LifeLock vs Zander – SAVE 75% On The Right One For You….

Comparing LifeLock to Zander Identity Theft Protection is a little like comparing oranges to apples. They’re both identity protection services, but that’s about all they have in common.

Zander is low-cost and offers minimum protection, while LifeLock touts extensive coverage and features at a much higher price.

After weeks of testing, I found that both services have major flaws, so I can’t recommend either. Instead, I recommend Aura.

If you lock in our OFF discount on Aura, they won’t increase your price next year like LifeLock.

You Should Get Aura If…

- You want to take a proactive approach to identity protection with comprehensive and accurate monitoring services.

- You want 24/7/365 access to threat resolution experts that can help you guard your identity if your information’s leaked.

- Privacy is important to you, and you want a full suite of online security tools, including a VPN, antivirus software, email alias creator, password manager, and ad-blocker.

- You have a family to protect and want Aura’s flexible family plans (which allow for up to five adults) plus their extensive parental control suite, which offers everything from screentime to safe gaming controls.

- The cost of your identity protection tool isn’t a factor in your decision, and you don’t mind a rate that increases after the first year.

- You want the $3 million in insurance coverage that comes with LifeLock’s top-tier plan.

- You want a stellar user interface, even if it means sacrificing monitoring accuracy and good customer service response times.

- You’re on a very tight budget and don’t mind sacrificing monitoring breadth for a lower-cost service.

- You have the time and energy to monitor your credit score independently.

- You’re willing to sort through a disorganized alert dashboard to find real threats.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

Aura offers all the bells and whistles LifeLock has at a price far closer to Zander (when you use our discount code).

It’s the best service I’ve ever tested (and I’ve tested many). With award-winning monitoring, amazing customer service, and a huge suite of digital privacy features, Aura brings total peace of mind – which is why I use it to protect my identity.

But if the LifeLock vs. Zander debate is why you’re here, you’re in luck. I’ve put together an in-depth review of these two services so that you can see exactly where they shine and where they falter.

Ultimately, I guess you’ll choose Aura (like I did). But everyone’s needs are different, so I’ll let you make that decision for yourself.

LifeLock vs. Zander Identity Theft Protection: Head-to-Head Comparison

Spoiler alert: Zander beats LifeLock in this review.

You might not realize this if you take a quick glance at the table of contents. From there, LifeLock comes out ahead more often than not.

But as you’re about to see, while LifeLock technically wins more categories, it has significant flaws. These flaws aren’t things I need to look past or justify. So, if I had to pick one of these services to protect my identity, I’d go with Zander, without a doubt.

If you’re curious about how I came to my conclusions, read on. I’ll walk you through my testing process from start to finish – starting with one of the most critical aspects of identity protection, monitoring, and alerts.

Editor’s Ranking

|  | ||

Overall Score | |||

Monitoring & Alerts |

|

|

|

Threat Resolution |

|

|

|

Theft Insurance Per Adult |

|

Only Ultimate Plus offers $1M coverage |

|

Customer Support |

|

|

|

Additional Services |

|

| Only Available on Elite plan

|

Cost |

|

|

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

Monitoring & Alerts: Winner —Tie

For this area, I looked at three key things:

- Comprehensiveness

- Accuracy

- Actionability

Let’s start with comprehensiveness. With Zander’s top-tier plan, you get monitoring for:

And that’s it.

With LifeLock’s top-tier plan review, you get all of the above, plus:

Clearly, LifeLock is offering more monitoring services – including niche monitoring for areas like investment accounts and home title, which are tough to find.

Aura is one of the only other services I’ve tested that gives such a broad range of monitoring capabilities. (Technically, Aura goes even broader by also including auto title monitoring).

While monitoring breadth isn’t everything, it means a lot. LifeLock provides more actionable alerts. Unfortunately, it’s not accurate. Zander is better at finding threats.

That made this category tough to call, and ultimately I decided these services tied. Ideally, though, I want a comprehensive, accurate service that provides actionable alerts – which means neither LifeLock nor Zander are real winners.

Related: More LifeLock alternatives and competitors

Dark Web Monitoring

In testing, Zander found a lot of alerts – 14 to be exact. Out of those alerts, two were what I’d call true dark web alerts. This is right in line with extremely accurate services like Aura.

Unfortunately, though, Zander doesn’t break out their dark web alerts. Instead, the service populated a report on “Personal Information Monitoring” with a critical alert list. I’ll touch on this in further detail in the next section, but let’s just say calling all of these alerts “critical” was a misnomer.

LifeLock only found one dark web alert on me, which shows the service is less accurate. But, the alert was correctly and clearly labeled as a dark web alert, as shown:

Alerts Dashboard

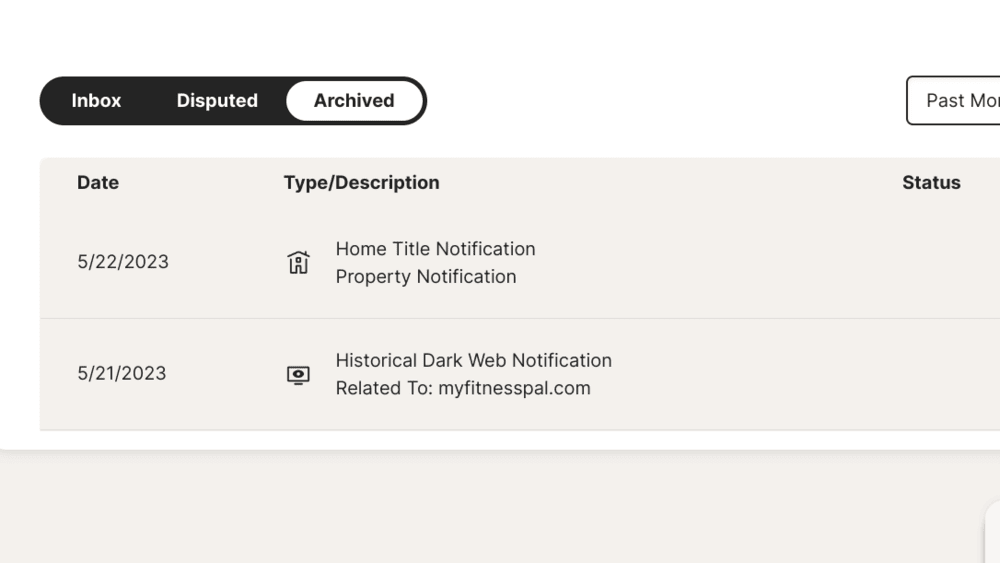

LifeLock’s alerts dashboard is better than Zander’s, without question.

In truth, LifeLock has one of the nicest dashboards I’ve ever seen. It has a well-organized layout, allowing you to see new alerts, archived alerts, and disputed alerts in three separate sections.

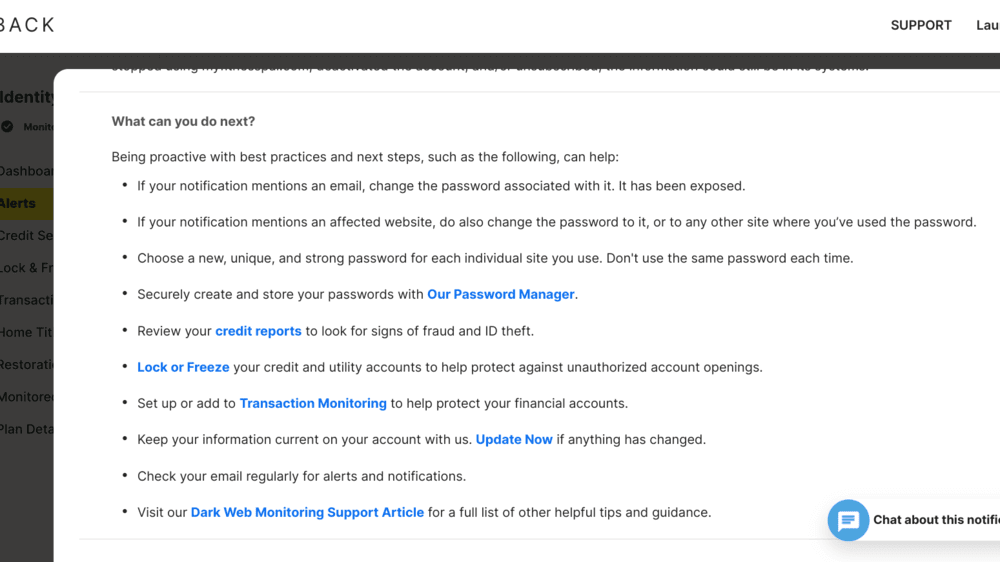

Each alert is also actionable. LifeLock provides details and gives you a list of next steps that are easy to look over quickly. If you need more detail, almost everything of substance includes a hyperlink to the relevant area of your account settings or a self-help article.

Zander’s alerts dashboard is much harder to use. The alerts don’t always give needed details (like the name of the site where your information was compromised).

And, their suggested next steps aren’t as easy to implement should you need to.

Since Zander doesn’t include services like credit or transaction monitoring, a lot of the advice consists of things you’ll have to do yourself (like reviewing your credit report with each bureau).

This brings me to my next point…

Financial and Credit Monitoring

Zander doesn’t offer credit monitoring, and its financial monitoring tools are scarce even with its top-tier plan.

According to Zander’s marketing materials, they leave out credit monitoring because it adds an unnecessary expense. After all, you can monitor your credit yourself.

And that’s true, BUT the added credit monitoring expense is minimal. Other services (like Aura) include it at a price point similar to Zander.

Monitoring your credit yourself takes time and energy, which few of us have. That’s why I prefer services to include it.

LifeLock offers one-bureau credit monitoring with all of its plans and three-bureau monitoring with its top-tier option. So, you can easily watch for signs of fraud without having to contact credit bureaus yourself.

It also includes a lengthy list of financial tools, including transaction monitoring, so you can review all your financial accounts in one place. If you use more than one bank like my family does, this is a great feature!

Both services offer an in-portal credit lock switch with their top-tier plans. Zander’s is with Experian, and LifeLock is with Transunion.

Notably, LifeLock also includes managed credit freezes for Experian and Equifax from your dashboard, while Zander simply offers a list of self-help articles on the subject.

Public Records Monitoring

LifeLock’s thorough monitoring services mean it has more to offer than Zander when it comes to tracking public records.

With LifeLock, you’ll know if someone has committed a crime in your name, thanks to court and criminal records monitoring. You’ll also know if someone uses your name to register as a sex offender. Plus, LifeLock monitors your home title for signs of fraud.

Zander doesn’t include any of the above.

However, Zander will reimburse your expenses if you become a home title fraud victim, so at least they take care of you after the fact.

Personally, I’d rather know someone is stealing my home title before I try to take out a second mortgage or put it up for sale. And for that, you need monitoring, not just reimbursement.

Threat Resolution: Winner — Zander

|  | ||

Expertise |

|

|

|

US Based Support? |

|

|

|

Customer Hours |

|

|

|

Concierge Resolution |

|

|

|

Lost Wallet Protection |

|

|

|

The best identity protection services start with exhaustive and accurate monitoring, but their services can’t end there – they also need to include top-notch threat resolution tools.

LifeLock’s threat resolution looks good on paper but fails to impress otherwise. Zander, though, does everything it claims to.

Customer Service

The first clue as to whether a company will be good at resolving threats is in its customer service capabilities. Here, Zander excels over LifeLock.

While both companies offer 24/7/365 customer service, it’s much easier to reach a person when you call Zander.

In testing, it took me less than a minute to reach one of Zander’s helpful representatives. I called on a Monday at eleven pm PST just to test their 24/7 capabilities, and I wasn’t disappointed.

With LifeLock, simply finding a number to call is difficult. When you click “Support” from your member dashboard, you’re directed to a series of self-help articles. It takes clicking through no less than three screens to get a phone number to their helpline.

At this point, I’ve tested LifeLock’s customer service several times. I’ve yet to be on hold for less than three minutes, and when I reach a representative, I’m always disappointed. They’re clearly reading from a script and seem unable to answer any questions that are outside the norm.

Concierge Restoration

Both LifeLock and Zander offer concierge restoration – meaning, should you become an identity theft victim, they’ll help you restore everything. They’ll file paperwork, arrange for phone calls with your financial institution, and essentially do all the heavy lifting.

Of course, to get to LifeLock’s restoration team, you’ll need to contact customer service first.

Given my difficulties reaching LifeLock’s customer service team, I know I wouldn’t want to use their restoration services. They could be incredible, and it still wouldn’t be worth the stress of getting through their convoluted customer service maze – not when I’m already stressing about losing my identity.

So, Zander comes out ahead here simply by offering a customer service team that’s easy to reach.

Wallet Protection

Both Zander and LifeLock offer basic lost and stolen wallet protection. They’ll help you cancel your wallet’s contents if you lose your wallet.

Notably, though, LifeLock goes a step beyond here. According to the fine print in their insurance policy, they’ll reimburse up to $500 in cash should you file a claim after losing your wallet. Zander does not include this.

Theft Insurance: Winner — LifeLock

|  | ||

Theft Insurance Score | |||

Theft Insurance |

|

|

|

Speaking of insurance policies, both LifeLock and Zander are a few steps above average here.

With Zander, you get $1 million in coverage per adult on your plan. This is similar to higher-end services like Aura (although Aura allows you to include up to five adults, not just two – meaning you get up to $5 million in coverage).

LifeLock’s insurance coverage is a little trickier.

The reason it comes out ahead here is because of what it offers with its top-tier plan. At the top level, LifeLock offers $1 million each for stolen funds, expenses, and legal fees per adult. That’s $3 million total per adult. And if you have kids on your plan, they also insure them for over $1 million each.

Unfortunately, this generous insurance policy is only available with the top-tier plan. Lower plan options include far less – dropping to as low as $25,000 each for stolen funds and expenses.

Annoyingly, LifeLock still claims to offer $1 million with every plan. They get away with this by offering $1 million in legal fee coverage only.

As you continue reading this review, you’ll find that this isn’t the only place LifeLock is a little deceptive – just wait until we discuss their plan pricing.

Family Plans: Winner — LifeLock

If you’re trying to protect your entire family, I wouldn’t pick either of these services (I’d choose Aura instead). But, for the purposes of this discussion, LifeLock is better than Zander in this area.

With LifeLock, family plans are somewhat rigid – only allowing you to include two adults and up to five children under 18. But their inclusions are lengthy. They offer full identity protection and theft insurance for each plan member, plus awesome extras like parental controls and stolen wallet protection that extend to your teenage kids.

Zander’s plans are a little more inclusive of extra-large families. You can include up to ten dependents under 18. But Zander’s plans are no-frills – they don’t offer the extras like parental controls.

I have to mention here, though, that if you’re looking for family-friendly features, Aura is by far and away the best choice.

My family uses Aura, and this is one of the main reasons – they offer award-winning parental controls with safe gaming tools. Their safe-gaming monitors player interactions on over 200 online games, alerting parents to signs of cyberbullying, violence, and harassment.

So, if you have young children at home, Aura is the best option.

Ease of Use: Winner — LifeLock

Norton acquired LifeLock in 2017. Now known as Gen Digital Inc., this company is worth over $10 billion – and it shows. There’s clearly a lot of money behind LifeLock’s interface. It’s fantastic.

Everything about LifeLock is a breeze to use. The sign-up is fast, navigation is straightforward, and you can glean all the information you need in a matter of seconds.

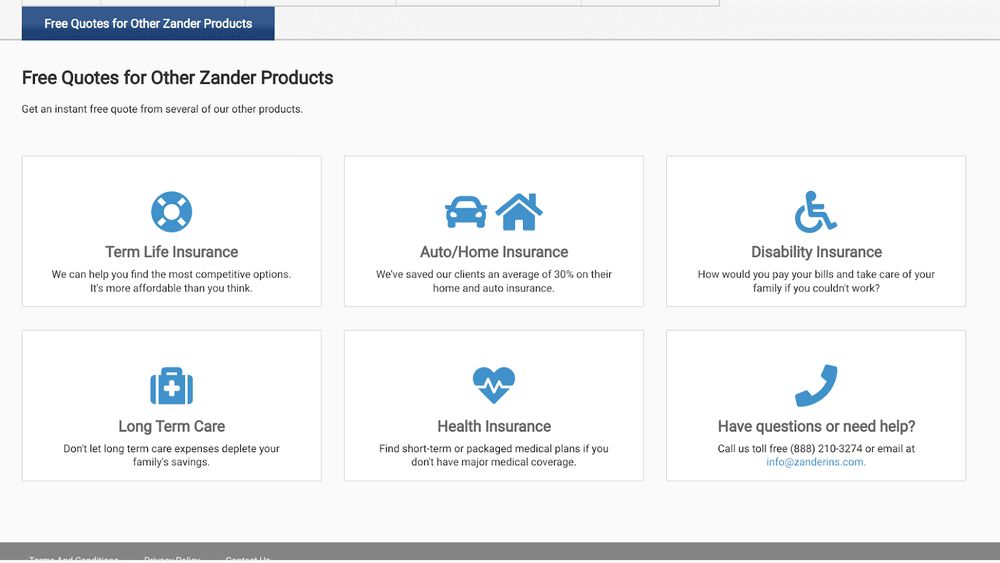

Zander’s dashboard isn’t as great. It’s not hard to use, but it’s also not pretty. Its navigation is a little bizarre, with separate pages for each monitoring area. And I don’t like that it uses prime dashboard real estate to upsell you on other Zander products.

One-click from their top-level menu brings you here:

I don’t mind that Zander offers other insurance products, but it seems a little cheesy that they try to push them so prominently.

Additional Services: Winner — LifeLock

Zander is a budget-friendly product, and its lack of additional services reflects that. With its highest-level plan, you get a VPN and antivirus software, but that’s it.

LifeLock offers a lot more, including:

Costs: Winner — Zander

|  | ||

Promo Code | |||

Individual Plan Cost |

|

|

|

Couple Plan Cost |

Covers 2 Adults |

|

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

|

|

Renewal Price Increased After 1st Year? |

|

|

|

Promo Code |

Of course, all of those extra services come at a high price – LifeLock is expensive. And here’s the thing, they might be able to justify their price point given the number of services they offer. But they don’t lose this category simply because they charge more.

LifeLock loses this category because it’s the only service I’ve tested that significantly increases its price upon renewal.

Zander might not offer many bells and whistles, but their price is very low. The Essentials plan is one of the cheapest options for identity protection available (under $7 per month for individuals). So, if you’re on a tight budget, it’s a good choice.

Zander vs LifeLock Final Verdict: Winner — Zander

Technically, LifeLock won more categories, but I can’t give them the win overall. LifeLock has too many major flaws, like deceptive pricing, poor customer service, and inaccurate monitoring.

That said, while Zander wins, I can’t recommend it to most. Yes, it’s very affordable. But there are other options that give you more at comparable rates.

Aura is my top pick for identity protection because it offers all the bonus features LifeLock provides at a cost comparable to Zander.

When you use our discount code, you can get award-winning identity theft and three-bureau credit monitoring that’s comprehensive and accurate. You’ll also get incredible 24/7/365 customer service, insurance that increases by $1 million for each adult on the plan, and amazing added features like a VPN, antivirus software, and parental controls.

Plus, their family plans are flexible, allowing you to include up to five adults. So, you can cover your college-aged kids or your aging parents – whoever you want.

I use Aura for my family, and I recommend it to just about everyone. Zander vs LifeLock both have great features, but neither is the best identity protection service.

Other Comparison Articles: