LifeLock vs. Experian: Compared & Reviewed

Testing LifeLock vs. Experian IdentityWorks for over eight weeks proved LifeLock is the better identity protection service.

LifeLock provides faster monitoring. Even though it only found one alert (Experian found eight), it found the threat almost instantly. Experian took over a month of testing to find anything, making its monitoring virtually useless.

LifeLock also comes with more identity theft insurance. LifeLock’s top-tier plan includes $3 million in coverage – Experian caps out at $1 million.

Plus, with LifeLock, you can include high-end device security features with your identity protection plan, like Norton antivirus software and a VPN.

Using our discount code, you’ll get off LifeLock, which makes it more affordable than Experian, too.

- You want fast monitoring that allows you to catch and deal with data breaches and other threats before they become bigger concerns.

- You want better identity theft insurance, including $1 million each for fund reimbursement, personal expenses, and legal fees – up to $3 million total

- You want device protection. You’ll feel safer online with Norton antivirus and LifeLock’s parental controls.

- You care more about protecting your credit score than your identity in full.

- You’re okay with limited customer service hours. While LifeLock’s customer support is available 24/7, Experian’s hours are limited.

- You don’t want any extra features. Experian doesn’t include any device security tools.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

LifeLock vs. Experian: Head-to-Head Comparison

The LifeLock and Experian battle was a tough one to judge. Not because these are two amazing services, but because they both have unignorable flaws.

Neither of them is as accurate with their monitoring as they should be, and both have significant customer service issues.

While both are easy to use and have better-than-average family plan offerings, the issues with monitoring and customer service are paramount. It’s because of those that I can’t recommend either option.

Aura might have a little less brand recognition, but in terms of services, it beats both LifeLock and Experian by a long shot. Aura offers more accurate monitoring and a more experienced customer service team.

So, if you want to protect your children, your spouse, and your good name, you should look at Aura instead. If you lock in our OFF discount on Aura, they won’t increase your price next year like LifeLock.

Still, if you’re hungry for the details of my testing experience, read on. I’ll explain everything you need to know before you sign up for one of these services.

Editor’s Ranking

Monitoring & Alerts: Winner — Tie

Both LifeLock and Experian claim to offer comprehensive monitoring, and on paper, they look pretty much even. Both include:

Notably, LifeLock also includes investment account and home title monitoring with their highest plan. That should put LifeLock ahead in this area, but upon testing their services, I found they weren’t very accurate.

Experian IdentityWorks was slightly better at monitoring but nowhere near as accurate as other services. So, this area was hard to judge.

Dark Web Monitoring

Both LifeLock and Experian failed to impress in this area. LifeLock found one alert on me.

Experian IdentityWorks found a few more, but it was slow. It took an entire month of testing before it started populating alerts. Once it began populating alerts, though, it managed to find a compromised phone number that no other service had found.

This leads me to believe that Experian IdentityWorks has a thorough monitoring system, albeit a slow one.

LifeLock, on the other hand, fails to catch what it should, making its dark web monitoring close to worthless.

Alerts Dashboard

If I were judging a product on looks alone, LifeLock would win.

Their alerts dashboard is very aesthetically pleasing and easy to navigate. Each alert gives you the information you need, including the next steps, in a succinct way.

In reading Trustpilot and App Store reviews, though, it seems that LifeLock may have a glitch.

Several users reported receiving the same alert over and over, even after they’d cleared it. I didn’t experience any problems, but I thought it worth mentioning, given the number of people who reported it as an issue.

Experian doesn’t have a bad alert dashboard by any means. It’s streamlined and provides the information you need for each alert. It’s not quite as pretty as LifeLock’s dashboard, but I have no complaints about its functionality.

Financial and Credit Monitoring

LifeLock excels at financial monitoring, at least with its top-tier plan, by offering investment account monitoring.

Your retirement savings is one of your most important assets, and you don’t want to leave it vulnerable. However, many services fail to offer investment account monitoring. That LifeLock includes it is a point in their favor.

LifeLock also offers three-bureau credit monitoring with their top-tier plan, which is good. However, it would be hard to beat Experian for credit monitoring capabilities.

Experian is one of the three major credit bureaus, so it’s no surprise that Experian IdentityWorks offers very comprehensive credit monitoring. Their Premium and Family plans offer:

Public Records Monitoring

Both Experian and LifeLock will monitor for crimes committed in your name. This is pretty standard for identity protection services.

LifeLock also provides home title monitoring, which is great to have if you own a home.

Experian offers sex offender registry monitoring, which alerts you when sex offenders move into your area or use your name on the registry.

Threat Resolution: Winner — Tie

| ||

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

I couldn’t choose a winner for this category, but not because I’m evaluating two amazing customer support teams.

Both LifeLock and Experian struggle in this area.

I’m sorry to say this section will make it painfully obvious that you don’t want either of these services.

Customer Service

Let’s start with LifeLock.

LifeLock claims to offer 24/7/365 customer service with U.S.-based reps. Unfortunately, I’m 99 percent sure that’s not the case.

While their helpline is open 24/7/365, their representatives aren’t in the U.S. That becomes obvious the second you get a hold of one – also a herculean task.

See, LifeLock does everything it can to keep you from calling its customer service team. It takes clicking through no less than three “contact us” pages before they’ll give you a phone number.

When you call that number, expect it to take at least five minutes to get through the machine prompts. Then, you’ll probably be on hold for several minutes after that.

I called LifeLock on a Tuesday morning, which shouldn’t be a particularly busy time, and spent ten minutes on hold after getting through the machine prompts. Once I reached a human, things didn’t get much better. He wasn’t very good at answering my questions.

The Experian helpline also failed to impress.

First, Experian has limited customer service hours (Monday through Saturday, 7 a.m. – 8 p.m.).

I called on a Friday afternoon. This was after I had to Google their customer phone number because they, like LifeLock, make it ridiculously hard to find on their site.

Also similar to LifeLock, I spent ten minutes navigating their machine answering service before I reached a live human. To Experian IdentityWorks credit, though, the customer service rep I reached was very helpful and definitely U.S.-based.

Concierge Restoration

LifeLock and Experian both offer concierge resolution services. So, if you’re a victim of identity theft, they’ll assign a specialist to your account.

This specialist should walk you through the process of repairing your identity and help you with the heavy lifting. They’ll file paperwork on your behalf, monitor your credit report for further signs of fraud, and even help you file a police report if necessary.

On paper, both LifeLock and Experian offer all of the above, but I have my doubts about how well they’d do in practice.

While Experian IdentityWorks boasts a highly trained identity restoration team, each with ten weeks of pre-job training, reaching them is notoriously difficult.

The same goes for LifeLock. Maybe they have a stellar team, but getting a hold of them is likely to be frustrating.

If a thief is messing with your identity, possibly stealing your assets, or ruining your credit, stress is a given. The last thing you need is a protection service that’s hard to get ahold of.

LifeLock and Experian need to make drastic improvements for their resolution services to be up to standard.

Wallet Protection

Both LifeLock and Experian offer wallet protection services, meaning they’ll help you cancel and replace your bank cards, health insurance, and ID if you lose your wallet.

Of course, you have to call in when you lose your wallet to get the promised help. Given my experience with each company’s respective helplines, I might decide it’s easier to cancel the cards myself.

Identity Theft Insurance: Winner — Experian

| ||

Theft Insurance Score | ||

Theft Insurance |

|

|

At first glance, it seems like Experian and LifeLock both offer the industry standard, $1 million in theft insurance coverage, for all paid plans, but that’s not quite true.

LifeLock only offers $1 million in aggregate coverage with their top-tier plan. Lesser plans offer far less.

Here’s what it looks like:

Reimbursement Items (includes loss of income, traveling expenses, elder or childcare, and arrest-related expenses)

Stolen Wallet Reimbursement

The exception is for legal fees. All of LifeLock’s plans come with a $1 million reimbursement for legal costs.

Experian IdentityWorks insurance coverage breaks down like this:

It essentially matches what you’ll find with other big names in identity protection, like IdentityForce.

As with most companies, Experian does not increase their insurance coverage with a family plan. So, two adults still get $1 million in aggregate coverage.

Notably, LifeLock does increase its insurance coverage with its family plans. They offer $1 million per adult. However, as we’ll discuss shortly, this increase in coverage comes at a very high cost.

Family Plans: Winner — LifeLock

This was another difficult area to judge. Both services have their pros and cons. I chose LifeLock because they offer more flexible family plans at a better price point. However, Experian offers some high-end features for families that are worth discussing.

With Experian, you have choices. You can sign up as a single adult and cover up to ten kids, making it a fantastic choice for single parents.

Alternatively, you can sign up as a family with two adults and up to ten kids.

The only problem with Experian IdentityWorks is that the insurance coverage doesn’t change. You get $1 million in identity insurance whether you’re a single adult or a couple.

LifeLock ups their insurance with each adult and child on the plan, but you can only sign up as a couple or as a family with up to five children.

However, in LifeLock reviews it offers a guided child credit freeze which is unique to their service. Hopefully, you never need to freeze your child’s credit, but having the added feature from LifeLock isn’t a bad thing.

Ease of Use: Winner — LifeLock

I will give LifeLock this – its user interface is magnificent.

Norton is a big company, and they clearly gave lots of financial backing to their product design team. Using LifeLock is a breeze. Everything is streamlined and aesthetically pleasing.

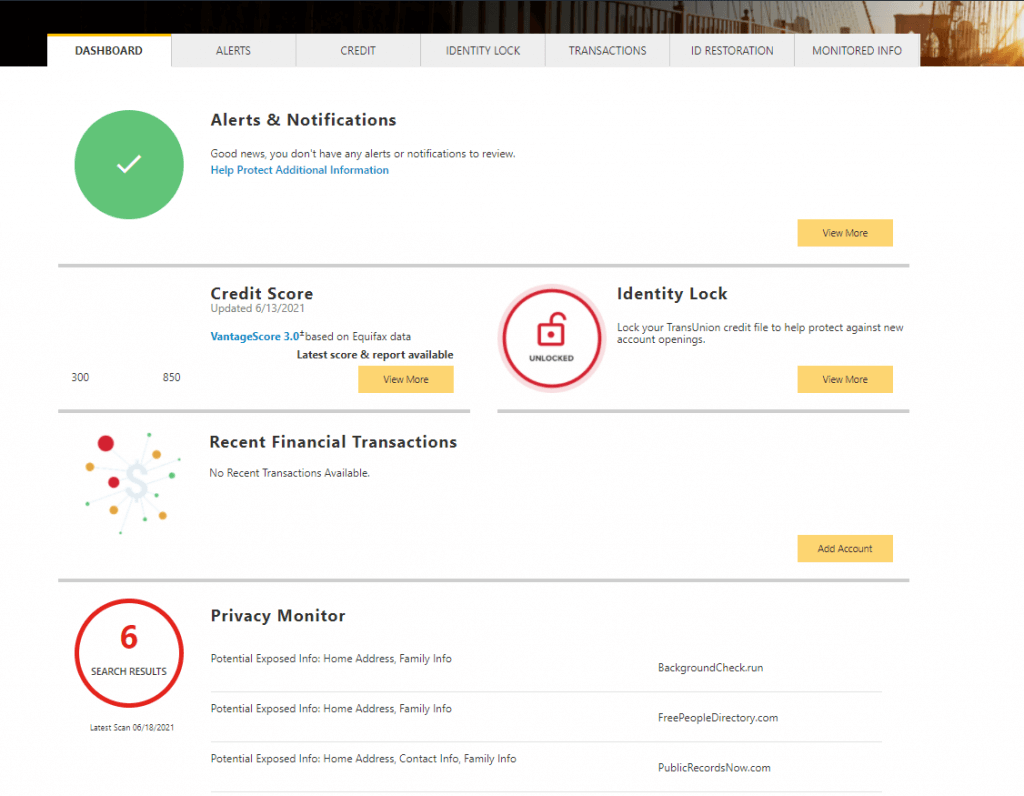

That’s not to say Experian IdentityWorks is bad. Their interface is also modern and simple to use.

My only issue with Experian is that its entire dashboard is devoted to credit monitoring, which seems to be their main focus.

The entire service seems to put credit monitoring first, which makes sense, given it’s an Experian product. However, I want a full identity protection service first and foremost. The credit tools should be part of it, but they needn’t be primary.

Additional Services: Winner — LifeLock

| ||

Additional Services |

|

|

LifeLock comes with all of the following:

That’s a huge suite of services!

Experian IdentityWorks offers none of the above. So, LifeLock is the clear winner here, but all of those extras come at a cost…

Pricing & Costs: Winner — Experian

| ||

Promo Code | ||

Individual Plan Cost | Annually

Monthly

|

|

Couple Plan Cost | Annually

Monthly

|

|

Family Plan Cost | Annually

Monthly

| 1 Adult and Up to 10 Children

2 Adult and Up to 10 Children

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

The cost of LifeLock is on the high side, though it doesn’t look like it.

Initial individual plans start at a very reasonable $9.99 per month (or $7.50 when paid annually). Unfortunately, that basic Standard plan doesn’t include much. For all the features we’ve been discussing, you’ll need their Ultimate Plus option, which increases the price to $19.99 per month.

Even more unfortunate – LifeLock significantly increased its pricing after the first year.

Experian starts with a slightly higher price point for its top-level plan, but there are no frustrating price hikes later.

Final Verdict – LifeLock Wins

LifeLock wins this battle.

With LifeLock, you get faster monitoring, more identity theft insurance, and more high-end device security features.

Though LifeLock has a few downsides, it’s better than Experian IdentityWorks. And, with our discount code, it’s cheaper too.

Related Comparison Articles: