Identity Guard vs. IdentityForce in 2024: Don’t Overlook This!

For twelve straight weeks, we compared Identity Guard vs. IdentityForce. In the end, Identity Guard won – handily.

Identity Guard gave us more peace of mind by finding 15 unique alerts – IdentityForce only found seven.

Identity Guard also offers $1 million in identity theft insurance to cover you, unlimited children, and up to five adults (rather than just you and your spouse).

Plus, Identity Guard comes with more useful security features, like a safe browser that you’ll actually want to use. IdentityForce offers a lot of features, but they’re all a bit clunky.

And, with Identity Guard, you have 24/7 access to a renowned customer service team. While IdentityForce also has 24/7 customer service, Identity Guard’s service representatives are impossible to beat.

Ready for the icing on the cake? Using our discount code, you can lock in off Identity Guard, making it far less expensive than IdentityForce.

- You want accurate monitoring. Identity Guard found more dark web alerts than IdentityForce (and just about every other identity protection service we’ve tested).

- You want an intuitive service. Identity Guard has a simple interface with next-to-no learning curve.

- You have a family to protect. Identity Guard goes above and beyond by allowing up to five adults on any family plan.

- You care about value. Identity Guard is inexpensive compared to other services but still offers a quality product.

- You care about security extras more than identity protection. Identity Force found fewer threats, but their service does come with extras like a VPN.

- You want social media monitoring. You can include ChildWatch social media monitoring with your Identity Force plan, but it only works on certain networks.

- You don’t need protection for your family. IdentityForce family plans are restrictive compared to Identity Guard.

Home Security Heroes independently tests and reviews every product. We may earn a commission when you buy through our links. Read more here.

IdentityForce and Identity Guard seem pretty evenly matched at first glance. But, after testing, Identity Guard uncovered more unique threats, which is huge. They’re also a little easier to use and offer packages that make more sense.

However, I have to point out, that Aura (the successor to Identity Guard) offers more than either one of these services.

We’ll deep dive into all of that in just a minute, but first…

Identity Guard vs IdentityForce: Head to Head Comparison

Putting them side-by-side, you’ll see that while IdentityForce has some awesome features (like ChildWatch and an included VPN), it falls behind in one of the most significant categories for identity protection:

Threat detection!

IdentityGuard catches more unique security threats, and that’s why they’re on top. But let me be completely transparent…

IdentityGuard is the old model, and it’s been rendered all but extinct by Aura.

Aura is IdentityGuard’s successor. It offers everything IdentityGuard has and everything I wish it had. So, if you’re trying to decide between IdentityForce and Identity Guard, the truth is, you’re probably not asking the right question.

Editor’s Ranking Table

Overall Score | ||

Monitoring & Alerts |

|

|

Threat Resolution |

|

|

Theft Insurance Per Adult |

|

|

Customer Support |

|

|

Additional Services |

|

|

Cost |

|

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

Monitoring and Alerts

Identity Guard is the clear winner here.

At first glance, both IdentityForce and Identity Guard offer all the monitoring tools you’d expect a comprehensive service to provide, like:

But, Identity Guard pulls ahead by including home title and 401(k) monitoring, both crucial services that IdentityForce fails to offer.

While both options also offer fast and accurate alerts, Identity Guard catches more information and has a cleaner alert interface (more on that below.) So, I have to give Identity Guard first place in this category.

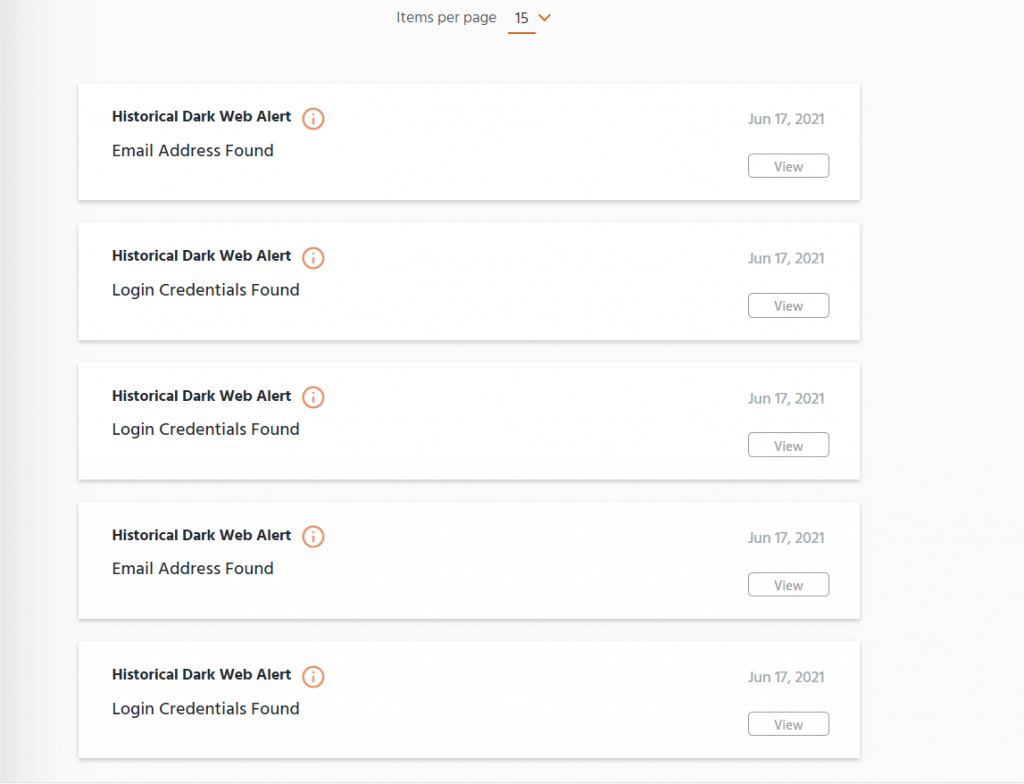

Dark Web Monitoring

Identity Guard came up with 15 dark web alerts after I ran an initial scan.

IdentityForce, however, only came up with a measly 7.

I think we can conclude that IdentityForce isn’t as comprehensive in its monitoring.

And that’s a big flaw.

Threat detection and resolution is one of the main reasons for investing in an identity theft protection service! You want one that catches as much as possible.

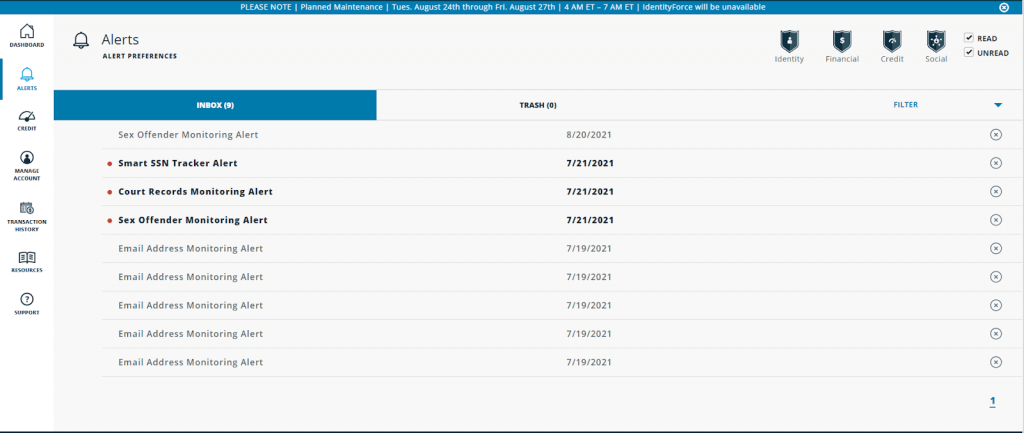

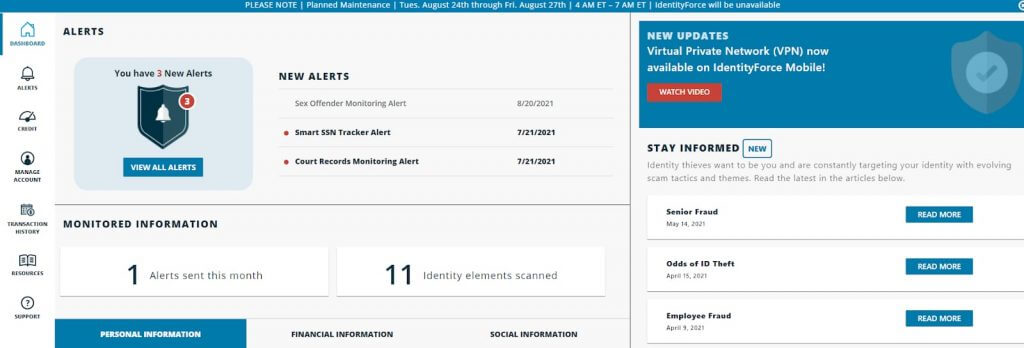

Alerts Dashboard

I’ll give IdentityForce this; their alerts come in fast!

Within seconds of setting up my account, I received a rapid succession of texts alerting me to identity issues. To be honest, it was a little annoying to receive that many texts, but at least I knew the software was working.

Identity Guard’s alerts came in a little slower, though not by much. While IdentityForce’s scan took less than one minute, Identity Guard took two.

Turns out, it was worth the extra minute. Identity Guard gave me more useful information about the alerts. They also compiled them in a more user-friendly format.

Here’s what I mean:

Where IdentityForce showed me the email address that was compromised for each alert, Identity Guard showed further details. They included login credentials for websites where they could, making the alert more useful.

Identity Guard also conglomerates email address alerts. So, instead of receiving five rather annoying text messages, I get a single, streamlined alert. The result is a cleaner interface that’s much easier to navigate.

Credit & Financial Monitoring

Both Identity Guard and IdentityForce offer monthly credit reports from VantageScore by Equifax. That’s what you’d expect from any identity protection service.

But, while IdentityForce stops there, Identity Guard gives you the tools you need to do something about credit report issues.

Let me explain:

Identity Guard offers credit lock and credit freeze services. So, if you know your data has been compromised, you can protect it by thwarting unwanted access.

Identity Force doesn’t take care of locks and freezes for you. You’ll have to reach out to the credit reporting bureaus yourself.

Public Records Monitoring

I already mentioned that Identity Guard offers home title monitoring while IdentityForce doesn’t.

But, when it comes to public records monitoring overall, both software could do a better job.

While both offer criminal records monitoring, neither offers data broker removal services, which is unfortunate.

Still, in this area, Identity Guard comes out on top.

Threat Resolution Services

|  | |

Expertise |

|

|

US Based Support? |

|

|

Customer Hours |

|

|

Concierge Resolution |

|

|

Lost Wallet Protection |

|

|

IdentityGuard is the overall winner here, hands down.

IdentityForce provides excellent customer service that’s always available, and they provide a few unique features, like dedicated support for deceased members. Meaning they’ll continue to secure member identities after they die, which is a nice benefit for surviving family.

However, Identity Guard’s white glove concierge service is top-notch.

Their expert team is a dream to work with. And with an average of 7 years of industry experience, they’re not using the term expert loosely.

Though they have slightly more limited hours when it comes to customer service, their response time is incredible. When I called on a Friday evening, they answered in less than one minute. Plus, their wallet recovery is far more comprehensive than IdentityForce (more on that below).

Customer Support

IdentityForce offers 24/7 live customer chat on its website. You can also call or email them with questions.

Their customer support team is U.S.-based and well-versed in troubleshooting software issues. When I tried their helpline, it took less than two minutes for me to reach an actual person.

IdentityGuard was faster to answer, taking under a minute when I called. However, their hours leave a little to be desired. They have customer support available Monday through Saturday by phone or email. The hours are generous (until 11 pm) but not 24/7, and they don’t offer a live chat service.

I like using live chat for working through small issues and I like 24/7 availability, so IdentityForce comes out ahead here, but only by a hair. IdentityGuard’s customer support team is just as friendly and knowledgeable, and their hours are generous enough for most people.

Concierge Service

As I mentioned, Identity Guard’s concierge service pushes them to the top of the threat resolution category.

If your identity is stolen, their expert team walks you through the process of fixing things step-by-step. They’ll even host a 3-way call with your bank or government agencies if necessary.

When someone steals your identity, it’s overwhelming. So, having a team like Identity Guard’s is a huge plus. Unfortunately, Identity Guard only includes this level of service with their top-tier plan.

IdentityForce includes premium resolution services with both tiers of their software. Like Identity Guard, their team is also skilled at walking you through the process of identity recovery. They file the paperwork on your behalf and help you manage each step.

However, their level of involvement isn’t as deep as Identity Guard’s. I don’t see them offering to make 3-way calls with you and your bank, as an example.

Wallet Protection Service

Both IdentityGuard and IdentityForce offer wallet protection, but IdentityGuard is the clear winner here.

IdentityForce will do the bare minimum–They cancel your debit and credit cards.

IdentityGuard does far more. If you lose your wallet or discover someone stole it, Identity Guard:

I think this shows, once again, how comprehensive Identity Guard is with their services.

Identity Theft Insurance

|  | |

Theft Insurance Score | ||

Theft Insurance |

|

|

When it comes to insurance, IdentityForce and Identity Guard come out even.

Take a look for yourself…

Identity Guard offers:

- $1 million aggregate insurance coverage. This covers everything from long-distance phone calls to hiring a personal investigator to help fix the damage done to your identity.

- $2,000 per week in lost wages for up to 5 weeks.

- $1,000 per policy period for travel expenses.

- $2,000 per policy period for child, elder, or spousal care.

IdentityForce offers:

- $1 million aggregate insurance coverage. Just like Identity Guard’s policy, this covers pretty much everything you might need to recover your identity.

- $2,000 per week in lost wages for up to 5 weeks.

- $2,000 per policy period for travel expenses.

- $2,000 per policy period for child, elder, or spousal care.

- $2,000 per policy period for an initial legal consultation.

They look pretty similar, right?

The only differences between Identity Guard and IdentityForce are the amount they put towards possible travel expenses and an initial legal consultation.

Family Plans

This was a close category to call. I’m giving it to IdentityGuard, but IdentityForce offers a few unique family features that really impressed me.

Let me explain…

IdentityForce boasts its Childwatch service, and they have good reasons to.

Childwatch offers some of the most comprehensive coverage for kids online. It monitors the dark web, their SSN, and their social media presence. It even alerts parents to possible cyberbullying.

Identity Guard’s family plans to offer child ID monitoring, dark web monitoring, and threat detection. But they aren’t as comprehensive when it comes to social media.

However, IdentityForce’s family advantages end there.

Though both Identity Guard and IdentityForce allow unlimited children on family plans, Identity Guard allows up to five adults. So, you can include your spouse, your adult kids, your parents, your in-laws, or anyone else who lives under your roof. IdentityForce only allows two adults per plan.

Two adults per plan might work for young families with no need to protect the other adults in their lives, but what about everyone else?

Many families don’t fit the two-adult mold, which is why I think Identity Guard wins.

Plus, Identity Guard offers a family version with appropriate pricing for each of their plan offerings. That makes it very easy to shop for a family plan.

Identity Force encourages you to call them if you want to purchase protection for the whole family (more on that below). Needless to say, the phone call is an extra step, and it can be a frustrating one. If you have a busy household, you don’t have time to waste on the phone.

Ease of Use

Both Identity Guard and IdentityForce have streamlined sign-up processes. You enter your information and provide a credit card, and they start monitoring the web for you. If they find an issue, you can expect an alert to appear within seconds.

When it comes to using their dashboards, though, I like Identity Guard better.

It provides at-a-glance information, so I don’t have to go digging for things I need.

IdentityForces’s dashboard isn’t bad, per se. They’ve actually cleaned it up quite a bit in recent iterations. But it still doesn’t give me much information without clicking around.

Both sites load quickly and have easy-to-use navigation tabs, so neither is that hard to use. This all boils down to first impressions, and Identity Guard wins (again.)

Additional Services

|  | |

Additional Services |

|

|

Technically Identity Force wins this category, but I have to be honest…

When it comes to additional services like VPNs, antivirus software, and parental controls in one Identity Theft software package, neither Identity Guard nor IdentityForce stands out.

Identity Guard offers a password manager but fails to offer a VPN, antivirus software, or parental controls. A password manager is an essential tool for protecting your identity online, but many popular internet browsers have one built-in.

IdentityForce doesn’t offer a password manager or antivirus software, but they do include a VPN with their top-tier plan. And, though they don’t offer parental controls, the social media suite within their ChildWatch add-on provides pretty thorough protection.

It watches social media accounts for suspicious activity and alerts parents to posts that include violence and profanity. It also provides alerts for cyberbullying and discriminatory behavior.

Given that kids are spending more time on social media than ever before, the ChildWatch service is arguably more valuable than typical parental controls. So, IdentityForce wins this category, though I’d say both services in question could offer more additional features.

Cost

Promo Code | ||

Individual Plan Cost |

|

|

Couple Plan Cost |

|

|

Family Plan Cost |

Covers 5 adults & unlimited kids |

|

Renewal Price Increased After 1st Year? |

|

|

Promo Code |

IdentityForce Cost

Individual Plan Pricing

IdentityForce offers two pricing structures:

Why anyone would select UltraSecure is beyond me, given credit score monitoring is a key feature of identity theft protection.

The price points on these plans are a little high compared to Identity Guard as well. Given what you get with IdentityForce vs. Identity Guard, I’m not sure the higher cost is justified.

Family Plan Pricing

The UltraSecure + Credit Family plan is the most popular choice here. It includes:

You get all of the UltraSecure features plus credit monitoring and enrollment in IdentityForce’s ChildWatch program. Alternatively, you can add a child to any of the Identity Force individual plans for $2.75 per month.

Here’s where I get a little frustrated with IdentityForce…

To learn about this plan and its pricing, you have to call their sales team. They don’t list the details of their family plan offerings on their site.

I’m not a big fan of negotiating plans with sales reps, and I wish they offered family selections from their site. That said, if you’re able to create a custom plan that gives you what you want and removes what you don’t, this might be a nice feature.

Identity Guard Cost

Individual Plan Pricing

Identity Guard offers three plan tiers for individuals:

I’d recommend going with at least the Total tier since that includes credit monitoring tools and bank account monitoring which the value plan doesn’t. Ultra is the best option, though, as it covers home title, 401 (K) monitoring, and social media monitoring.

As for how they compare to Identity Force’s individual plan options….

The price point for the total tier is a little lower than Identity Force’s UltraSecure plan. Since it includes basic credit monitoring, it’s the better deal.

The Ultra plan is a little bit higher in price than Identity Force’s top-tier plan, but it includes home title monitoring and 401(k) monitoring which is a huge value.

Family Plan Pricing

Identity Guard offers three family plan tiers that mimic their individual plan structures but at a higher price point. With the family pricing, you can have up to (4) adults on one plan and unlimited children.

Here’s the catch…

Children only receive online account monitoring and SSN monitoring features. Compared to IdentityForce’s ChildWatch service, that’s not very much.

So, though Identity Guard offers a better family plan setup, it might not be comprehensive enough for some parents who want things like cyberbullying alerts.

Final Verdict: Identity Guard

If you were keeping score, you saw Identity Guard won almost every category.

The only time they came in second place was “Additional Features.” That’s because IdentityForce offers a VPN, and their ChildWatch add-on features a uniquely comprehensive social media suite.

But here’s the thing…

Identity Guard offers a VPN, parental controls, a password manager, and antivirus software. That means Aura offers the best value overall. And, with our affiliate code, it’s incredibly affordable for life. That’s right —the price doesn’t change down the line.

So, if you want all the extra features, incredible threat detection and resolution services, and the best bang for your buck, get Aura.

If you’re good without the extras and want the slightly lower price point, stick with IdentityGuard. And unless you’re really sold on ChildWatch, forget IdentityForce. As good as they seem on paper, they’re just not comprehensive enough.

See Also: Is Identity Guard Worth It?

Other Comparison Articles: