Identity Guard Reviews 2024 : Is This The One To Get?

Of course, if you choose Aura, you can lock in our OFF discount on Aura, today!

- 60-Day Money Back Guarantee

- You want the higher $5M of theft insurance ($1M/adult) that Aura offers.

- You need a Family plan – Aura offers more value here than Identity Guard.

- You want 24/7 customer service, 365 days a year – because bad stuff can happen anytime.

- You want access to Circle parental controls, antivirus and VPN that Aura offers as part of the package.

- You want the same online monitoring that Identity Guard offers.

- You want more protection for your money.

- You don’t need more than $1M total theft insurance

- You want great identity theft protection at the cheapest price – Get the Value plan from Identity Guard

- You don’t need any extras that Aura offers

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Identity Guard Overview

When it comes to identity theft protection, there are a few big names on the market everyone has heard of. Identity Guard, perhaps, is the most famous of them, and has a legit reputation.

This reputation, in my opinion, is well-earned. While there are a few minor gripes I have with this identity theft protection service, it is an excellent service overall, and well worth looking into for anyone who has a need for identity theft protection options.

For this review, we’ll focus on the Ultra plan rather than lower-tier plan options. Unfortunately, the other plan tiers don’t offer very many features. If we focused on any of them, we wouldn’t have much to review! That said, if you’re curious about their other plans check out the plan comparison table below. It will give you a brief review of the different options and how they compare.

Identity Guard Review

|  | |

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

|

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Monitoring and Alerts

|  | |

Monitoring Score | Aura makes excellent monitoring standard on all plans | You can only access all the monitoring features in the higher cost plans |

Dark Web & Data Breach Monitoring |

|

|

Data Broker Removal Request |

|

|

Credit Monitoring | Available on ALL plans

| Available only on higher plans

|

Financial Monitoring | Available on ALL plans

| Available only on higher plans

|

Public Records Monitoring | Available on ALL plans

| Available only on higher plans

|

Reputation Monitoring |

| Available only on higher plans

|

Let’s start with the monitoring and alerts. This is where the service really shines, as it should. As you may have noticed, it includes a slew of monitoring features that help cover pretty much every major threat to your identity.

The big standouts here are is the home title monitoring as well as bank account, debit card, and “high risk transaction” monitoring tools. These are the real big-money items when it comes to identity theft. They’re harder for a potential fraudster to break into, but can be absolutely devastating if it happens.

That’s not to say it’s monitoring tools aren’t worthwhile. Data breach and dark web monitoring help protect you from identity theft by alerting you when your login information for various sites and accounts have been compromised.

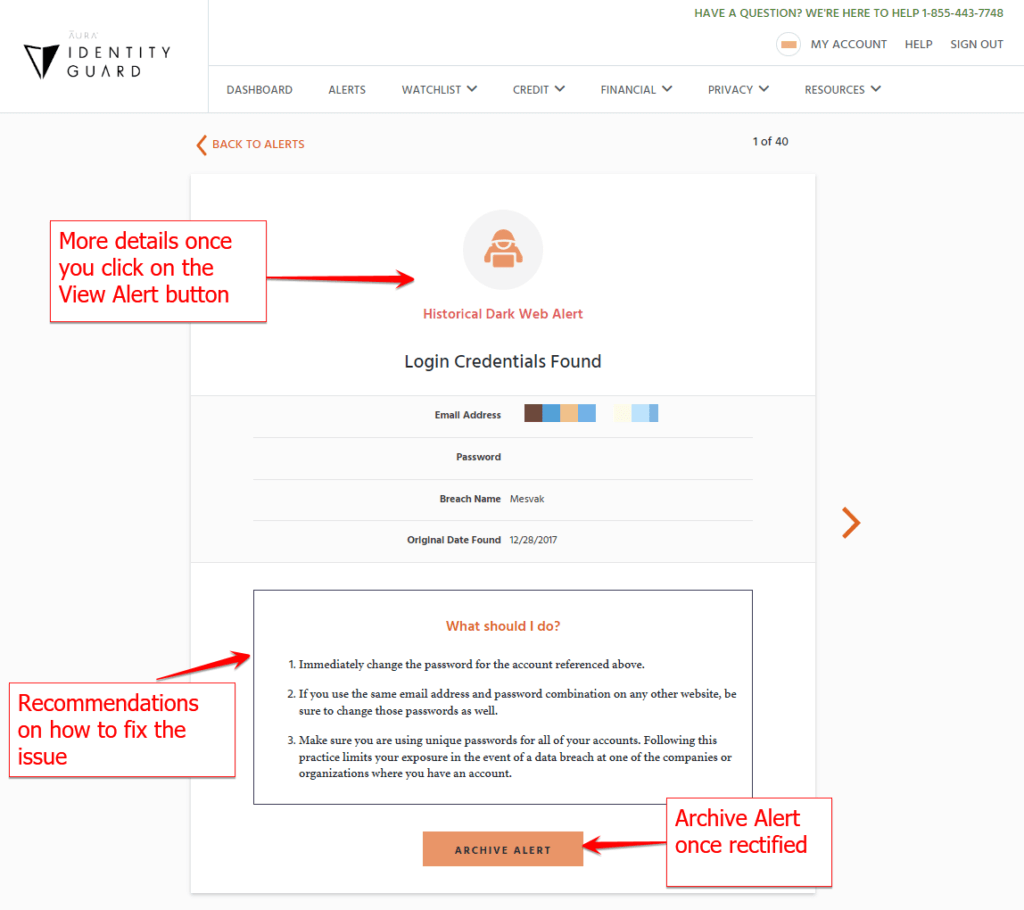

During testing for this review, it came up with 40 alerts. These alerts how up on it’s dashboard as shown above and they don’t disappear until you’ve dealt with them.

Alerts are crucial to help protect you from identity theft. If something like your Facebook account is hacked, that can lead to a lot of your other information being compromised. Your Facebook account page would give information like your email address, which, if logged into, could give a whole lot more information about you, and so on. This problem is exacerbated if you use a predictable set of passwords across multiple accounts. One account being compromised could then lead to them ALL being compromised.

However, while knowing when these things have been compromised is highly useful, it’s often too late to prevent that cascade from compromising something like your bank account. That’s why you need the other identity protection tools, like bank account and high risk transaction monitoring.

Those combined with Identity Guard’s other features create an effective identity theft protection net.

It’s alerts are also fast and accurate. The monitoring systems were able to throw up alerts, pulled from known issues with our test case information, within minutes of inputting the relevant account info. This tells us that however this system works in the background, it must have a lot of power behind it. Given relatively vague information it was still able to find the identity threats we expected fast.

All in all, the identity monitoring performed really well. I knew their monitoring service was good, but the speed was particularly surprising; other services I’ve reviewed have taken days or even weeks to throw up the identity threat alerts Identity Guard found in minutes.

It also found more alerts than any other identity protection service I’ve reviewed – 40, which was far higher than its competitors.

Threat Resolution & Customer Service

|  | |

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

Once you’ve received your alerts, what matters the most is what tools you have to deal with it.

Thankfully, it doesn’t drop the ball on that front: far from it.

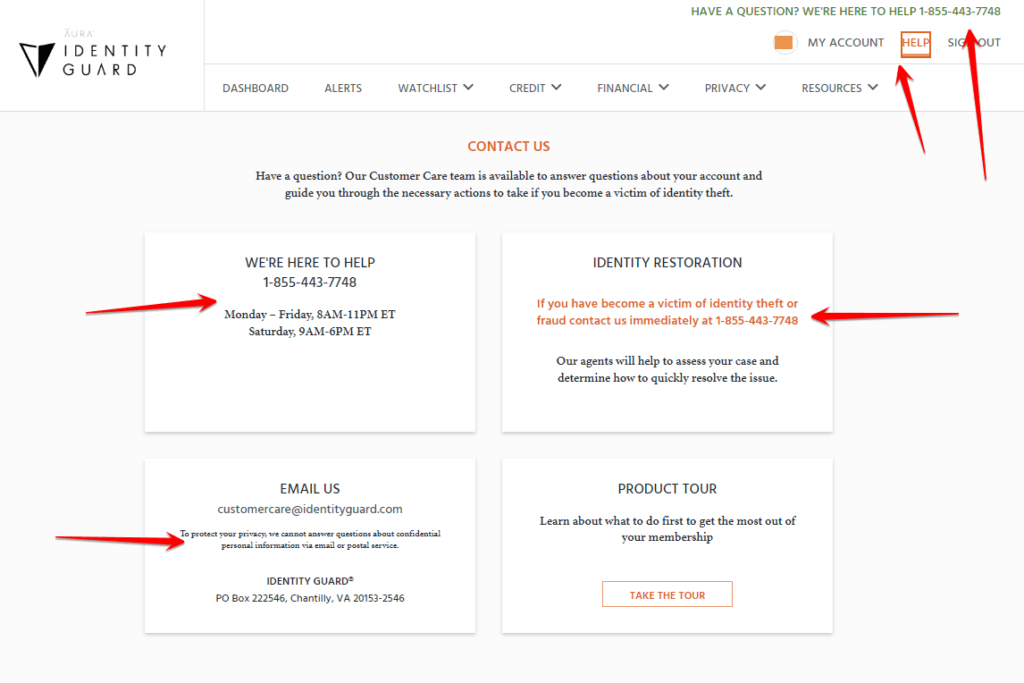

Again, a shout out to Identity Guard for making it so easy to find their customer service number. I find this very helpful, especially given the stress you are likely under when dealing with a possible case of identity theft.

The customer support team is available via phone, and all of their agents are extremely knowledgeable. Even better, their customer support staff is large enough that wait times on hold are typically quite short. I never spent more than one to two minutes on hold when calling Identity Guard.

I would, however, prefer 24/7 customer service, which they don’t offer. Their experts are available Mon-Fri from 8am-11pm ET and Saturdays from 9am-6pm ET. No support on Sundays! That’s frustrating if you ask me.

It offers a few niche threat resolution services alongside their general customer service line. Of particular note is their Wallet Protection service. With this, it will help you replace the contents of your wallet if its lost or stolen. They’ll even review your credit report to ensure all of your current cards are accounted for.

Identity Theft Insurance

|  | |

Theft Insurance |

|

|

Identity Guard’s insurance policy is very good. It’s not the best I’ve reviewed (that belongs to Aura), but as far as identity theft insurance goes, it’s hard to beat! At every tier of service, even the lowest, you get $1 million in insurance coverage.

This isn’t just lost funds reimbursement either, like many other services out there. Pretty much any identity theft protection provider will give you a significant amount of reimbursed funds. That is, if money is directly stolen from your account, they will give it back to you up to the maximum amount the policy covers.

The insurance policy, however, is infinitely more flexible and useful to the average consumer, covering pretty much any money you could lose as a result of your identity being stolen.

This includes the obvious reimbursed funds, of course, but also unexpected identity theft related expenses like needing to hire childcare when you normally wouldn’t, or reimbursing lost wages for work you missed in order to handle your identity restoration.

Identity Guard’s insurance is quite thorough and covers a generous amount for each specific type of monetary loss, too. For example, they will cover up to $2000 per week in lost wages (to a limit of 5 weeks).

While having it’s identity theft insurance can’t completely alleviate stress, missing work, for example could still have consequences, it will at least help. You won’t have to worry about lost wages on top of everything else.

Identity Guard Identity Theft Protection Plans

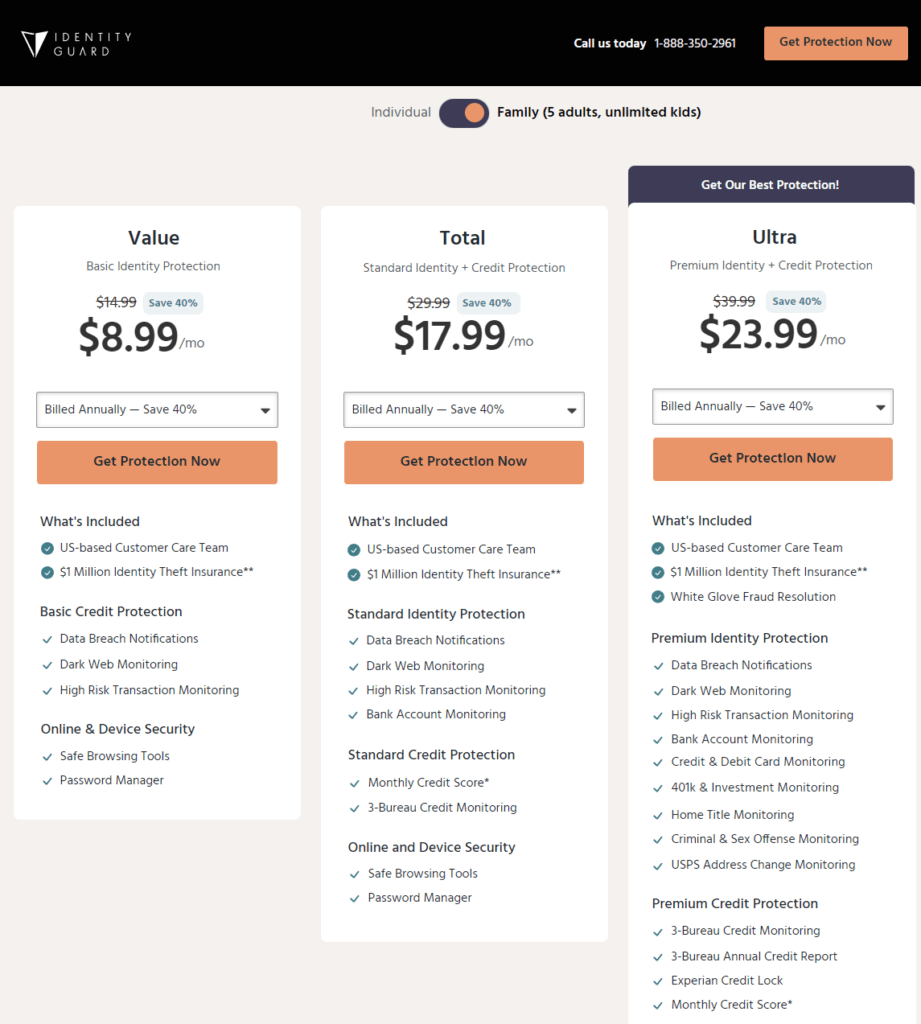

Identity Guard’s Value plan only includes identity theft insurance, access to the customer care team, risk management, data breach, dark web, and high risk transaction monitoring, plus a safe browsing tool.

With the Total plan, you get all of that plus bank account monitoring and the 1 bureau credit score and 3 bureau monitoring.

As you can see, the features are pretty thin until you get to the Ultra plan. Nothing changes here between individual and Family plans, save that the coverage is extended to more people.

Here’s a quick list of what you get with the Ultra plan:

Identity Guard Family Plans

Identity theft protection companies don’t just vary in breadth of coverage. They also vary in how many people they promise to help protect from identity theft.

The safety of your family members is often intrinsically linked to yours. If a spouse’s information is breached, particularly stuff like bank details, it could lead to identity issues for both of you. Even if accounts aren’t directly linked, some types of data breaches can tank your credit, and while that may not directly affect both of your credit scores, it can negatively impact things like jointly applying for a home loan, since both of your credits will be taken into account there.

Besides things happening to your family that might directly impact your identity, you’ll obviously want to keep your family safe from harm, so covering as many people as possible is a no-brainer.

Identity Guard Family Plans are a bit different compared to the family plans offered by other identity protection service, like LifeLock or Identity Force. While some limit the number of kids that are covered to a maximum of 5 and/or 10 kids, it has no limits whatsoever. You could have 20 kids and they’d all be covered. The only caveat here is that they all have to live in the same household, and that goes for any adults (up to 5) covered by family plans as well.

This might seem like an inconvenience, but given it’s generous pricing, it makes sense. You can’t cover another adult living in a different household.

This makes the plan better in some niche circumstances, and worse in others. If you do happen to have 20 kids, its is an incredible deal.

If, on the other hand, you and a spouse may have a different legal address for whatever reason (business, legal separation, etc.), or some other uncommon but variable circumstances…you’re kind of out of luck.

Still, in terms of pure cost efficiency the family plans should be great for the majority of standard family units: two adults and a variable number of kids.

And the family plans provide the same identity protection features as the individual plans.

Identity Guard’s Value plan is going to be largely worthless to a lot of people, but it’s not quite completely pointless. The main benefit of the Value plan is that it’s extraordinarily cheap. For a nominal cost, you still get it’s $1 million identity theft insurance policy and their basic dark web monitoring. Few other identity protection services offer that much for so little.

The Total plan is one I’d ignore completely in this scenario. Compared to competitors, it’s only slightly cheaper even with discounts applied and doesn’t offer any stand-out identity protection features.

That leaves Identity Guard’s Ultra plan, which, as usual, is going to be your best bet. If offers a wide range of identity protection features, including an insanely good monitoring suite that provides a broad spectrum, deep dive analysis of your history on the internet and off of it. It also provides particularly good protection for your family home with home title monitoring. Even if you don’t own a home yet, the 401(k) and investment monitoring is something you’ll want to focus on. If you’re starting a family, you already need to be thinking about retirement (and preferably have been buying in for years already).

So, is Identity Guard’s Ultra plan worth it? Under most circumstances, I’d say yes. If you have a spouse, or live together with your significant other, then purchasing a plan like this will give you an exceptional amount of identity protection tools and the peace of mind that comes with them.

If you have kids? Absolutely, Identity Guard’s Ultra family plan is even more worth the price. You can cover an unlimited number of kids for the cost of a third of an account, essentially, which is a great deal. Even if you’re a single parent, getting the family plan might be worth it if you’re worried about your kids’ identities being stolen or just want the extra identity protection features. The extra cost is nominal when you consider the peace of mind this type of plan can bring you.

Ease of Use

In this part of the review, I’m focusing on how easy it is to actually use Identity Guard’s identity protection features – primarily by looking at the the website.

The site is well laid out and comprehensible, even on the main page with an easy to find Login screen. Rounding things out is a quick list of all the plans, their identity protection features, and prices.

Of special note is that the signup process is among the easiest in the business, matched by a few of Identity Guard competitors. The part of the site that gathers your information and payment info before confirming is easy to use, with properly flowing multi-stage textboxes (eg. when they ask you for your phone number, you don’t have to click on the next box to input the part of the number after the area code, and so on), and all in all it took me about 5 minutes to sign up, if that.

It’s surprising that this needs to be mentioned as an upside in this day and age, but some of the site’s competitors are stuck in the late 90s/early 2000s in terms of their web design.

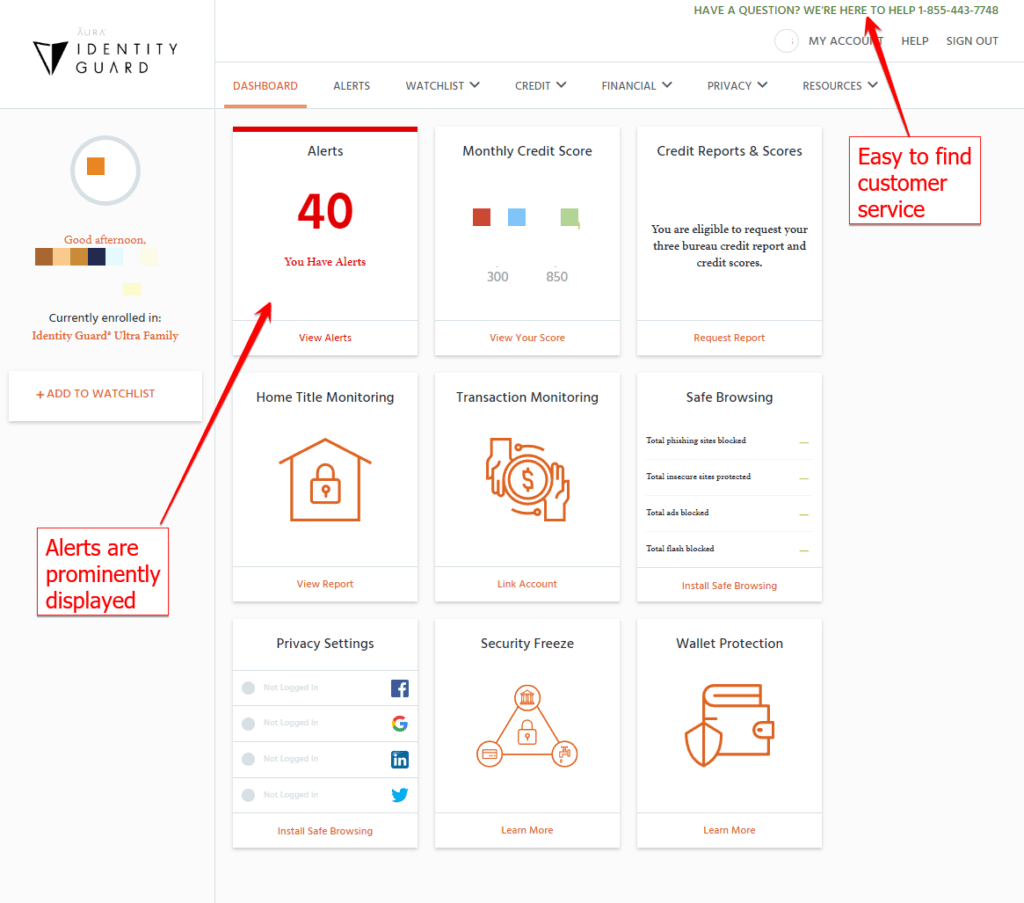

Inside the user account, things are nicely streamlined. A lot of the information you need is visible right from the main dashboard, as pictured below.

Identity Guard makes it super easy to find their customer service number – I find this simple fact puts them ahead of the pack, I’ve written reviews for many of Identity Guard’s competitors, and sadly, customer service numbers are often difficult to find. ..

As you can see, most of the commonly used identity protection features are available without navigating the tabs. You have a quick overview of how many unresolved alerts the system has found, your monthly one bureau credit score, shown prominently, your three bureau reports (available annually), and the status of your safe browsing service and privacy settings on various social media sites.

Additionally, it provides quick links to some of the most commonly used items: home title monitoring and transaction monitoring, as well as resolution tools like the security freeze and wallet protection features which are helpful if you have already been compromised or think you will be soon.

The rest of the site is similarly easy to navigate, with “sticky” drop down boxes that stay open when clicked for much easier navigation than “soft” dropdown boxes which open only when moused over. This is a significantly better design, as it prevents minor frustrations from mouse slipping or just awkwardly shaped boxes making navigation harder.

The interface is overall clean and easy to use, which is exactly what we look for.

Though I focused on their website for this review, it does have a mobile app as well. I’ll briefly review that here. Unfortunately, the mobile app is cumbersome and slow, with even simple tasks taking longer due to the slow loading times and much more obtuse layout. Reviews from customers shed light that this is a more recent development, as it used to be much cleaner, and so this could be subject to change in the future.

I would suggest sticking to the website, whether you’re on your computer or on mobile. It’s just going to provide a much better, frustration-free experience.

How Much Does Identity Guard Cost?

Pricing Plans

|  | |

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

|

Covers 5 adults & unlimited kids |

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

As you can see, in the grand scheme of things the prices aren’t too far apart. While the Value plan is notably cheaper, it isn’t going to offer you much, and the Ultra plan offers at least 3 times the functionality for around $80 to $100 per year more than the Total plan. The Total membership is the “hard no” recommendation here. I can see arguments for getting the Value plan, but Total is simply not worth the money you’re paying.

If you pay month to month especially, the prices are actually pretty close together (it’s only $10 a month more for Ultra than Total) so you can easily try the service for a month to see if you like it without worrying too much about missed savings when you move to an annual plan afterward.

The value difference between Ultra and the other packages is already clear when it comes to their individual plans, but is even more stark when it comes to comparing their family plan prices, as seen below.

You can get coverage for two adults and an unlimited number of kids for about $80 extra per year. That’s a steal: the equivalent of buying one account and getting another for a third of the normal price.

The only issue is the caveats Identity Guard puts on its plan that some others don’t – the main one being that all people covered by the family plan must live under the same roof. The deal is quite good if it works for you, and it should work out fine for most families.

Identity Guard Identity Theft Protection FAQ

Final Verdict

- You want the Higher $5M of Theft Insurance ($1M/adult) that Aura offers

- You need a Family Plan – Aura offers more value here than Identity Guard

- You want White Glove fraud resolution standard on all plans, not just the Ultimate

- You want access to Circle parental controls, antivirus and VPN that Aura offers as part of the package

- You want the same online monitoring that Identity Guard offers

- You want more protection for your money

- You don’t need more than $1M total theft insurance

- You want great identity theft protection at the Cheapest Price – Get the Value plan from Identity Guard

- You don’t need any extras that Aura offers

Identity Guard is going to be your best bet if you want pure, raw efficiency in your identity monitoring service. In terms of depth and breadth of scans, and giving you a large number of options to actually do something about it, it’s simply the best on the market right now.

It’s cost-effective if you seek out the right deals, and has unparalleled performance when it comes to the speed and accuracy of its alerts. The customer support team is great, with knowledgeable experts available who can get you sorted out pretty much no matter what happens.

Everything else is likewise top-notch, from the insurance plan to the website layout. Aside from a few minor gripes, like the caveats they put on the family plans, and the failings of the mobile app, I have absolutely no complaints with this service.

However, I think Aura’s overall package is a better choice for most people and families. It provides everything Identity Guard does, but with higher insurance per family, white-glove concierge on all plans, and a series of useful extras like parental controls. For other best id theft that you can trust, we have here the Top 11 Best Identity Theft Protection Review.