Brokers

Aura really doesn’t advertise this feature enough. I didn’t even know about it till I tested it out. During my trial, I was particularly impressed with the protection it offers related to credit cards and SSN misuse.

Aura automatically sends data opt-out requests on your behalf to all the major data brokers. While it remains to be seen how effective this is, I love that it’s automatic! This includes keeping a close eye on your credit card report, making sure there’s no unauthorized data exposure.

Hopefully, this is the end of all those pesky calls and junk mail. With their proactive approach, and the incorporation of antivirus software as well as 2FA where needed, my online information feels more secure.

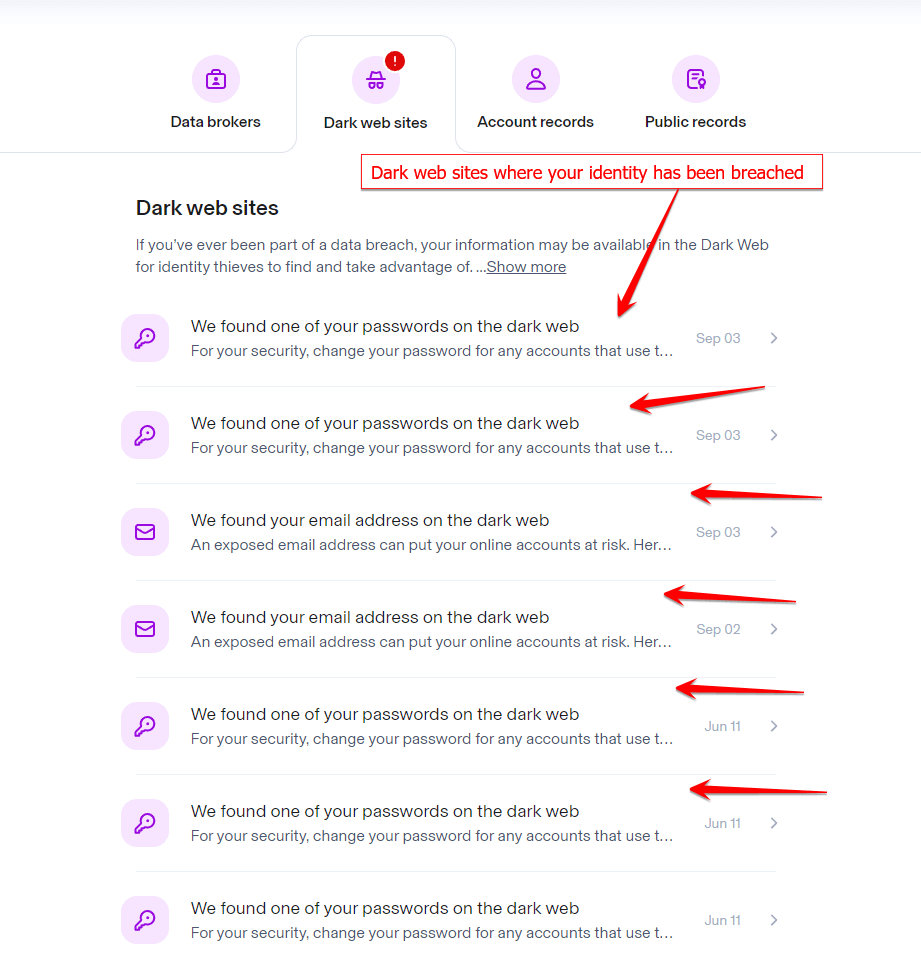

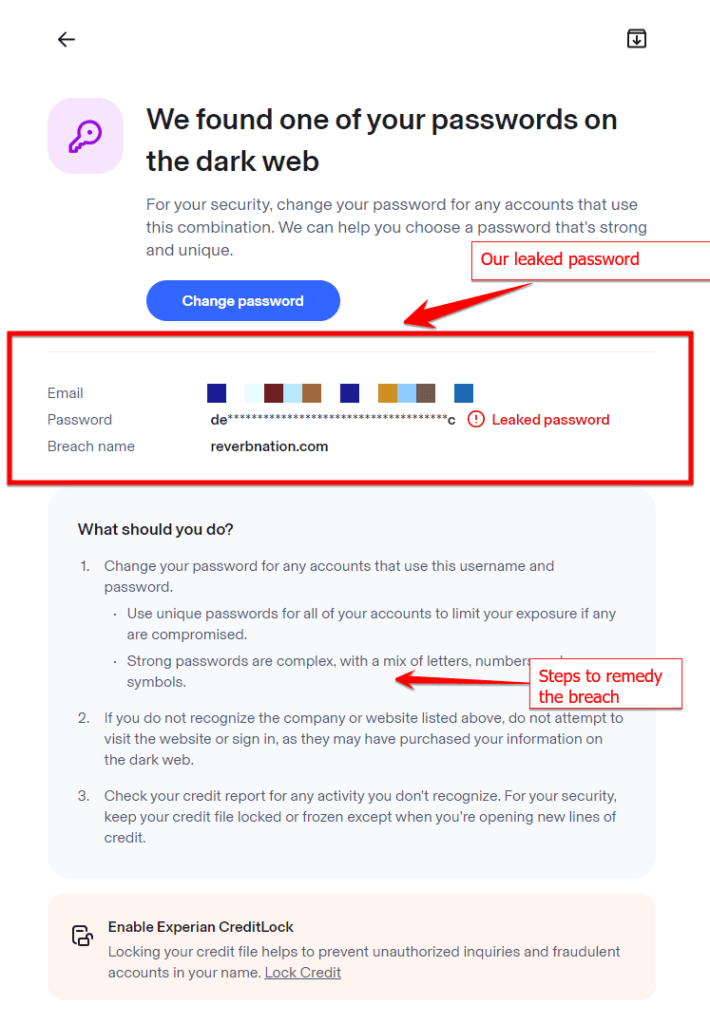

Dark Web Site Monitoring

Fixing the problem is simple, but here’s the thing:

Unless you are using a service like Aura to alert you, you could easily go years without knowing your password had been leaked online.

Just imagine how disastrous that could be, especially If you use the same login info for something like online banking!

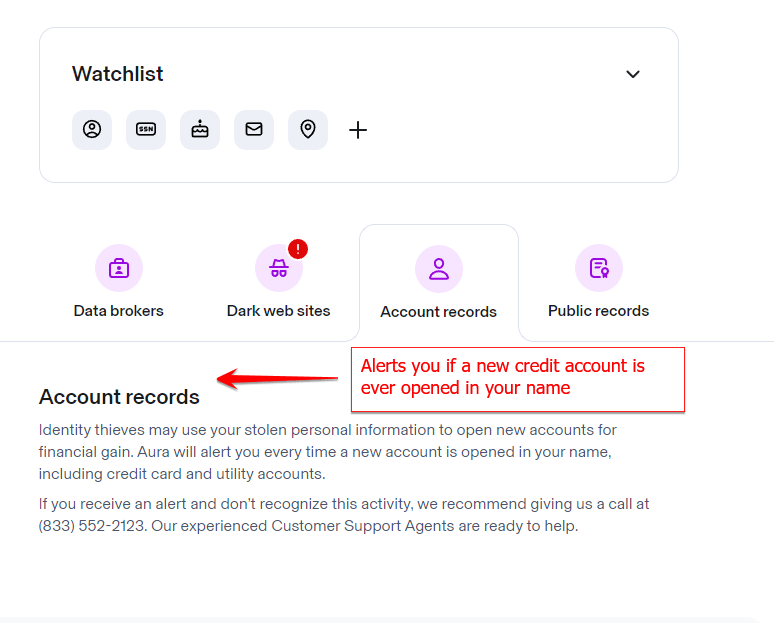

Aura’s Account Records Monitoring

Aura continuously monitors to see if new accounts are being created online using your identity.

Yes, there are free online services that will do this for you, but I like having it monitored via Aura.

Here’s why:

Though no alerts came up for my information, I like that I can see everything pertaining to my identity through one company service. It’s simpler that way.

Home Title Monitoring

Threat Resolution and Customer Service

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

Similarly to monitoring services, Aura is the gold standard for threat resolution.

In addition to all of the benefits I expect, like wallet restoration services, Aura offers an invaluable feature:

24/7/365 customer support access.

I always love when I see this. It’s as good as threat resolution gets without factoring in highly specialized side benefits that some companies offer in exchange.

All Aura plans also offer White Glove concierge service, which includes 24/7 support available to all customers.

As an added bonus, Aura has a built-in team of experienced customer support representatives to draw on from Identity Guard. So, any growing pains when it comes to customer service should be minimal.

I tested their 24/7 customer service by calling at midnight on a Saturday. It only took 2 minutes to reach a US-based representative. He was very knowledgeable and answered all my questions right away.

That’s a far cry from some other options like LifeLock, which make it very hard to find a phone number to call. And when you finally connect, it’s typically with someone based in Asia.

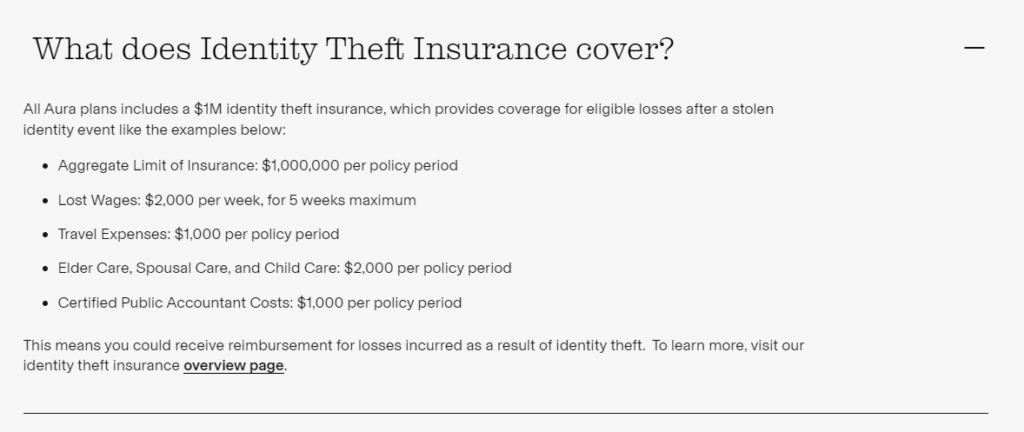

Identity Theft Insurance

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

At first glance, it’s pretty standard stuff.

$1M in coverage for all their customers that covers both stolen funds and expenses separately﹘lawyer’s fees and daycare costs aren’t going to cut into the up to $1 million you could recover in funds siphoned from accounts or invalid debts incurred.

This is exactly what I expect from a top-of-the-line service and where it usually ends.

Aura goes one step further.

It covers up to $5 million in lost funds.

That’s $1M for each individual adult on a plan. So if you have a spouse on your couples plan, you are covered for up to $1 million in lost funds each.

Maybe you think this is overkill, but why complain about more identity theft insurance coverage for a great price?

Aura Family Plans Review

If you have a family you’re responsible for, you know your identity isn’t the only thing you need protecting. Personal information is one of the most valuable assets we have, and with Aura Identity Theft Protection Family Plans, you can rest assured that your personal data is secure online.

Moreover, Aura offers encryption, management, and authentication features for desktop, mobile, and laptop devices, ensuring comprehensive protection of your information online. Their platform even supports biometric authentication, which adds an extra layer of security for your data.

Your spouse might have their own assets that need protecting online. Even if they don’t have anything of note, ensuring they have good credit and aren’t being taken advantage of is important.

Family coverage is even more important if you have children.

It might be surprising to hear, but kids are actually more at risk from identity theft than adults are. You might think, “But they don’t have anything to steal!”

True, and that’s what makes them such perfect targets for identity thieves.

Let me explain:

A child’s credit score is a blank slate. Identity thieves can do whatever they want with it. And since people don’t expect children to need identity or credit monitoring…they don’t look into fraud protection services.

This means when identity thieves get ahold of a child’s information, the effects can be long-term. These untended wounds on the child’s credit lay unseen until the child hits adulthood and gets their credit checked for the first time by credit bureaus companies like TransUnion.

The child’s first car, first apartment, student loan application…whatever it is, turns up disturbing black marks on their credit.

Getting these problems solved years after the fact is an exercise in frustration and sometimes completely futile; only more time can fix it. This is why it’s crucial for families to invest in identity protection services that include credit monitoring for all members.

This is why Aura family plan options are important. Other fraud prevention services may offer decent individual plans but aren’t the best identity theft protection for families.

For the most part, Aura’s family plans offer the same benefits as their individual offerings. There are no specific features unique to a family plan. But there is one major modification:

More insurance coverage.

With Aura, each individual adult is covered by their own insurance plan.

And better yet, Aura allows for up to five adults and unlimited children.

Most identity protection services offer two adults and a fixed number of children (usually five or ten). With Aura, you can have your spouse, your adult children, your in-laws, or your parents all on the same plan, plus all of your minor children too.

The only real restriction is this:

To add a child account, the account owner needs to be their parent or legal guardian, and the child must live at the same address. Everything else is fair game.

The added adult members essentially have their own full-fledged accounts. While the primary account owner is in charge of payment, other adult members get their own account page (kept private from the primary account owner for privacy) and full suite of features.

Children have a more limited version of the plan, and only the account holder can view their info. A child identity protection account doesn’t need all the security features an adult account does because they don’t have the same assets. Basic identity and credit monitoring is enough to catch a thief.

Additional Services

But one thing it lacked?

Extras.

Extra security features have become the main selling point for several identity theft protection services, and Identity Guard lacked most of them.

Aura shores up that gap by providing a wide variety of additional device security services. This takes Aura from basic identity theft protection to a total online privacy package.

…At least in theory.

In practice, I think a lot of these features are very basic. Still, they’re worth discussing. And you might find you like having them from one, convenient service.

VPN

Aura’s “VPN,” sometimes billed as “Wifi Security” is really just an IP masker. It doesn’t have any of the other benefits you’d expect from a VPN service worth the name. So it’s not going to replace your NordVPN or whatever subscription service you have.

That said, if you don’t already subscribe to a VPN, you might get away with Aura’s service for now. Just know a true VPN offers a lot more than this add-on.

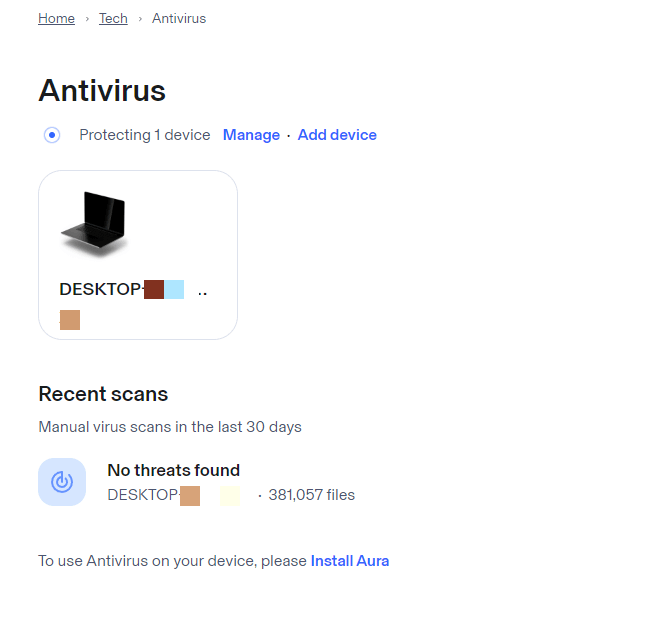

Antivirus and Password Manager

Aura’s antivirus plan is about as basic as their VPN. It’s primarily a program that you can use to scan stuff before you download it to your device. This is nice but limited compared to full-fledged antivirus services.

Aura’s password manager is a decent tool. But if you are already using a password manager like Bitwarden, stick with that.

Circle Parental Controls

The Circle parental controls app is a nifty feature available with the Family plan. It allows you to limit screen time and filter the types of websites your kids can access on their devices.

There are other parental control services that offer more to keep your kids safe on the internet, but it’s nice that Circle is included with Aura subscription.

Overall, Aura’s additional internet security features might underwhelm. Taken together, however, they add up to the beginnings of a true “digital halo”.

If you are already paying for something better…yeah, it’s probably best to keep doing that. But if you’re looking to save a bit of money, these services can fill in the gaps.

Pricing and Cost

Promo Code | |

Individual Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Couple Plan Cost |

|

Family Plan Cost |

Aura only offers one plan but offers the same benefits as Identity Guard's Ultra plan |

Renewal Price Increased After 1st Year? |

|

Promo Code |

Given all the features and services we’ve discussed, I bet you think Aura comes at an insanely high price.

WRONG.

Aura offers the best value in ID theft protection thanks to an extremely reasonable price (especially with our promo code).

Since you’d be silly not to use the discount code we found you, we’ll be discussing pricing based on those rates (not the website rates, which are a wee bit higher).

See what I mean?

These prices are great! Aura’s individual plan costs the same as some other services that offer a whole lot less. And their family plans are the first I’ve ever seen to cover five adults and unlimited children.

Each adult gets their own $1M insurance plan as well, giving you an insane amount of family insurance coverage. It’s an absolute steal for the price.

Plus, you can try Aura’s 14 days free trial.

Aura FAQs

So, Should You Get Aura

This Aura review proves it – Aura is the best identity theft protection service.

Identity Guard was already the service I judged all other services against, and generally found them wanting. But Aura took all the complaints I had about its predecessor and fixed them.

Saying Aura is “perfect” isn’t accurate, of course. As this rating showed, I have my gripes with its website layout (and hopefully, they’ll spruce it up at some point). There’s always room for improvement –especially when it comes to their additional features. I’d be willing to pay more for a more robust VPN, for example.

But Aura protection is as close to perfect as I’ve seen. There’s very little that would improve the service in any measurable capacity.

Aura set out to surpass and replace the best service on the market, and it succeeded in spades. So, should you get Aura?

The answer is yes, absolutely. If you want the best identity protection for you and your family, Aura is the best pick.