IdentityForce vs Experian – Which Is Better?

After eight weeks of testing IdentityForce vs. Experian IdentityWorks, we found that IdentityForce is the better choice.

It found eight unique identity threats and IdentityForce only found seven. However, IdentityForce found those seven alerts within minutes. It took Experian a full month of testing to find anything.

IdentityForce also offers peace of mind with excellent, 24/7 customer service, while Experian has limited hours.

And, while both services come with $1 million in identity theft insurance coverage, IdentityForce is the only one to include additional services like a VPN and password manager.

Using our discount code, you can get a 14-day free trial on IdentityForce, too, making it the better financial choice.

- You want fast and actionable alerts that help you protect your identity.

- You want 24/7 customer service ready to help you with all of your questions and concerns.

- You want a VPN and password manager to help safeguard your digital privacy.

- You want a free plan to monitor your credit and aren’t worried about actual identity protection.

- You’re okay with a customer service team that’s only available during extended business hours.

- You don’t want any digital security extras included in your plan.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

If you’re set on knowing who wins the IdentityForce vs. Experian competition, the answer is IdentityForce.

If you’re curious as to why, read on. I’ll show you exactly what these services have to offer, from their monitoring capabilities to their extra features. And my guess is you’ll come to the same conclusions. IdentityForce may win this match

IdentityForce Vs. Experian: Head-to-Head Comparison

Looking at IdentityForce and Experian’s IdentityWorks head-to-head took several months of testing, mainly because Experian was so slow (more on that below).

In the end, IdentityForce won in every category except for cost. Technically, Experian offers a free version of its IdentityWorks service. So, if you’re judging these two on price alone, Experian’s IdentityWorks is the winner.

For everything else, though, IdentityForce beat Experian without question. I’ll explain why in detail as we go.

Editor’s Ranking Table

Monitoring and Alerts

IdentityForce offers better monitoring and alerts than Experian, without a doubt. Both services offer all of the typical monitoring tools, like:

IdentityForce’s tools are fully functional, blazing fast, and accurate. I can’t say the same for Experian.

Want to know why I’m so sure?

Keep reading.

I’ll explain how I tested both services in key areas, starting with their dark web monitoring capabilities.

Dark Web Monitoring

I test identity protection services for a living, so I’m almost never surprised by the dark web alerts they find on me. Still, the number of dark web alerts gives me a good idea of how accurate the service is.

Within one minute of signing up, IdentityForce came up with 7 unique dark web alerts that are impressive–especially compared to Experian.

Let me explain.

Experian found the same dark web alerts. It also found one I didn’t know about (a compromised phone number none of the other services I’ve tested have found) This would be impressive, except…

IdentityWorks took the full month of testing to find the same alerts that IdentityForce found in under sixty seconds.

Speed isn’t everything in an identity protection service (accuracy and thoroughness obviously count), but it is important. If your identity is compromised, acting quickly prevents further damage. So, a service that takes a month to find fairly obvious alerts is a no-go in my book.

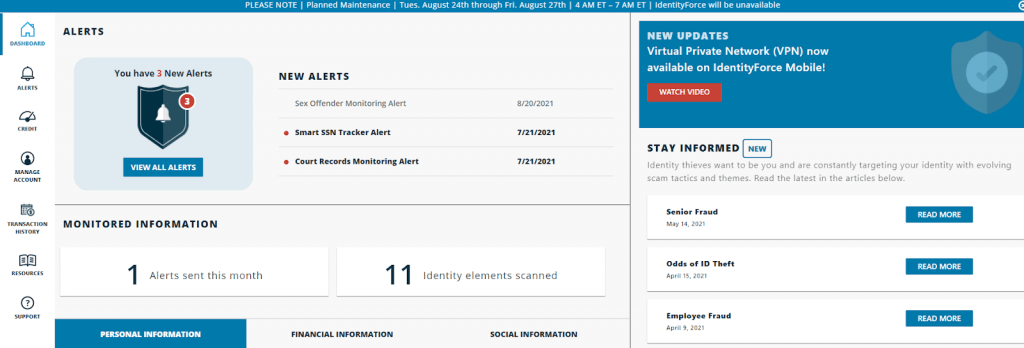

Alert Dashboard

The way a service dishes up your alerts goes a long way in determining whether the service is useful or not.

In this area, IdentityForce comes out ahead.

Here’s why:

The IdentityWorks alert dashboard initially shows a list of alert categories, like dark web and criminal records monitoring. Once you click into each category, you’ll see a list of actual alerts.

You can then click on each alert to get the details, such as the compromised website name and date of the alert. Under that, IdentityWorks gives a list of actions you can take to remedy the alert.

But here’s the thing, almost all of IdentityWorks’ suggestions consist of freezing your credit or using their credit monitoring tools. That’s par for the course with IdentityWorks. The more I dug into their service, the more it became clear…

IdentityWorks is more of a credit protection tool than an identity protection service.

IdentityWorks’ dashboard wouldn’t be so bad if it didn’t take so many clicks to get to any useful information. The navigational maze on their site further shows that monitoring alerts are secondary to credit protection in their eyes.

All of that said, IdentityForce’s dashboard is nothing to write home about. It’s a bit clunky, but at least alerts are easy to see. As soon as you log in, there they are, front and center.

IdentityForce doesn’t give much information with its alert listings. They could offer more details at a glance, but the alerts are where I expect them to be. And, once you click on the alert, IdentityForce provides more detailed information than IdentityWorks, including a helpful list of steps you can take to protect yourself.

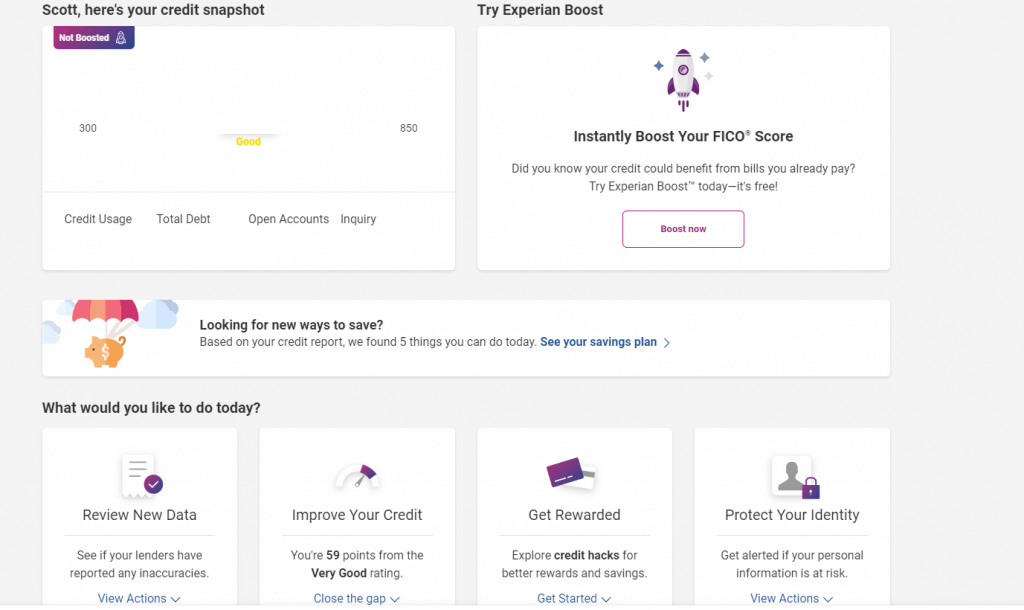

Credit and Financial Monitoring

It probably comes as no surprise that IdentityWorks offers better credit monitoring. You can lock your credit with one click, monitor your FICO score daily, and review a variety of “credit hacking tools” to help improve your credit score.

All of this makes sense, given Experian, one of the major credit reporting bureaus, owns IdentityWorks.

Credit monitoring tools are great, but again, my issue is that IdentityWorks puts credit monitoring above identity protection.

Don’t get me wrong, your credit score and your identity are closely related, but they aren’t the same thing.

IdentityForce understands this. Their top plan comes with a full credit monitoring suite, but it’s not their focus. Instead, IdentityForce puts an emphasis on monitoring your finances and credit in total. It offers investment account monitoring, credit card and bank account alerts, and credit freeze assistance alongside its credit monitoring tools.

Public Records Monitoring

Both IdentityWorks and IdentityForce offer the minimum here. They’ll monitor some public records, like court records, to ensure criminals aren’t committing crimes in your name.

Threat Resolution

|  | |

Expertise |

|

|

US Based Support? |

| |

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

IdentityForce wins the threat resolution category without question.

Threat resolution comes down to three things for any identity protection service:

While IdentityForce does well in all three categories, Experian falls way below expectations.

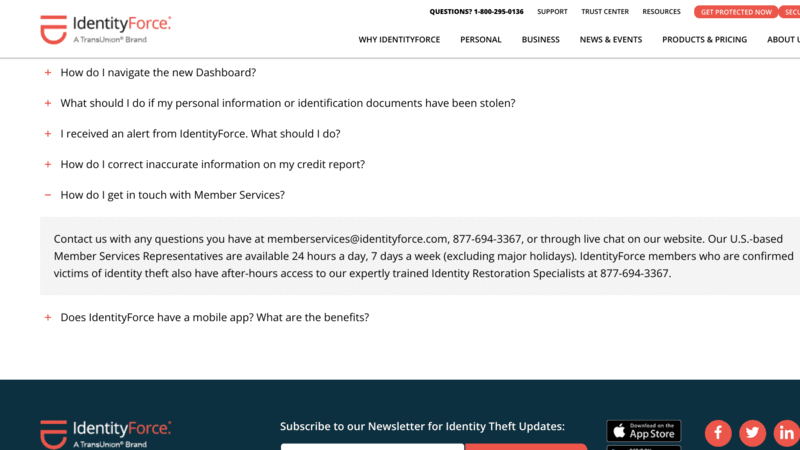

Customer Support

IdentityForce offers top-notch customer support. Their member services team is available 24/7 (except for major holidays) to answer any and all of your questions.

I tested this by calling on a Monday at 4:30 am. I reached a live person within two minutes. He was knowledgeable, polite, and definitely in the U.S.

I can’t say the same for IdentityWorks.

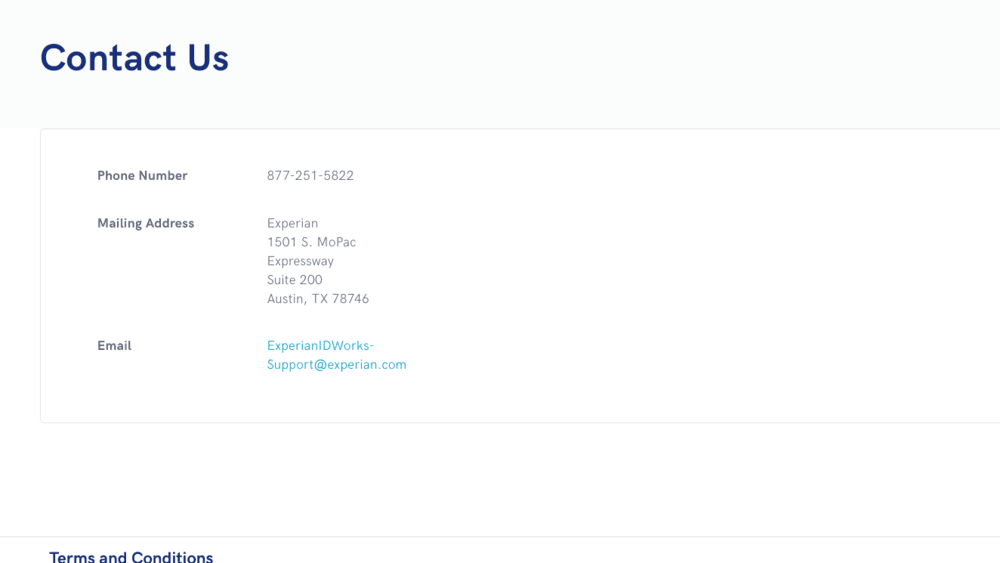

First, finding the support phone number for IdentityWorks is nearly impossible. You’re better off Googling it than looking for it on their site.

Once you find it, good luck getting past their electronic answering service. They try every trick in the book to keep you from talking to a person.

After over ten minutes of negotiating with a robot, I finally reached a human being. She was nice enough and seemed competent. I’m also fairly certain she was in the U.S.

However, IdentityWorks’ customer support is only available from 7 am to 8 pm, Monday through Saturday.

That might not sound bad, but if you’re dealing with an identity theft issue, time is of the essence. And, if you have a question at 9 o’clock one night, waiting until the next morning can feel like an eternity.

Concierge Service

Here IdentityForce is the absolute winner.

IdentityForce offers high-end white glove identity restoration should you need it. That means that if a thief steals your identity, they’ll hook you up with an experienced restoration specialist. He or she will walk you through the process of getting your identity back. They’ll help you file paperwork, sit on calls with your bank, and watch for signs of further fraud.

IdentityForce even offers restoration services for your immediate family without a family plan.

And, IdentityForce continues to protect and restore member identities after they pass away. It may sound strange, but thieves often target the recently deceased, creating a mess for surviving family members.

IdentityWorks offers essentially none of the above.

While they offer restoration services, they don’t promise white glove-level help. And, given my experience with their customer service team, I have my doubts about their availability.

Wallet Protection

Both IdentityForce and IdentityWorks offer wallet protection. So here, the services tie.

If you lose your wallet, they’ll help you cancel your bank cards and restore your identification cards.

Some identity protection services, like IdentityGuard, go above and beyond in this category by wiring emergency funds, but neither IdentityForce nor IdentityWorks offers anything special here.

Theft Insurance

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

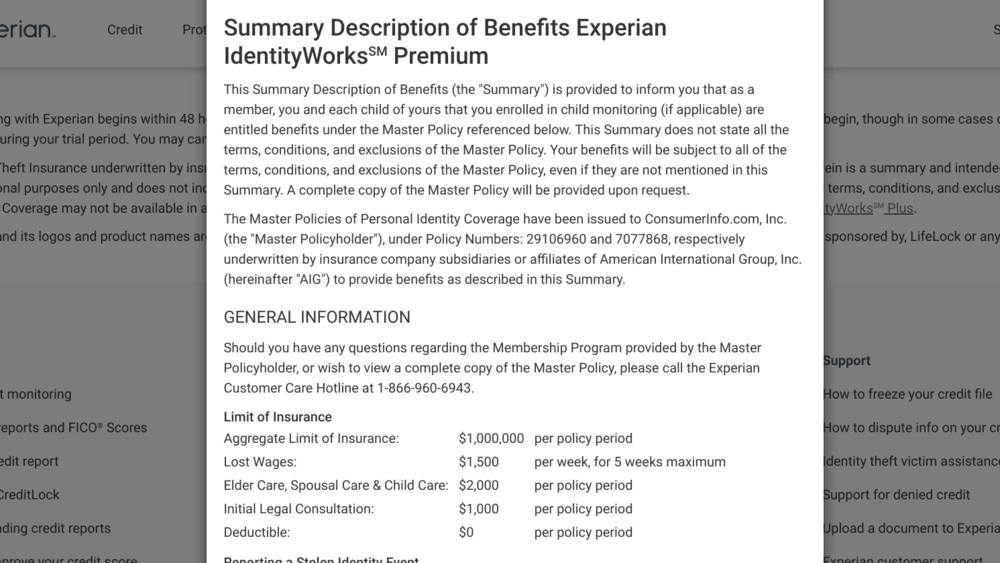

Both Experian’s IdentityWorks and IdentityForce offer the industry standard $1 million in aggregate identity theft insurance.

However, IdentityForce has more generous expense limits, putting them slightly ahead in this category.

Let’s look at it side-by-side.

Here’s IdentityForce’s coverage breakdown:

And here’s Experian’s:

Notice, that IdentityForce offers $2,000 in lost wages per week. IdentityWorks only offers $1,500. IdentityForce offers $2,000 towards an initial legal consultation, and IdentityWorks only offers $1,000.

These probably seem like little things until you need to use your policy. Then, suddenly, an extra $500 or $1000 in a certain area can make a significant difference.

Family Plans

I’m going to be blunt here.

If you’re trying to protect your family, including a spouse and children, neither of these plans is worth your time.

If I have to choose a winner in the IdentityForce vs. Experian race, IdentityForce wins for family plans.

It’s sort of a pathetic win, though. See, IdentityForce doesn’t even really advertise their family plans. You have to call them to get the information, and I’m not one for lengthy phone calls with sales reps.

After a far-too-long conversation one Friday afternoon, they quoted me $35.90 for a family plan with two adults and unlimited children. That plan includes everything from their UltraSecure + Credit plan (their top offering) plus their ChildWatch suite.

ChildWatch is a full identity protection service geared towards children, and it has some cool features, like social media monitoring. If the service picks up any sign of cyberbullying or discriminatory content, it alerts parents so they can take action.

IdentityForce also allows you to add ChildWatch to any plan for $2.75 per child. That means single parents can protect their children without purchasing a full-fledged family plan—a huge win in my book!

IdentityWorks’ family plan is simply their premium plan for one extra adult and up to ten kids. They also have a single-parent plus children option. However, their plans don’t include any extras for kids like IdentityForce’s ChildWatch.

Ease of Use

I’m not a huge fan of IdentityForce’s website, but at least it puts identity protection services at the forefront. Experian’s IdentityWorks doesn’t.

Here’s what I mean:

IdentityForce’s website is a little clunky. It’s not the most streamlined user interface, and I’m not in love with the setup. However, I can get to everything I need to with relative ease.

The left-side navigation menu is clearly labeled, and alerts are front and center.

I can’t say the same for IdentityWorks.

When you log in to IdentityWorks’ site, you get a page full of credit monitoring tools. That’d be fantastic if IdentityWorks was solely a credit monitoring service, but it’s not.

Navigating to the alerts dashboard or to restoration services isn’t as easy as it could be. They have an old-school drop-down menu that disappears if you’re not hovering over it, and nothing is easy to find (except their credit score tools).

Additional Services

|  | |

Additional Services |

|

|

IdentityForce wins this category with one caveat…

Neither IdentityForce nor IdentityWorks has all the additional features I want to see. The best identity protection services offer a VPN, parental controls, a password manager, and antivirus software. Together these tools create a one-stop identity health service.

IdentityForce offers a VPN and a password manager. This is a step up from IdentityWorks, which offers neither.

Cost

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

If we’re looking at price alone, Experian’s IdentityWorks doesn’t look bad.

Here are three reasons why:

- They offer a free version. It’s quite basic, but how do you compete with free?

- Their “premium” option is also relatively affordable.

- Their family pricing is right in line with IdentityForce.

There’s only one problem…

IdentityForce brings way more value to the table. So, while a free service, or lower-cost service, seems enticing, it’s not ideal if it doesn’t offer full functionality. And, IdentityWorks doesn’t offer full functionality.

Conclusion

If you’re comparing IdentityForce vs. Experian’s IdentityWorks, IdentityForce wins. There’s no question it provides more comprehensive monitoring, better threat resolution services, better insurance coverage, and more added features.

But if you (like me) are on a quest to find the best identity protection service, you don’t want either of these services.

You want Aura, instead.

Aura offers industry-leading threat detection, incredible threat resolution services, and up to $5 million in insurance coverage to protect your family. Plus, it offers the best value thanks to an incredible rate you can secure for life by using our promo code.

If you’re serious about protecting your assets and your family, forget IdentityForce or Experian and choose Aura instead.

Other Comparison Articles:

Citations:

1. https://www.usa.gov/identity-theft

2. https://www.identitytheft.gov/#/Warning-Signs-of-Identity-Theft

Table of Contents