IDNotify Reviews – Get This One Instead. Save 68%

I enjoyed testing IDNotify over the past several weeks, which was a pleasant surprise. Still, it didn’t compare to my top pick for identity protection – Aura.

IDNotify is an Experian product, and my experiences with other Experian protection services have left a lot to be desired. So, I didn’t think I’d like IDNotify as much as I did.

Unfortunately, it still fell short in a few areas which Aura excels. That’s why I can’t recommend Experian IDNotify to most people.

If you’re looking to protect your identity, your assets, and your family’s information, look at Aura.

You can lock in our OFF discount on Aura, they won’t increase your price next year.

- You want to protect your entire family, including your adult children, spouse, grandparents, and in-laws, using a family plan that includes up to five adults.

- You have investment accounts like a 401(k) you want to protect with investment account monitoring.

- You want the best value in the industry, with better coverage than IDNotify.

- You want comprehensive monitoring and don’t mind if alerts are vague.

- You don’t need family coverage to include more than two adults.

- You don’t mind paying a steep price for a service that doesn’t include add-ons like a VPN or parental controls.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

It offers better monitoring, customer service, and insurance coverage. It also includes more additional features. And, with our discount code, you can get Aura at a better price than IDNotify.

That said, for those who want the details behind IDNotify’s services, I have you covered. This review digs into everything from their monitoring services to their threat resolution capabilities.

Is IDNotify Worth It?

Experian IDNotify isn’t worth getting.

While this service is one of the best Experian offers, it’s still not as great as other options (like Aura digital security). Worse, it’s on the expensive end of the identity protection services I’ve reviewed.

The only reason I think you might consider it is if you really want the credit tools included with the Premier plan. Even then, though, these tools focus on your VantageScore, which isn’t as widely used as a FICO score is.

As you’ll see in this review, IDNotify isn’t a bad service. But it’s far from the best. And when it comes to protecting things like your bank account, your home title, and your children’s Social Security number, you don’t want to settle for second-rate options.

Still, if IDNotify has stoked your curiosity, keep reading. I’ll explain everything this service has to offer.

Editor’s Ranking Table

|  | |

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

|

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Monitoring and Alerts

Experian’s IDNotify offers an impressive breadth of monitoring tools, and my testing proved them to be accurate.

With IDNotify’s Premier plan, you get:

Though some of the names are different from other services, these are most of the same features that other comprehensive identity theft protection plans offer. For example, internet surveillance includes dark web monitoring, and non-credit loan monitoring is the same as payday loan monitoring.

Where IDNotify really fails is in how it presents alerts to you (more on that below). Overall, though, IDNotify’s monitoring capabilities are right in line with other high-end identity protection services.

Dark Web Alerts

I purposely allow some information about me to exist on the dark web. I do this so that I can test services. If the service finds the information, I know its monitoring is accurate. If it doesn’t find it, I know it’s not to be trusted.

Many services miss the information they should easily find. IDNotify isn’t one of them.

IDNotify managed to find all of the information I expected it to. Unfortunately, the way it presented that information wasn’t very helpful, which brings me to my next point…

Alerts Dashboard

IDNotify makes understanding (and therefore fixing) alerts unnecessarily difficult.

When you receive a dark web alert, for example, there’s no breach name. You might get a compromised username, but there’s no site name, so you have no clue where the username was used!

It’s not the best security practice, but there are a few sites where I use the same username. I’m guessing I’m not alone in that. If that user name comes up as compromised, I have no idea which site had the breach. Was it my health insurance? My auto loan company? With IDNotify, I can’t tell.

Sometimes the alert shows up with a “potential site” field, but that’s inconsistent. Other services are much better at providing information on the breach, giving you a better sense of where you need to increase your security.

Other than this rather LARGE flaw, IDNotify’s alerts dashboard is streamlined and easy to use. If it provided the right information, I’d give them high scores.

Credit and Financial Monitoring

IDNotify is an Experian product, so its suite of credit monitoring tools is a given. With all of their plans, you get Experian credit monitoring, which should help you find signs of fraud fast.

With their Premier plan, the breadth of credit monitoring tools greatly increases and includes:

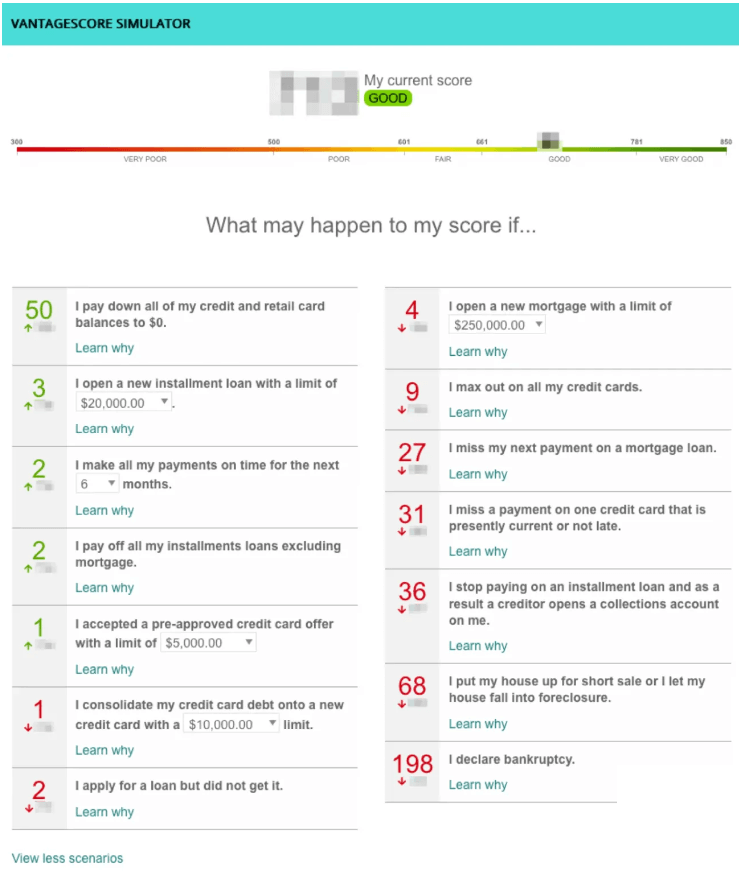

My only issue here is Experian’s insistence on using VantageScores instead of FICO.

VantageScores are gaining more acceptance, but the vast majority of lenders still rely on FICO scores when determining whether or not to issue a loan. So, while knowing your VantageScore may be helpful, knowing your FICO score is more important.

As for the finance side of things, IDNotify includes financial account takeover monitoring and regular bank account monitoring services, but it doesn’t offer investment account monitoring.

That means retirement accounts, like your 401(k) are left vulnerable. Given IDNotify’s price point, no investment account monitoring is less than ideal.

Public Records Monitoring

IDNotify monitors public records exactly as I expect a good identity protection service to, including:

The only thing it’s missing is home and auto title monitoring – something Aura includes, but many other services miss. It’s important to have, though, given your car and home are probably two of your biggest assets. Protecting them should be paramount.

Threat Resolution

|  | |

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

As an Experian product, I wasn’t looking forward to testing IDNotify’s threat resolution capabilities. My experience testing other Experian products in this area hasn’t been great.

However, IDNotify was much better than some of the other Experian services. Overall, IDNotify is pretty good at threat resolution.

Customer Service

My call to IDNotify’s customer service team wasn’t amazing, but it also wasn’t terrible.

Here’s what I mean…

I called during normal business hours on a Tuesday (though IDNotify does offer 24/7/365 customer service, so I could have called anytime). Upon calling, I had to navigate a rather annoying line of bot responses. Ugh!

Though it only took two minutes to reach a live human, it felt like far longer. Other companies, like Aura, handle this much better by limiting tiresome machine questions.

Once I got ahold of a representative, I found them to be professional and helpful. They answered all of my questions quickly. So, I don’t have any real complaints about their service. It just wasn’t as great as other companies I’ve experienced.

Concierge Service

IDNotify offers concierge resolution services if you fall victim to identity fraud. Notably, these services include Limited Power of Attorney (LPOA).

With LPOA, representatives are able to go a step further in helping your case. Rather than simply creating a restoration plan for you to follow as some services do, IDNotify’s certified representatives can help you enact that plan by filling out paperwork, issuing disputes, and even working on a police report on your behalf.

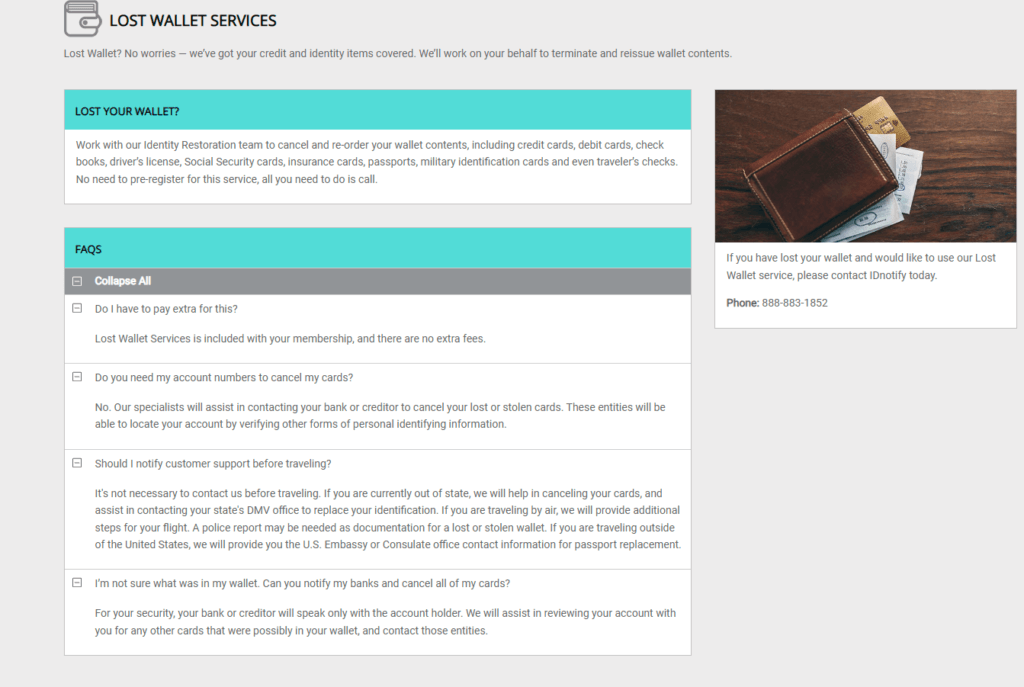

Lost Wallet Protection

With IDNotify plans, you’ll receive lost wallet protection. So, if your wallet is lost or stolen, you can call their customer service team. A representative will help you cancel and replace your bank cards, insurance cards, and identification documents.

This is an industry-standard service and not that impressive. Other services go above and beyond by wiring emergency funds or creating a wallet vault, where you can pre-store your credit card and ID information, making it that much easier to cancel and replace it.

Other than that, having a wallet restoration service is always nice. This is the service that helps you cancel your credit cards and so on and then order replacements if your wallet is lost or stolen, preventing anyone from making use of your cards and ensuring you have access to replacements for your identification cards.

They also, of course, offer a fairly solid insurance plan which we’ll discuss in more detail below.

Other than that, there are no particular extra benefits, but what they do offer is excellent.

Identity Theft Insurance

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

Theft insurance through IDNotify is a standard $1 million policy. This doesn’t go up with a family plan, and it’s only available with Select and Premier plan levels. The Essential plan does not include any insurance coverage.

Where it’s offered, the insurance policy has all the regular inclusions, such as lost wages, legal fees, childcare costs, and expenses related to restoring your identity.

While this isn’t the worst theft insurance policy I’ve come across, it’s far from the best.

Theft insurance is important. If you fall victim to identity theft, the expenses can add up fast. In the worst-case scenario, thieves can steal your assets. But even if they don’t touch your bank account, you’ll find that there are costs associated with lost work, travel, and childcare as you try to piece your identity back together.

So, though $1 million sounds like plenty, it might not be – especially if you’re using it to cover a family.

This is why I like Aura so much. Aura offers $1 million in theft insurance per adult on your plan (and you can have up to five adults). That gives you a lot more to handle expenses and lost funds.

Family Plans

Family plans are available with IDNotify’s Premier, Select, and Essential tiers. For $10 more per month, you can add an extra adult and up to ten children up to 18. For $5 more per month, you can add children without an extra adult.

This is more flexible than some identity services – many only allow for two adults and a set number of children, eliminating single parents, and a few don’t have family offerings at all. However, Aura’s family plans are much more flexible.

With Aura, you can add on your kids under 18 and up to five adults. That means you can include your spouse, your adult children, your in-laws, and your grandparents in one plan. And said plan is more affordable than IDNotify, especially when you use our discount coupon.

Ease of Use

Besides my issue with IDNotify’s alert dashboard, I enjoyed testing this service. Its user interface is sleek and modern, with straightforward navigation and clean graphics.

When you log in, you’ll see the main dash, which gives you a snapshot of everything the service is monitoring, as well as items you’re still able to add (extra emails, credit cards, and so on).

It also shows your current alerts. Clicking on each one gives you a slightly more detailed report (though not quite detailed enough to be useful).

Across the top is a navigation bar that features a list of each monitoring type. Each monitoring type then has its own drop-down menu. At first, this can feel a little overwhelming, but as I grew familiar with the interface, it actually made navigation faster.

Additional Services

IDNotify comes with very few additional services. There is a credit simulation tool that comes with the Premier plan, but they don’t offer a VPN, password manager, parental controls, or antivirus software.

A credit simulation tool is helpful if you’re getting ready to make a big purchase or trying to repair your credit, but given IDNotify’s price points, I’d expect them to include more. Similar products offer a VPN and password manager, at least.

The best identity protection services, like Aura, offer all of the above – a VPN, password manager, antivirus software, and parental controls alongside their identity protection services. Aura even includes safe gaming services, which alerts parents to bullying, harassment, grooming, and racism in online gaming platforms.

So, if you want a full suite of add-ons, IDNotify isn’t the best choice. Aura, on the other hand, offers everything you could possibly want (at a more affordable price point).

Cost & Pricing

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

Covers 2 Adults |

|

Promo Code |

Covers 5 adults & unlimited kids |

Additional children are $5.99 per month |

Renewal Price Increased After 1st Year? |

|

|

Family Plan Cost |

At first glance, IDNotify seems inexpensive. $9.99 per month for the Essential plan is a great price until you realize what it includes.

Unfortunately, the Essential plan doesn’t come with much. It has some credit and monitoring capabilities but no identity theft insurance.

That means, if you’re at all serious about protecting your identity, you need at least the Select plan, but probably the Premier. Suddenly your price per month is at $17.99 – $25.99 per month as an individual – more for families.

Given that IDNotify isn’t the best in the identity protection game, these prices aren’t justified.

You can get Aura, which offers more informative alerts, better customer service, and more flexible family plans with more insurance coverage for less using our discount code. So, if you’re looking for the best value, I’m not sure why you would opt for IDNotify.

FAQs

Conclusion: IDnotify Review

I was pleasantly surprised by IDNotify. As an Experian product, I didn’t have high hopes for it, but it turned out to be fairly impressive.

IDNotify offers comprehensive monitoring, top-notch threat resolution, and it’s easy to use.

Still, it’s not my first choice. Aura’s award-winning identity theft and credit monitoring is far more comprehensive – it includes 401(k) monitoring – and their alerts are more helpful. Aura also provides a better customer service experience, offers more flexible family plans, and provides more additional features.

Aura does all of that at a price that’s better than IDNotify.

That’s why I’d pick Aura over IDNotify. Even though IDNotify is far from a bad choice, Aura is a better one.

Related Articles:

Citations