Identity Guard vs. LifeLock Comparison Review – Save 40% Today

Ninety days of testing Identity Guard vs. LifeLock revealed that Identity Guard is the better protection service.

Identity Guard caught more threats – 15 vs. LifeLock’s one. It was also easier to reach Identity Guard’s customer service team. LifeLock hides their customer service number, making it hard to ask questions or get help with threats.

Plus, Identity Guard lets you protect your entire family (up to five adults and unlimited kids). LifeLock’s plans aren’t as generous.

Ultimately, with Identity Guard we felt like we could breathe a little easier about our personal information online.

With our discount code you can secure off Identity Guard for life and avoid LifeLock’s renewal price hikes.

- You want accurate and effective monitoring. Identity Guard is better at catching threats to your identity than LifeLock.

- You’re looking for straightforward identity protection. Identity Guard offers a no-frill, low-priced plan that’s exceptionally affordable.

- You want quick answers to service questions. Calling Identity Guard’s customer service team was a breeze.

- You have a family to protect. Identity Guard family plans include unlimited kids and up to five adults.

- You want antivirus software first and foremost. Some LifeLock plans include Norton antivirus software (something you could also purchase as a standalone product).

- Price increases don’t bother you. LifeLock’s introductory prices end when your subscription renews and the increase is significant.

- You don’t plan to call customer service. LifeLock makes reaching their customer service team difficult.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Overview: Identity Guard vs LifeLock

Identity Guard and LifeLock are two of the most well-known identity protection services. Both have been around for a long time, but their similarities end there.

LifeLock offers a shady past, full of lawsuits and data breaches. Even if you can look past their history, LifeLock’s present doesn’t look much better.

LifeLock’s services are expensive, with prices that increase after the first year. They also have terrible customer service, and their product doesn’t work that well. Our testing revealed that LifeLock’s dark web monitoring isn’t very accurate.

Meanwhile, Identity Guard has never had a data breach (or FTC lawsuit, for that matter). You can feel safe giving them your personal information to monitor, and they will monitor it effectively. Our testing showed that Identity Guard catches more dark web threats than any other identity protection service (except Aura, which caught the same amount).

Identity Guard also offers some of the best customer service. When testing their services, we called several times, and not once were we able to stump them with a question about their product.

The only thing lacking with Identity Guard is its breadth of protection features. It’s a pretty bare-boned service, especially next to LifeLock. That said, Identity Guard and Aura are owned by the same company. So, if you want the most accurate monitoring and fantastic customer service alongside a full breadth of protection features, you should look at Aura instead of Identity Guard.

Still, either one is a better choice than LifeLock.

Identity Guard Pros and Cons

Pros

- Excellent customer service

- Very accurate dark web monitoring

- Low-price, no-frills value plan offers very affordable protection

Cons

- Doesn’t include as many protection features

- White-glove identity theft restoration services only available with top-plan

- Customer service is not 24/7

LifeLock Pros and Cons

Pros

- Offers a wide breadth of tools and monitoring services with top-tier plans

- Very easy-to-use interface

- Can opt to include Norton360 antivirus software and VPN

Cons

- Price jumps significantly when the subscription renews

- Poor customer service

- History of customer data breaches

- Monitoring is not as accurate as Identity Guard (or Aura)

Our Video Review

Editor’s Ranking Table

Identity Guard vs LifeLock: Head-to-Head Comparison

With all the above in mind, let’s start going over these services’ respective features and compare Identity Guard and LifeLock head to head.

Monitoring and Alerts:

Here we get to the real meat of the services, and it’s where Identity Guard really starts to shine. In terms of the monitoring services and online security offered, and how well it executes on them, Identity Guard blows LifeLock out of the water.

As part of the Ultimate plan, it offers dark web monitoring, data breach alerts, online banking and high-risk transaction monitoring (including credit and debit card monitoring for up to 10 cards), 401(k) and investment monitoring, criminal and sex offender registry monitoring, social media insight reports (analyzing your social media habits and keeping an eye on the accounts), USPS address change monitoring (mail fraud protection, essentially), and home title monitoring.

Monitoring

To its credit, Norton’s LifeLock offers most of these just with its Advantage plan, losing out on the 401(k) investment monitoring and home title monitoring, which are available with the Ultimate Plus plan (losing the pricing edge, but making up for the feature loss). None of LifeLock’s services offer the social media insights report, but it offers file-sharing network monitoring (for services like Dropbox).

So, on paper, the two services are pretty equal. If you don’t need the 401(k) and Home Title Monitoring services, LifeLock even has an edge, since you can stick with the Advantage plan and save about 33%. Based on the prices using our affiliate links, the final total would be $15.99 monthly for an annual subscription to LifeLock, and $20.99 for Identity Guard, which adds up a lot over a year.

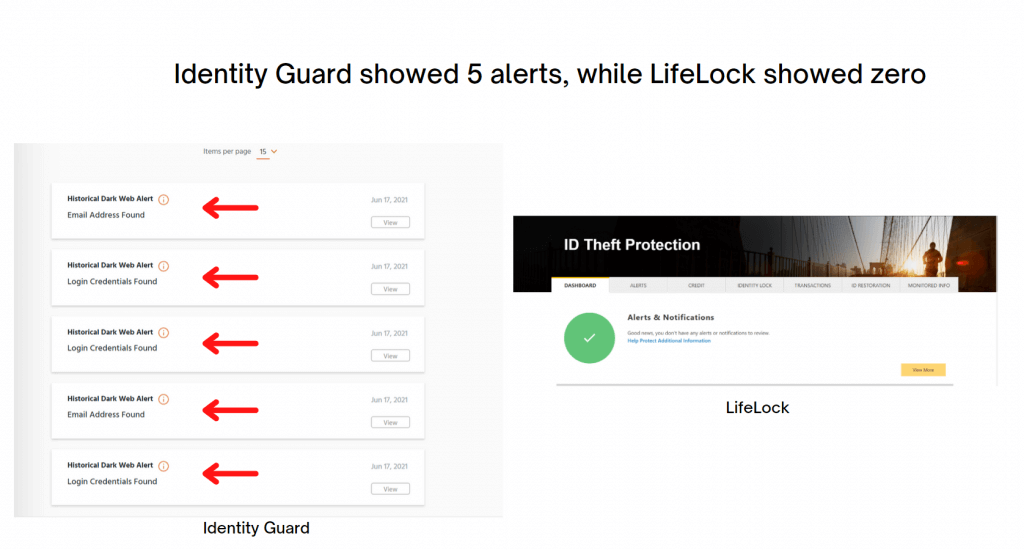

In practice, however, things are different. Take a look at the respective alert pages for these services.

That is Identity Guard on the left and LifeLock on the right. Both of these companies have access to the same information. The five alerts thrown up by Identity Guard are known issues that were not detected at all by Norton LifeLock.

This tells me that while the services are nominally the same in what they track, Identity Guard is much more thorough and accurate in its reading, keeping a much closer eye on your personal online information and throwing up relevant alerts and security so you can take steps to correct the issues.

In addition, Identity Guard also gave us a clear Risk Management Score (shown below) which was very helpful.

Threat Monitoring & Alerts

This is by far the most important category for an identity theft protection service. Nothing else matters if there’s a gap in the monitoring. Without knowing there’s a problem, you can take no steps to rectify any of the problems that are thrown up.

If there was a data breach that leaked your personal bank account’s username and password, in one of the worst-case scenarios, Identity Guard would throw you an alert immediately, whereas going by our tests LifeLock would throw them up too late or even not at all (the fastest was about 48 hours, with an average closer to 3 days, and some took a week or more to show up. That is simply unacceptable).

Nearly two weeks after signing up, Norton was eventually able to throw up some (but not all) of the same alerts. This is far too late to matter.

Threat Resolution

Both Identity Guard and LifeLock are pretty solid when it comes to helping you resolve various threats and fraud. Particularly, Identity Guard has excellent customer service and identity recovery specialists available to help resolve issues. LifeLock has a slight edge in that these specialists are available 24/7, while Identity Guard, if you have the Ultimate plan, includes “White Glove Concierge Service”; a representative whose whole attention will be focused on you and your problems rather than being beholden to the usual call center demands and need to wrap up calls within a certain amount of time.

My experience with Identity Guard was that they were quick to access; I was only on hold for a few minutes, though this may be because I took advantage of the ability to call at very late hours and still get a call. I got courteous, professional customer support representatives, who were better able to answer my questions off the top of their heads rather than needing a moment to double-check options, which is what I experienced with LifeLock when I finally got through to someone…

Ultimately, Identity Guard seems to have better-trained agents on staff available to call directly, which is what you’d expect from something billed as a concierge service.

A special bonus to Norton here for having a 24/7 text chat option available via their website. This is perfect if you are uncomfortable talking on the phone, or are in a situation where you can’t easily talk out loud (at work, on the bus, at night when everyone else is asleep, and so on).

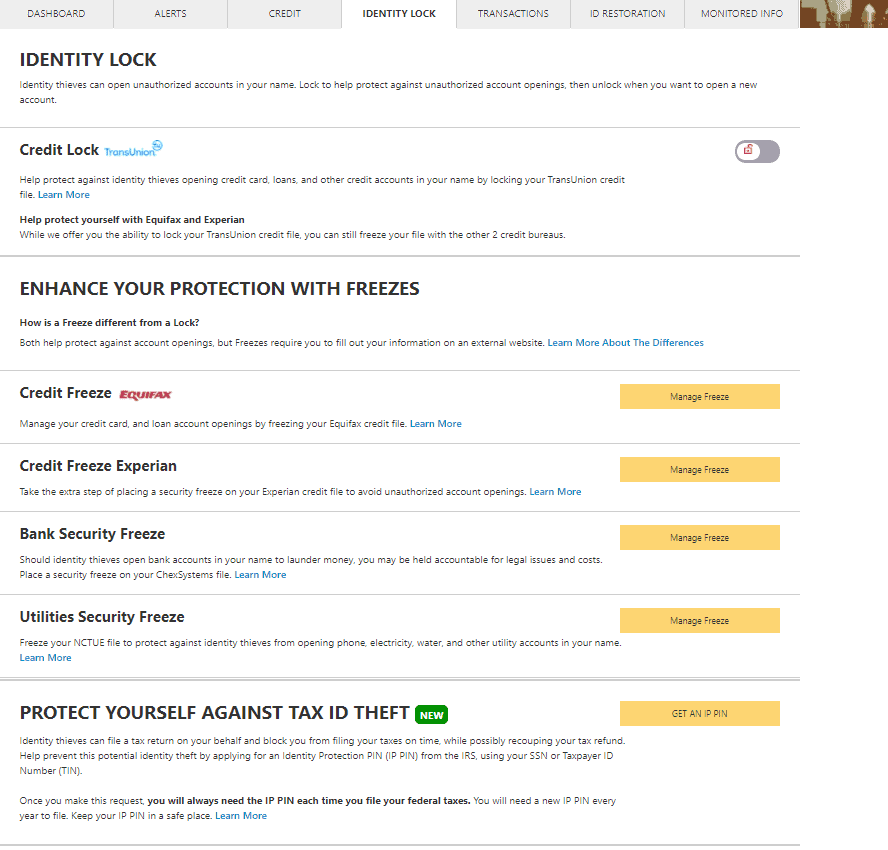

Both services offer credit freeze options, with LifeLock identity theft service having a distinctly better option in this regard with their Identity Lock service, which acts as a sort of “soft freeze” to your TransUnion credit report until you unlock it. Unlike a credit freeze, which requires a pretty painstaking process to both activate and deactivate it (meaning it cannot be done casually), a credit lock can be toggled on and off at any time.

This means you could theoretically keep your credit locked permanently, toggling it off for a day or two any time you need to apply for a loan or something similar, and then toggling it back on when everything is finalized.

This is just as secure, but infinitely more convenient for the user.

The large number of options here is great to see and allows you to both preemptively protect yourself, and react quickly to any alerts that pop up to minimize any damage done.

IdentityGuard also offers credit freeze capability, but it’s a lot harder to navigate than LifeLock’s.

You get the same number of options but laid out in a more annoying way on this one. A minor gripe, but one worth noting, especially when it’s going to be an added source of frustration to an already stressful situation.

In addition to these services, Identity Guard also offers a Wallet Protection service, which is very nice. If your wallet is lost or stolen you can talk to a representative, who will help you go through everything you have and cancel cards, order replacements, and keep an extra eye on the personal information that may have been gleaned from your wallet (driver’s license info, hints to passwords and security questions due to family information, and stuff like that) so you can minimize the damage.

That pushes Identity Guard out ahead in my book, since it provides a significantly more robust suite of options, with only a few minor hiccups in how the site layout is presented; a small price to pay for an increase in options.

Threat Resolution & Customer Support Comparison

They simply provide you with more options to resolve any issues that may crop up. Think of this as having more tools in your toolbox. While you may not need a power drill, a handsaw, a soldering iron, and a full collection of socket wrenches for every job, chances are if you’re a DIYer you’re going to need at least one of them for ANY job. Having the right selection of tools to choose from is the difference between success and failure at any stage.

Ease of Use

This is a quick measure of how easy the services are to navigate. Both LifeLock vs Identity Guard are pretty good about this, but their websites are wildly different.

Of particular note, LifeLock comes with an app that can be installed on various devices, which also allows for control of some of its extra features, including the Norton 360 antivirus system it comes bundled with.

Norton LifeLock Dashboard

Keep in mind here that while this is a nice extra, that’s mostly what it is. Many of these extras come free from LifeLock competitors (like AVG or Credit Karma for credit scores), so the main benefit here isn’t in added protection, but a bit of convenience.

Having everything available in one place will save you a few clicks, but in the long run, isn’t something to factor in when you’re trying to judge a service on its identity protection merits.

For that reason, things, like added antivirus services or multi-bureau credit reports, are going to be weighted much lower than more immediately relevant features.

This app is pretty easy to navigate, and gives you quick access to some of its core features, though ultimately most of them just led to the website anyway, so there’s not much point to using it except when it comes to the specific Norton 360 services.

Norton LifeLock Alerts Page

The website dashboard is simply laid out and easy to navigate, but nothing special, and the different tabs do need to be clicked on individually, with a short loading time (under a second with fast internet) before each comes up.

If you have good internet, this shouldn’t be an issue, but if you have a spotty connection it can be a pain, making its usage on the go ill-advised if you have some urgent need to access multiple tabs, like if you’ve just received a major alert. In that case, it may be better to simply call customer support immediately instead of fiddling around with the website on your phone.

Identity Guard Dashboard

Identity Guard seems to have spent a bit more time on its website’s layout, giving you a very good overview of your basic information before you even start shifting tabs.

You can view all available alerts, the status of any activated options, all of your credit scores, and even social media login info before even leaving the dashboard, as seen above.

The layout of the dashboard is also significantly nicer to look at, requiring much less scrolling than LifeLock’s main page, which puts everything in line. Overall, this results in a far better user experience.

The tabs up top all bring drop-down boxes that are simple to navigate and tell you exactly what page or service you’re navigating to, so there’s no wasted motion. They do have a pretty useful app as well.

In the end, both websites and apps do their job well enough, but Identity Guard has a slight edge here I think just for giving you a bit more information from the main page.

Navigating the Identity Guard website is much easier and faster, making it easier to get things done when you need it. Since you never need to leave the dashboard to view the most basic info, it’s easy just to pull up the main page on your phone and take in everything you need to know at a glance.

Pricing & Plans

Both Norton’s LifeLock and Identity Guard have three service tiers, scaling up in price the more services they offer. Each also has family plans which allow a variable number of people to be bundled into a single plan.

Across the board, prices are comparable, with Identity Guard’s three tiers (Value, Total, and Ultra) costing pretty much the same as LifeLock’s Select, Advantage, and Ultimate Plus membership tiers. Identity Guard has a slight edge in price at the lowest tier, with the Identity Guard Value plan being cheaper by about $1 per month than LifeLock’s Select plan, but the middle and top tiers for both companies are identical in price.

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

For family plans, things also look very good for LifeLock, with their family plans having options for two adults, or two adults and up to 5 kids, with a cost reduction (50% over getting two accounts for two adults, and only costing as much as two accounts for 5 children to be added on a potential 80% cost reduction) for “buying in bulk”.

Identity Guard’s Family Plan is also quite good, though comes with a few more restrictions. It costs an extra 33% more (raising the price of the Ultra plan from $29.99 per month to $39.99 per month), and covers two adults and a seemingly unlimited number of children, with one big caveat: it only covers family members living under the same roof.

This means that buying a family plan to cover yourself and your spouse, plus your kids is an absolutely excellent deal, proportionally cheaper than LifeLock Advantage for 2 adults and 5 children (though still more expensive in real terms by about $3 per month). Buying a Family Plan to cover something like yourself and one of your adult children going off to college…well that becomes a whole lot more expensive since you need to buy two full accounts now.

Although it’s worth mentioning, LifeLock also offers child protection alone for an additional $5.39 per month, so you don’t necessarily need to buy a family plan as a single parent to cover your child.

Additional Services

| ||

Additional Services |

|

|

This is one category where LifeLock wins handily, on paper. LifeLock subscriptions come with a free subscription to Norton 360, Norton’s PC health and antivirus service. This gives you the ability to scan your computer for threats, help optimize its performance, and do stuff like manage your passwords and back up your computer’s info from the app.

Identity Guard doesn’t have any services unrelated to the total identity theft package, so in this regard, LifeLock is the clear winner.

FAQ

Final Verdict: Identity Guard vs LifeLock

Identity Guard takes the top spot based on its superior monitoring service alone, and the fact that it is competent or has the edge in every single other category besides price more than makes up for the edge that its higher price would normally give LifeLock.

Citations:

1. https://hr.carnegiescience.edu/health/lifelock-identity-theft-protection