LifeLock vs CyberScout: Protect Yourself from Cyber Theft

We spent over three weeks comparing LifeLock vs. Cyberscout’s services, and ultimately, LifeLock provided better identity protection.

While Cyberscout includes an impressive $2 million in identity theft insurance coverage, LifeLock’s top-tier plan includes up to $3 million per adult plus up to $1 million per child on family plans.

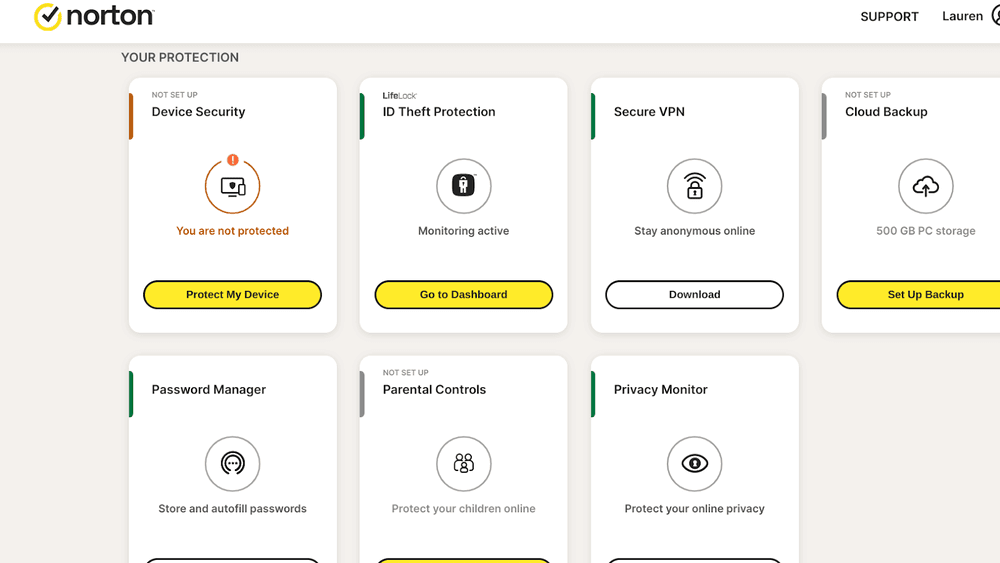

LifeLock also includes more digital security features, including Norton antivirus, a VPN, a password manager, and an in-portal credit lock tool, helping you protect your entire online presence. Cyberscout doesn’t include any extra security features.

And because LifeLock doesn’t require an employer or association sponsor, you’ll have full control over your identity protection.

CyberScout requires an employer or association sponsor who may limit some of the identity protection features offered in their plans. You could also lose your identity protection if you change jobs.

Plus, with our discount code, you can get OFF LifeLock, making it comparable (if not more affordable) than Cyberscout’s employer-sponsored rates.

- You want top-tier protection and the $3 million in identity theft insurance that comes with it.

- You want top-notch digital security features, including Norton antivirus and a convenient in-portal credit lock.

- You want complete control over your identity protection plan no matter what happens in your professional life.

- Your workplace or association offers CyberScout at an exceptionally attractive price.

- You’re sold on a great reimbursement policy that includes things like phishing reimbursement.

- You want accurate monitoring, and if it’s missing a few handy monitoring tools – that’s okay.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

However, with Aura, you get all the added features LifeLock offers (and then some) with CyberScout’s accuracy and attractive price. That’s why, after testing many identity protection services for months on end, I ultimately chose Aura to protect my identity and my family.

That said, choosing identity protection is personal. You want a service that you feel confident with and one that fits your budget. This review should help you decide which service that is.

You Should Get Aura If…

- You want award-winning identity theft and credit monitoring to help keep you and your family safe.

- You want flexible family plans that allow for up to five adults with increasing insurance coverage, so you can protect whoever you need to.

- You want a full suite of digital security features, including a VPN, antivirus software, parental controls, and safe gaming tools.

LifeLock vs. CyberScout: Head-to-Head Comparison

LifeLock vs CyberScout comparison is a little different than comparing other top identity protection services, like, say, Aura and LifeLock, because CyberScout isn’t available to individuals.

Rather, CyberScout is a business-to-business brand from Sontiq (the same company that provides IdentityForce). They partner with employers and associations to offer identity theft protection at a discounted rate, but you can only sign up for them with your own.

The question is, should you opt for CyberScout if your employer offers it? Or should you purchase individual identity protection from a better-known brand?

To answer that, we need to look at what CyberScout offers and how well it delivers on its promises.

Editor’s Rating

|  | ||

Overall Score | |||

Monitoring & Alerts |

|

|

|

Threat Resolution |

|

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

|

Customer Support |

|

|

|

Additional Services |

|

|

|

Cost |

|

|

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

Monitoring and Alerts – LifeLock

When it comes to monitoring capabilities, CyberScount and LifeLock are similar. At their top tiers, both offer:

- Dark web monitoring

- Social Security number monitoring

- Bank account monitoring

- Three-bureau credit monitoring

- Court records monitoring

- Change of address monitoring

- Sex offender registry monitoring

- Investment account monitoring

- Payday loan monitoring

LifeLock also offers home title monitoring, while CyberScout doesn’t. But, CyberScout offers social media monitoring, while LifeLock doesn’t.

I’d rather have home title monitoring than social media monitoring, but that’s a very personal choice. If you don’t own your home, home title monitoring does very little for you – of course, the same is true of social media monitoring if you’re not big on social media.

To really compare these two options, we need to dig deeper past general monitoring breadth and into their specialty monitoring tools and accuracy abilities.

Dark Web Alerts

Talking about CyberScout’s dark web alerts is difficult because I couldn’t fully test their services – I’m an individual. So,I had to use a mix of user reviews and my experiences with Sontiq’s other products to form an opinion.

However, I think it’s safe to assume that they’re going to have the same dark web monitoring capabilities as IdentityForce, given they have the same platform and parent companies. Assuming that’s the case, CyberScout’s dark web monitoring capabilities are top-notch.

When I tested IdentityForce, it found two dark web alerts on me in a matter of minutes, which aligns with Aura and other high-end services.

LifeLock wasn’t as good in this area. It only found one alert.

I consider dark web monitoring to be the backbone of any identity protection service, so to miss things here isn’t a good sign (especially when a service is priced the way LifeLock is).

So, from this angle, CyberScout is better than LifeLock, but that doesn’t hold true as we examine things further.

Financial and Credit Monitoring

At its top tier, LifeLock offers three-bureau credit monitoring, an in-portal Transunion credit lock tool, and investment account monitoring. With family plans, it also includes child credit file detection.

These are all great tools, especially the in-portal credit lock, which is very convenient and only available with other top-end services like Aura (though Aura also goes a step further by providing in-portal child credit freeze assistance).

CyberScout’s Platinum plan offers the same with one exception – rather than an in-portal credit tool, CyberScout only includes credit freeze assistance. This means you’ll have to call their customer service team for help freezing your credit at the three major bureaus.

While one call to customer service is certainly easier than a call to each credit bureau, an in-portal tool is much better. So, here, LifeLock starts to inch ahead of CyberScout.

Public Records Monitoring

As far as public records monitoring goes, LifeLock and CyberScout are almost dead even. Both include USPS address change monitoring, court record monitoring, and sex offender registry monitoring.

However, LifeLock also offers home title monitoring. If you’re a homeowner, this is a huge plus. After all, your home is probably amongst your most valuable assets – it deserves top-notch protection!

Is LifeLock worth it? LifeLock isn’t the best service I’ve seen in the public records arena (Aura offers auto title monitoring, too), but it’s close. So, if I were judging on this category alone, LifeLock would be the winner.

Threat Resolution – CyberScout

When evaluating a company’s ability to resolve identity threats, I look at one thing above all else: customer service capabilities.

That’s because most services require you to call the main customer service line first if you need help resolving a threat or restoring your identity. They might connect you to a separate restoration team later, but, as they say, you never get a second chance at a first impression.

And, when you’re calling because you’re worried about your identity, that first interaction is everything.

So, let’s start with customer service when evaluating LifeLock and CyberScout, shall we?

Customer Service

Both LifeLock and CyberScout offer 24/7 customer service lines. So, in theory, they’re both available whenever you need them.

CyberScout’s customer service line automatically connects you with threat resolution specialists, and they offer multilingual services. So, you can discuss your concerns in whatever language you feel most comfortable with.

LifeLock works differently.

With LifeLock, you have to call a general customer service line before they connect you with a resolution specialist. And, unfortunately, they make that general line difficult to find.

Here’s what I mean.

With LifeLock, you have to go through not one, not two, but three “contact us” pages before they even give you a phone number. As you navigate their “support” maze, LifeLock does everything it can to solve your problem using a pre-written article or chatbot.

Once you get their phone number, if your experience is anything like mine, you’ll end up speaking to a customer service rep that’s clearly overseas and not very knowledgeable about identity protection.

Concierge Restoration Services

LifeLock and CyberScout promise concierge restoration services, meaning they’ll do everything they can to help restore your identity if you become a theft victim. Their specialists will help you file paperwork, arrange phone calls with financial institutions, and even help with police reports.

The difference here is simply that CyberScout connects you with someone who can help right away. LifeLock forces you to talk to a rather general customer service rep before connecting you to a specialist.

If I was a victim of identity theft, I know which I would prefer…LifeLock clearly loses in this area.

Lost Wallet Protection

There’s one area of identity restoration we haven’t covered yet – lost wallet protection.

This means that the service will help you cancel and replace the contents of your wallet, including bank cards and identification documents. Some services go above and beyond by offering cash reimbursement or extra careful credit monitoring to watch for signs of fraud.

Here, LifeLock stands out.

They’ll provide up to $500 in cash reimbursement should you lose your wallet. CyberScout only offers the basics. They’ll help you replace everything in your wallet except for cash.

Theft Insurance: Tie

When it comes to theft insurance, both LifeLock and CyberScout are above average.

What is average?

Most identity protection services include a $1 million theft insurance plan. That $1 million usually covers stolen funds, expenses, and legal fees. And it’s often static, meaning it doesn’t increase when you add your spouse or other family members to your plan.

CyberScout goes above and beyond here by offering $2 million in theft insurance with its premium plans. This covers stolen funds and expenses (including legal fees). It is static, though. So, if you include your spouse or other family members, the $2 million in coverage stays the same.

Notably, though, CyberScout includes $25,000 in ransomware and $25,000 in social engineering reimbursement. Social engineering includes things like phishing and baiting, making CyberScout’s insurance coverage uniquely comprehensive.

Of course, LifeLock’s insurance is pretty amazing, too – at least with its top-tier plan. At that level, you can get up to $3 million in coverage per adult and over $1 million per child if you opt for a family plan.

That $3 million is split into $1 million portions – one for stolen funds, one for expenses, and one for legal fees. Still, that’s a lot of coverage!

Unfortunately, lower-tier plans with LifeLock offer less than the industry average. The lowest-tier plan only includes $25,000 each for stolen funds and expenses. That’s really low.

That means unless you can afford LifeLock’s top-tier plan, the insurance coverage isn’t great. You’d be far better off with CyberScout or another identity protection service.

Family Plans: Tie

If you need to cover your family, I wouldn’t choose either of these services. That’s not because they don’t offer a few unique features…

LifeLock offers insurance that increases with each child as well as each adult. And it includes a full suite of family-friendly tools, including parental controls and a secure VPN for unlimited devices.

Meanwhile, CyberScout gives you flexibility. It allows you to include seniors in your plan so that you can cover aging parents as well as children.

You can get the best of both of these services in one, though.

With Aura, you get more flexibility than CyberScout AND more family tools than LifeLock.

Aura allows you to include up to five adults and unlimited children on any family plan. And Aura comes with all of the following family features:

- Parental Controls, including the ability to pause the internet with one click.

- Safe Gaming, which monitors the player interactions on over 200 popular games for signs of grooming, harassment, and cyberbullying

- Family storage vault, allowing you to securely share files and passwords with family members

Additional Services: LifeLock

In terms of additional services, LifeLock beats CyberScout.

While CyberScout offers thorough identity protection, it lacks digital security features. There’s no VPN, antivirus software, or other add-ons.

LifeLock, on the other hand, offers some of the best in this area. With LifeLock, you can include Norton’s antivirus software, a solid VPN, an ad-tracker blocker, and an anonymous browser.

Ease of Use: LifeLock

If you’re choosing a service based on ease, LifeLock is the way to go.

LifeLock’s interface is beautiful, and it’s very easy to use. Sign-up is simple, navigation is easy, and it’s overall intuitive to use.

From the get-go, CyberScout is a little harder to work with.

Even if you sign-up through your company or association, you’ll have to call your representative to set things up. Once you’re in, the interface is very similar to IdentityForce – usable but dated.

Cost: CyberScout

|  | ||

Promo Code | |||

Individual Plan Cost |

|

|

|

Couple Plan Cost |

Covers 2 Adults |

|

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

|

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

I’m going to be straightforward here – I don’t like LifeLock’s pricing.

It looks great initially, but it increases significantly after the first year.

That said, it’s hard for me to compare LifeLock’s pricing to CyberScout’s because CyberScout’s pricing changes depending on the association or employer you join through. In my research, I saw prices as low as $9.50 per month for individuals and $17.50 per month for families, which is very good.

But, different associations and employers have different rates, and what your employer offers you may not be as attractive.

LifeLock vs CyberScout Final Verdict: LifeLock Wins

It almost pains me to say this, but in the CyberScout vs. LifeLock battle – LifeLock wins.

I’m not a huge fan of LifeLock. It has major issues. Its customer service is terrible, the price increases after the first year, and it’s not as accurate as it should be when it comes to monitoring the dark web.

But, it’s easier to use, offers more additional security features, and slightly more comprehensive monitoring tools than CyberScout.

Honestly, though, I wouldn’t choose either of these services – not when you can get Aura at a comparable price. With our discount code, Aura’s price is close to the lowest-end pricing I found with CyberScout, yet Aura offers WAY MORE than CyberScout.

With Aura, you get award-winning identity theft and credit monitoring and first-rate threat resolution services with 24/7/365 access to a U.S.-based expert team.

Plus, you get flexible family plans that include up to five adults and unlimited children. They also include a full set of digital security features, including a VPN, antivirus software, and parental controls.

For the best bet for identity protection, Aura is far better than LifeLock and CyberScout. But neither CyberScout nor LifeLock are bad. So, you and your family are better off having one of them. Which is it?

Related Comparison Articles For You: